- Hong Kong

- /

- Healthcare Services

- /

- SEHK:383

3 Promising Penny Stocks With Market Caps Below US$800M

Reviewed by Simply Wall St

As global markets react to the changing political landscape and economic indicators, investors are reassessing their strategies in light of recent volatility. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.23 | MYR346.22M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.43 | SGD303.74M | ★★★★★☆ |

Click here to see the full list of 5,801 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited is an investment holding company that operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in China, with a market cap of HK$3.55 billion.

Operations: The company generates revenue primarily through Passenger Vehicle Sales and Services, which accounted for CN¥67.59 billion, and Automobile Operating Lease Services, contributing CN¥448.73 million.

Market Cap: HK$3.55B

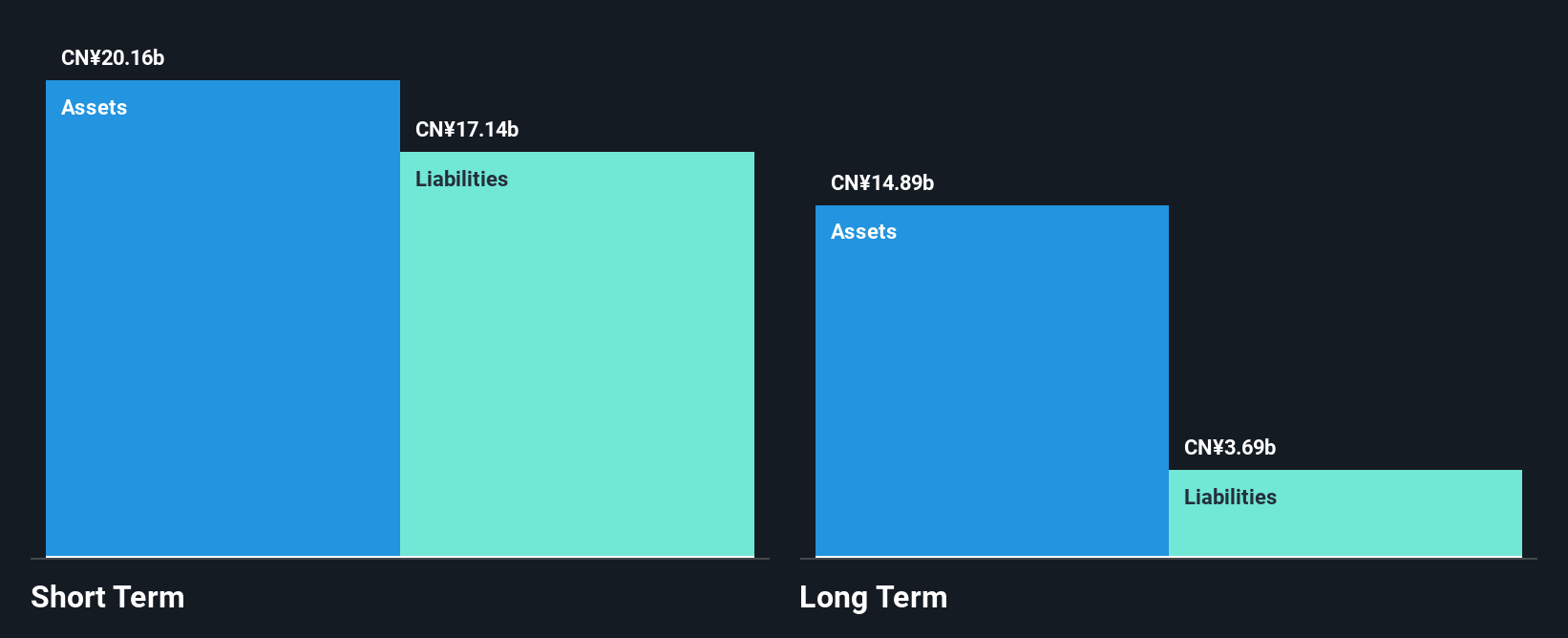

China Yongda Automobiles Services Holdings faces challenges typical of penny stocks, with declining earnings and reduced profit margins compared to the previous year. Despite a stable weekly volatility of 10% and an experienced management team, the company's net profit margin has dropped from 1.5% to 0.4%. Interest coverage remains weak at 1.7x EBIT, although debt levels have significantly decreased over five years. Short-term assets exceed liabilities, providing some financial cushion; however, negative earnings growth (-75.9%) highlights ongoing struggles in revenue generation and profitability despite a forecasted annual earnings growth of 23.52%.

- Click here and access our complete financial health analysis report to understand the dynamics of China Yongda Automobiles Services Holdings.

- Learn about China Yongda Automobiles Services Holdings' future growth trajectory here.

Tian An Medicare (SEHK:383)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tian An Medicare Limited is an investment holding company that primarily operates hospitals in the People’s Republic of China and Hong Kong, with a market cap of HK$890.52 million.

Operations: The company's revenue is primarily derived from its Healthcare segment, contributing HK$1.59 billion, followed by Eldercare at HK$37.71 million and Property Investment at HK$3.34 million.

Market Cap: HK$890.52M

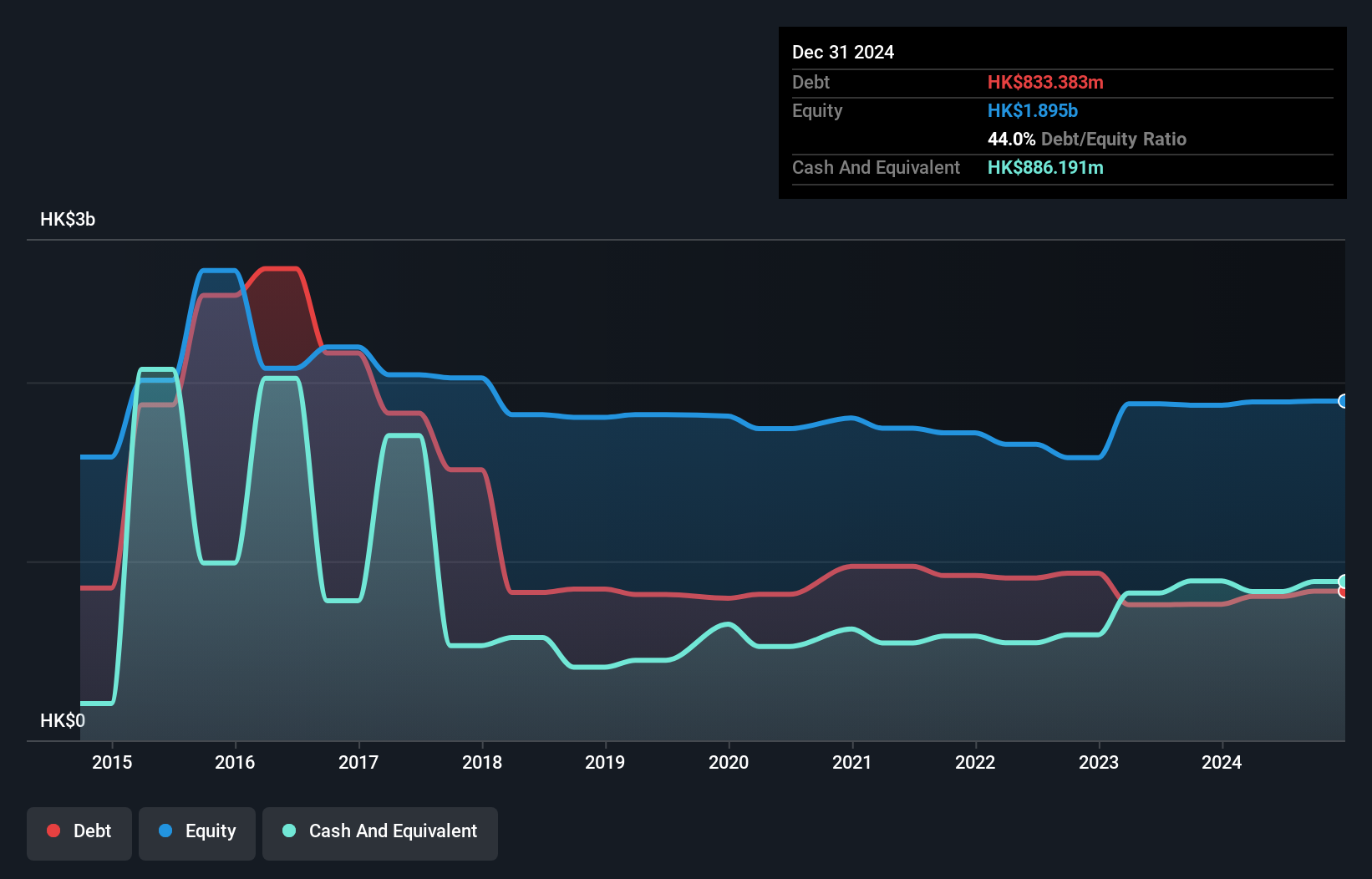

Tian An Medicare Limited presents a mixed picture typical of penny stocks, with its recent profitability marking a positive shift. The company has more cash than debt, and its interest payments are well covered by EBIT at 43.7x. Short-term assets exceed both short and long-term liabilities, suggesting solid liquidity management. Despite trading significantly below estimated fair value, the return on equity remains low at 2.4%. The experienced management team and stable weekly volatility (7%) add stability to the stock profile; however, potential investors should weigh these factors against the inherent risks associated with such investments.

- Unlock comprehensive insights into our analysis of Tian An Medicare stock in this financial health report.

- Gain insights into Tian An Medicare's past trends and performance with our report on the company's historical track record.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd operates in the research, development, production, and marketing of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors both in China and internationally with a market cap of CN¥5.28 billion.

Operations: No specific revenue segments have been reported for Zhejiang Hailide New Material Co., Ltd.

Market Cap: CN¥5.28B

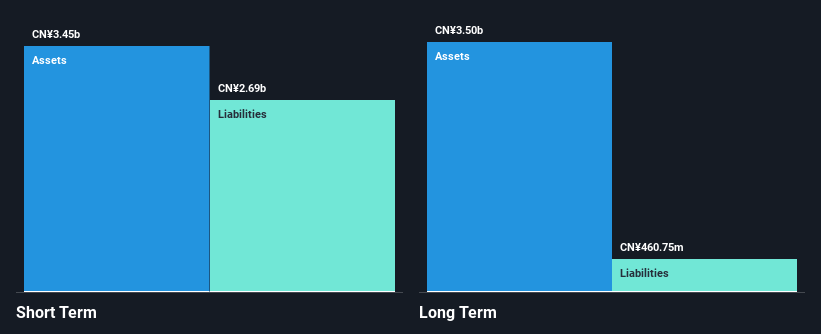

Zhejiang Hailide New Material Co., Ltd shows characteristics typical of penny stocks, offering a mix of potential and caution. The company has demonstrated consistent revenue growth, with earnings rising 15.5% over the past year, exceeding industry averages. Its net debt to equity ratio is satisfactory at 25%, and interest payments are well covered by EBIT at 13.6x, indicating manageable leverage. However, shareholder dilution occurred with a 4.5% increase in outstanding shares over the past year. Trading at a lower price-to-earnings ratio compared to the market suggests potential value but requires careful consideration of its unstable dividend history and low return on equity (9.9%).

- Take a closer look at Zhejiang Hailide New MaterialLtd's potential here in our financial health report.

- Examine Zhejiang Hailide New MaterialLtd's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Get an in-depth perspective on all 5,801 Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tian An Medicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:383

Tian An Medicare

An investment holding company, primarily operates hospitals in the People’s Republic of China and Hong Kong.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives