- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3669

3 Asian Penny Stocks With Market Caps Over US$200M To Watch

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a renewed sense of optimism. In this context, penny stocks—despite their somewhat outdated moniker—remain an intriguing area for investors seeking opportunities in smaller or newer companies. These stocks, when supported by solid financials, can offer a blend of value and growth potential that may not be as readily available among larger firms.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.86 | THB3.01B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.56 | THB1.62B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.098 | SGD41.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.191 | SGD38.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.08 | HK$681.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.11 | HK$1.85B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.93 | HK$1.61B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,165 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ruifeng Power Group Company Limited is an investment holding company that designs, develops, manufactures, and sells cylinder blocks and heads in the People's Republic of China with a market cap of HK$2.23 billion.

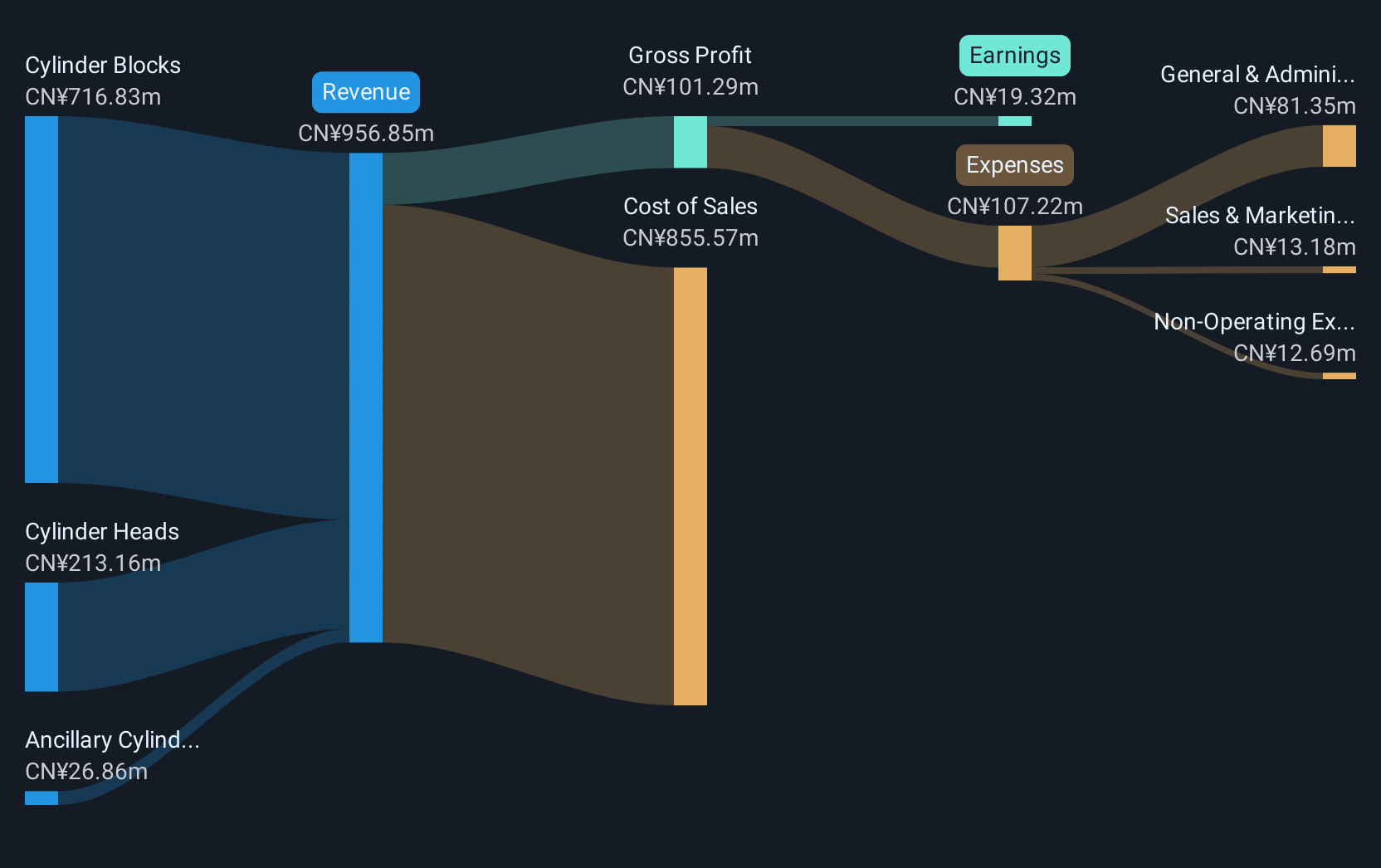

Operations: The company's revenue is primarily derived from cylinder blocks (CN¥716.83 million) and cylinder heads (CN¥213.16 million), with additional income from ancillary cylinder block components and others (CN¥26.86 million).

Market Cap: HK$2.23B

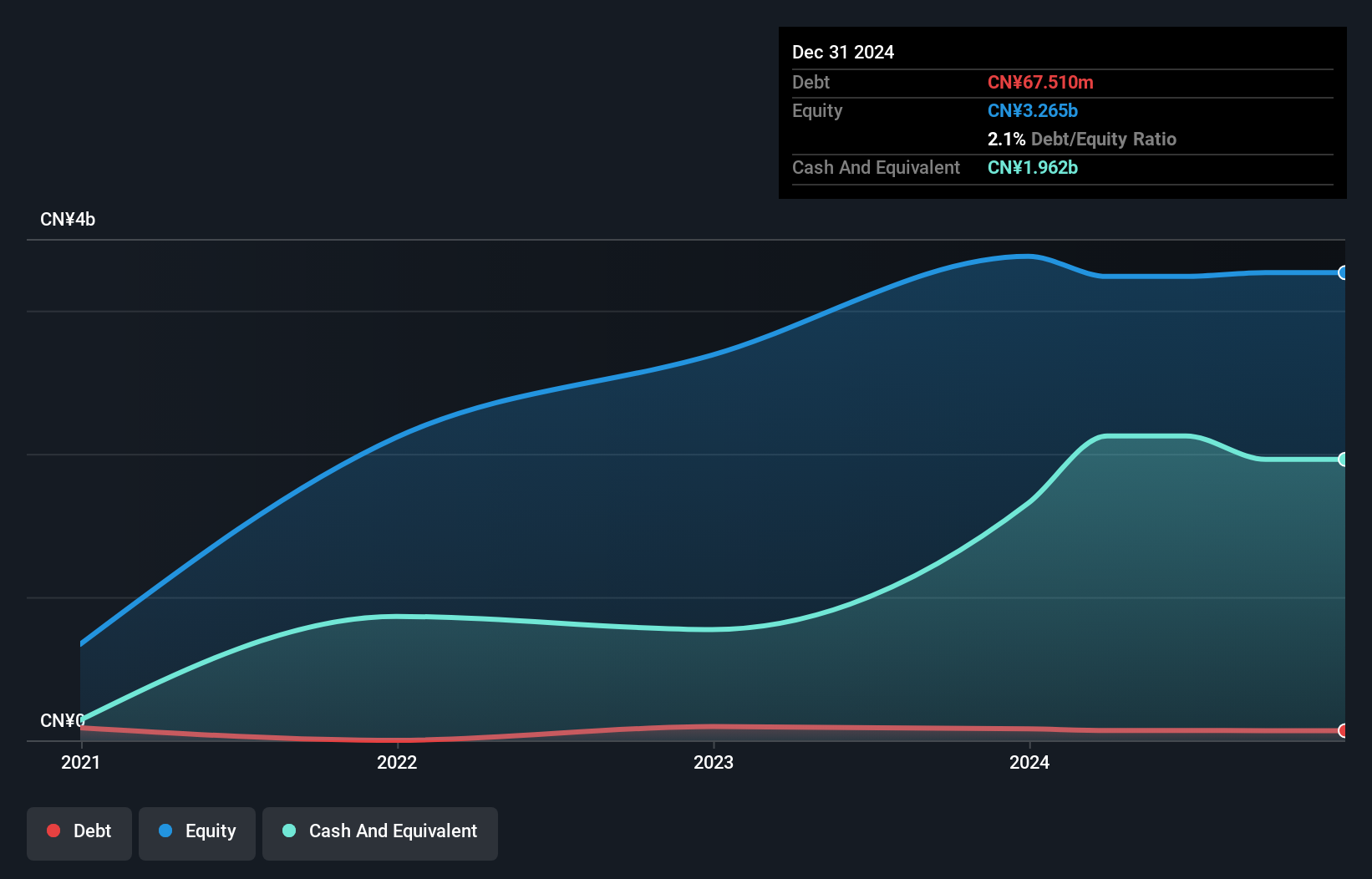

Ruifeng Power Group has demonstrated significant earnings growth, with a 71.5% increase over the past year, surpassing its five-year average decline of 19.4% annually. The company's revenue for 2024 reached CN¥956.85 million, largely driven by increased sales volume and benefiting from a new value-added tax input deduction. Despite a low return on equity of 1.9%, Ruifeng maintains stable financial health with satisfactory net debt to equity and interest coverage ratios, alongside an experienced board averaging 7.5 years in tenure. Recently, the company proposed a dividend increase to HKD 0.02 per share for shareholders' approval in May 2025.

- Take a closer look at Ruifeng Power Group's potential here in our financial health report.

- Learn about Ruifeng Power Group's historical performance here.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$6.78 billion.

Operations: The company generates CN¥6.47 billion in revenue from its retail segment, specifically through grocery stores.

Market Cap: HK$6.78B

Guoquan Food (Shanghai) Co., Ltd. has shown stable financial performance, with revenue reaching CN¥6.47 billion in 2024, though net income slightly decreased to CN¥230.56 million from the previous year. The company maintains a strong balance sheet, with short-term assets significantly exceeding liabilities and cash surpassing total debt. Despite a one-off loss impacting recent earnings, the company's operating cash flow robustly covers its debt obligations. The board and management team are seasoned, averaging 3.5 and 4.9 years of tenure respectively, contributing to strategic stability as evidenced by the proposed dividend increase subject to shareholder approval in June 2025.

- Dive into the specifics of Guoquan Food (Shanghai) here with our thorough balance sheet health report.

- Explore Guoquan Food (Shanghai)'s analyst forecasts in our growth report.

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited is an investment holding company that operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in China, with a market cap of approximately HK$4.64 billion.

Operations: The company's revenue is primarily derived from Passenger Vehicle Sales and Services, which account for CN¥63.01 billion, followed by Automobile Operating Lease Services contributing CN¥465.96 million.

Market Cap: HK$4.64B

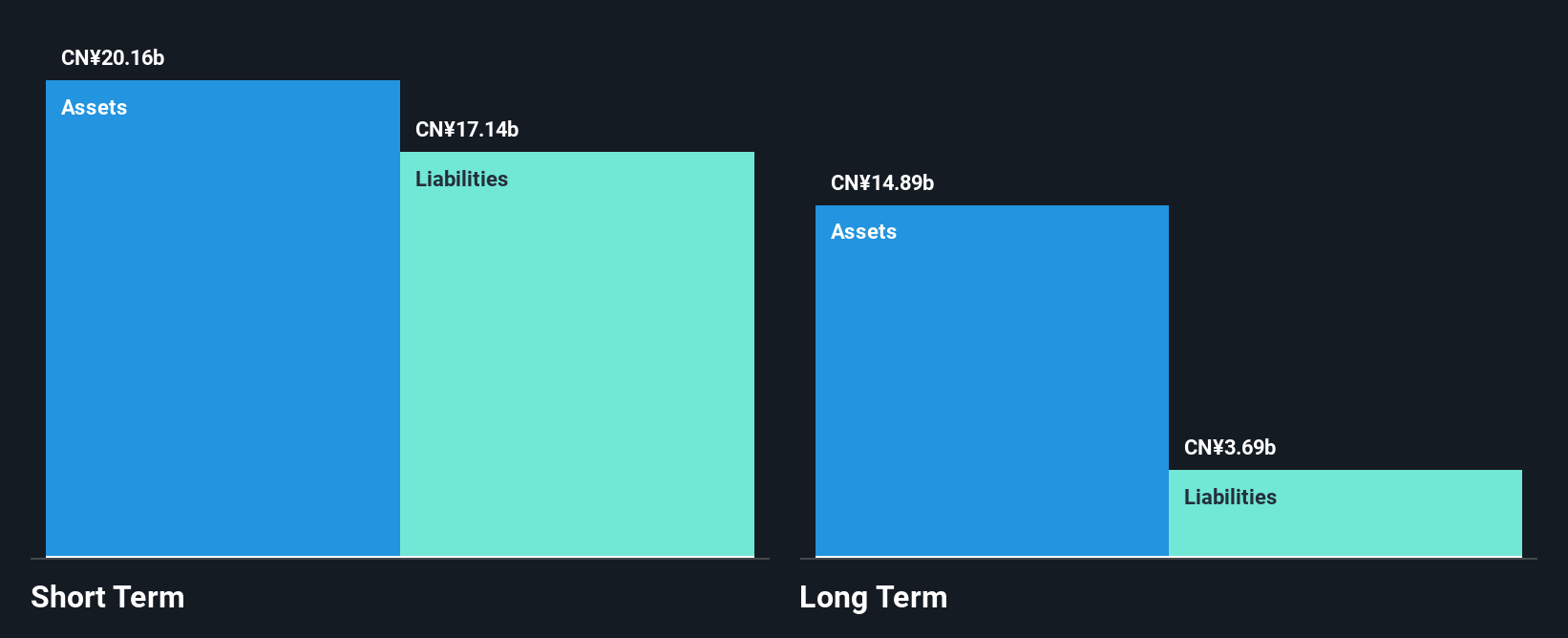

China Yongda Automobiles Services Holdings faces challenges with declining earnings, reporting a net income of CN¥200.77 million for 2024 compared to CN¥572.58 million the previous year. Despite this, short-term assets (CN¥20.2 billion) surpass both short and long-term liabilities, indicating solid liquidity management. The company's debt is well-covered by operating cash flow and has seen a significant reduction in its debt-to-equity ratio over five years. However, profit margins have decreased to 0.3%, and interest coverage remains weak at 1.5 times EBIT, raising concerns about financial sustainability despite trading below estimated fair value by 44%.

- Get an in-depth perspective on China Yongda Automobiles Services Holdings' performance by reading our balance sheet health report here.

- Assess China Yongda Automobiles Services Holdings' future earnings estimates with our detailed growth reports.

Taking Advantage

- Explore the 1,165 names from our Asian Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3669

China Yongda Automobiles Services Holdings

An investment holding company, operates as a passenger vehicle retailer and service provider for luxury and ultra-luxury brands in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives