- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2528

Can You Imagine How Forward Fashion (International) Holdings' (HKG:2528) Shareholders Feel About The 10% Share Price Increase?

Forward Fashion (International) Holdings Company Limited (HKG:2528) shareholders might be concerned after seeing the share price drop 20% in the last quarter. Looking on the brighter side, the stock is actually up over twelve months. However, its return of 10% does fall short of the market return of, 23%.

View our latest analysis for Forward Fashion (International) Holdings

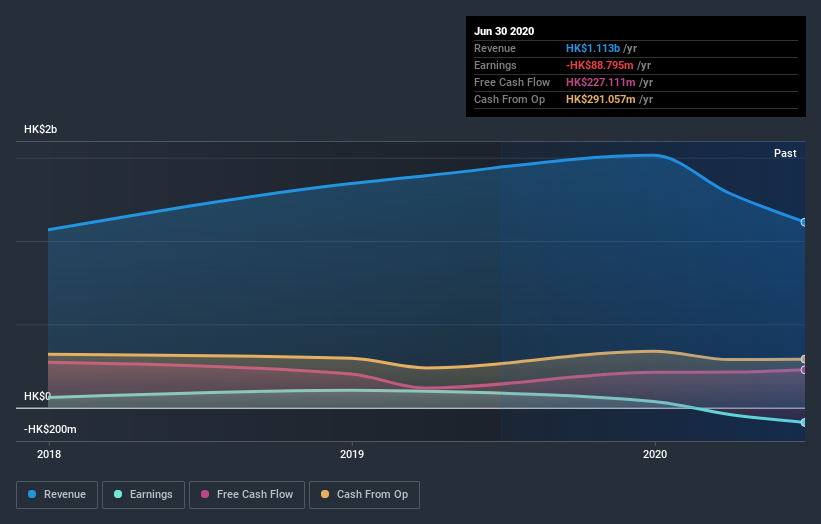

Forward Fashion (International) Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Forward Fashion (International) Holdings actually shrunk its revenue over the last year, with a reduction of 22%. The lacklustre gain of 10% over twelve months, is not a bad result given the falling revenue. We'd want to see progress to profitability before getting too interested in this stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Forward Fashion (International) Holdings' financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Forward Fashion (International) Holdings, it has a TSR of 15% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Forward Fashion (International) Holdings shareholders have gained 15% for the year (even including dividends). The bad news is that's no better than the average market return, which was roughly 23%. The stock trailed the market by 34% in that time, testament to the power of passive investing. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). It's always interesting to track share price performance over the longer term. But to understand Forward Fashion (International) Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Forward Fashion (International) Holdings (of which 1 doesn't sit too well with us!) you should know about.

Of course Forward Fashion (International) Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Forward Fashion (International) Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2528

Forward Fashion (International) Holdings

Engages in the retail of fashion apparel in Macau, Mainland China, Hong Kong, and Taiwan.

Flawless balance sheet and good value.

Market Insights

Community Narratives