- Hong Kong

- /

- Specialty Stores

- /

- SEHK:248

Here's Why HKC International Holdings Limited's (HKG:248) CEO May Not Expect A Pay Rise This Year

The disappointing performance at HKC International Holdings Limited (HKG:248) will make some shareholders rather disheartened. The next AGM coming up on 27 August 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. The data we gathered below shows that CEO compensation looks acceptable for now.

Check out our latest analysis for HKC International Holdings

Comparing HKC International Holdings Limited's CEO Compensation With the industry

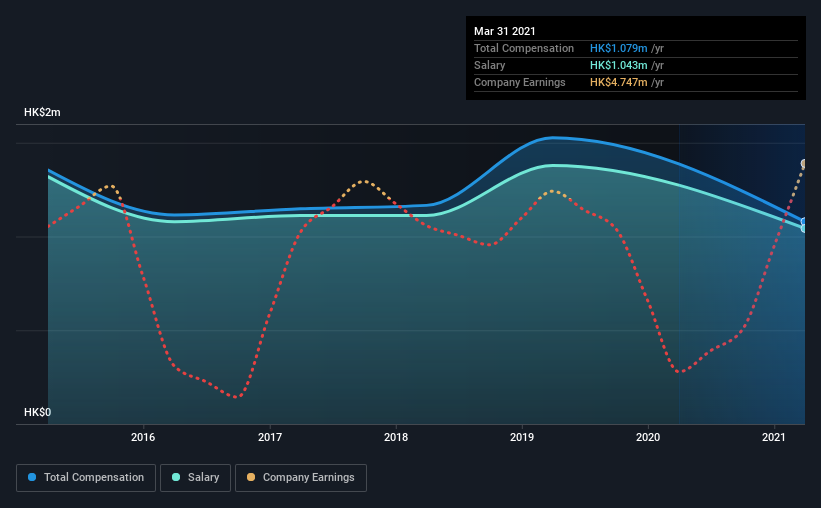

According to our data, HKC International Holdings Limited has a market capitalization of HK$142m, and paid its CEO total annual compensation worth HK$1.1m over the year to March 2021. Notably, that's a decrease of 29% over the year before. We note that the salary portion, which stands at HK$1.04m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.7m. Accordingly, HKC International Holdings pays its CEO under the industry median. Furthermore, Hubert Chan directly owns HK$77m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2019 | Proportion (2021) |

| Salary | HK$1.0m | HK$1.4m | 97% |

| Other | HK$36k | HK$148k | 3% |

| Total Compensation | HK$1.1m | HK$1.5m | 100% |

On an industry level, roughly 88% of total compensation represents salary and 12% is other remuneration. Investors will find it interesting that HKC International Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at HKC International Holdings Limited's Growth Numbers

Over the last three years, HKC International Holdings Limited has shrunk its earnings per share by 31% per year. It saw its revenue drop 6.5% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has HKC International Holdings Limited Been A Good Investment?

Since shareholders would have lost about 26% over three years, some HKC International Holdings Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Hubert receives almost all of their compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for HKC International Holdings that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HKC International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:248

HKC International Holdings

An investment holding company, provides information communication technology solutions in Hong Kong, Mainland China, Singapore, and other countries in South East Asia.

Good value with adequate balance sheet.

Market Insights

Community Narratives