- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1929

Here's Why I Think Chow Tai Fook Jewellery Group (HKG:1929) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Chow Tai Fook Jewellery Group (HKG:1929). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Chow Tai Fook Jewellery Group

Chow Tai Fook Jewellery Group's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Chow Tai Fook Jewellery Group's EPS has grown 20% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

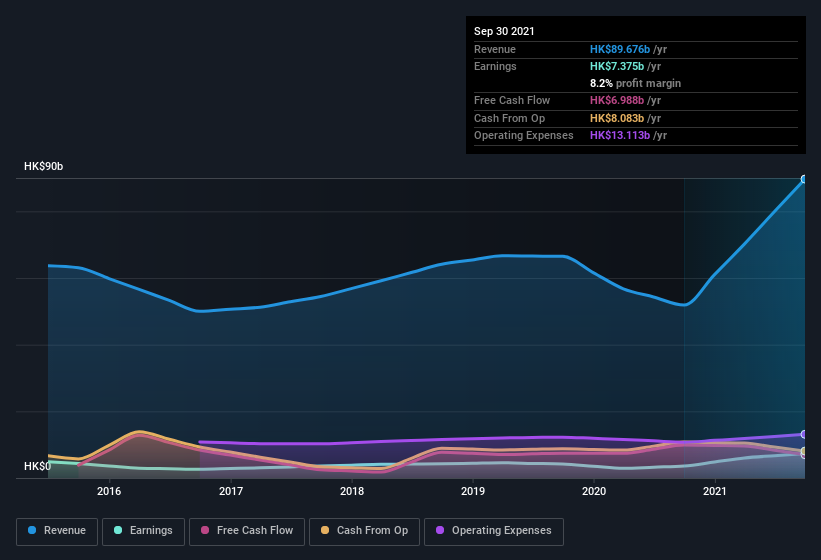

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Chow Tai Fook Jewellery Group's EBIT margins were flat over the last year, revenue grew by a solid 73% to HK$90b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Chow Tai Fook Jewellery Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Chow Tai Fook Jewellery Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Chow Tai Fook Jewellery Group insiders walking the walk, by spending HK$6.2m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Executive Chairman, Kar Shun Cheng, who made the biggest single acquisition, paying HK$5.9m for shares at about HK$13.95 each.

Should You Add Chow Tai Fook Jewellery Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Chow Tai Fook Jewellery Group's strong EPS growth. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Chow Tai Fook Jewellery Group is a strong candidate for your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Chow Tai Fook Jewellery Group that you need to be mindful of.

The good news is that Chow Tai Fook Jewellery Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1929

Chow Tai Fook Jewellery Group

An investment holding company, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives