- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1872

With EPS Growth And More, Guan Chao Holdings (HKG:1872) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Guan Chao Holdings (HKG:1872), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Guan Chao Holdings

Guan Chao Holdings's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. It is therefore awe-striking that Guan Chao Holdings's EPS went from S$0.0036 to S$0.011 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

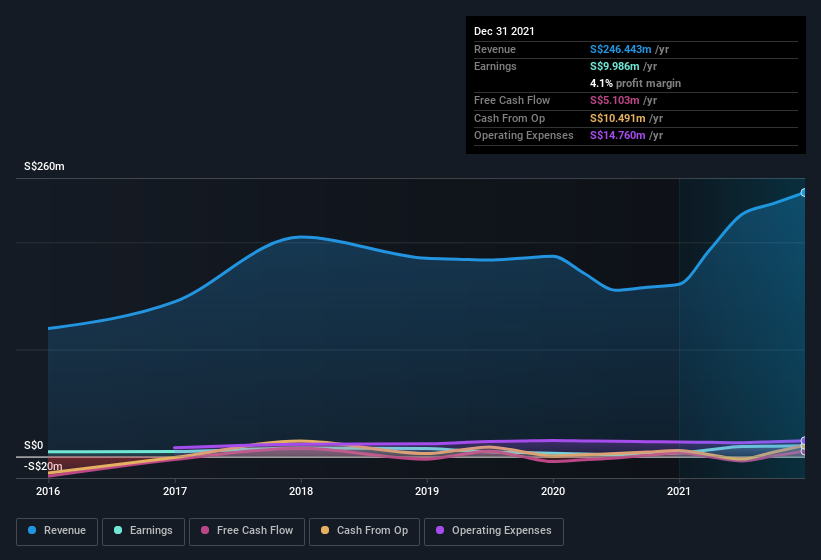

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Guan Chao Holdings is growing revenues, and EBIT margins improved by 2.6 percentage points to 5.7%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Guan Chao Holdings isn't a huge company, given its market capitalization of HK$188m. That makes it extra important to check on its balance sheet strength.

Are Guan Chao Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Guan Chao Holdings shares, in the last year. So it's definitely nice that De Yu Ang bought S$325k worth of shares at an average price of around S$0.18.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Guan Chao Holdings insiders own more than a third of the company. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only HK$188m Guan Chao Holdings is really small for a listed company. So despite a large proportional holding, insiders only have S$89m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Guan Chao Holdings Worth Keeping An Eye On?

Guan Chao Holdings's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Guan Chao Holdings deserves timely attention. You should always think about risks though. Case in point, we've spotted 3 warning signs for Guan Chao Holdings you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Guan Chao Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1872

Guan Chao Holdings

An investment holding company, sells parallel-import and pre-owned motor vehicles in Singapore.

Excellent balance sheet low.

Market Insights

Community Narratives