- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1872

If EPS Growth Is Important To You, Guan Chao Holdings (HKG:1872) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Guan Chao Holdings (HKG:1872), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Guan Chao Holdings

How Quickly Is Guan Chao Holdings Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Guan Chao Holdings' EPS has grown 26% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

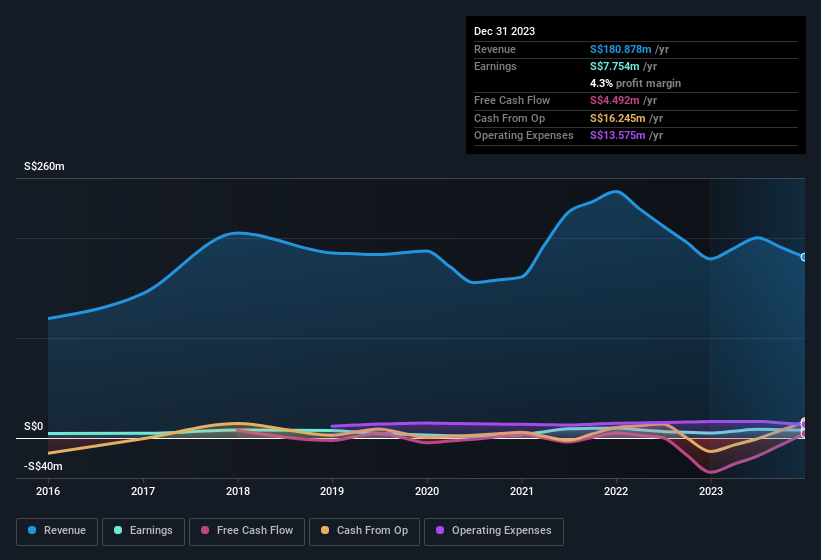

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It seems Guan Chao Holdings is pretty stable, since revenue and EBIT margins are pretty flat year on year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Guan Chao Holdings isn't a huge company, given its market capitalisation of HK$85m. That makes it extra important to check on its balance sheet strength.

Are Guan Chao Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping S$11m that the company insider, Bin Wu spent acquiring shares. The average price paid was about S$0.63. It's not often you see purchases like this and so it should be on the radar of everyone who follows Guan Chao Holdings.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Guan Chao Holdings will reveal that insiders own a significant piece of the pie. In fact, they own 50% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Although, with Guan Chao Holdings being valued at HK$85m, this is a small company we're talking about. That means insiders only have S$43m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is Guan Chao Holdings Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Guan Chao Holdings' strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 5 warning signs for Guan Chao Holdings (1 is significant) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Guan Chao Holdings, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1872

Guan Chao Holdings

An investment holding company, engages in the sale of parallel-import and pre-owned motor vehicles in Singapore.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success