Global markets have been experiencing significant shifts, with U.S. stocks rallying to record highs amid expectations of economic growth and regulatory changes following a major political shift. In this evolving landscape, investors are increasingly looking at penny stocks—often representing smaller or newer companies—as potential opportunities for growth. While the term "penny stocks" may seem outdated, these investments can still offer value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.78 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.92 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR761.86M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

Click here to see the full list of 5,780 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lokotech Group (OB:LOKO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lokotech Group AS is a management and holding company that provides software and hardware solutions for the crypto industry, with a market cap of NOK180.40 million.

Operations: Lokotech Group has not reported any specific revenue segments.

Market Cap: NOK180.4M

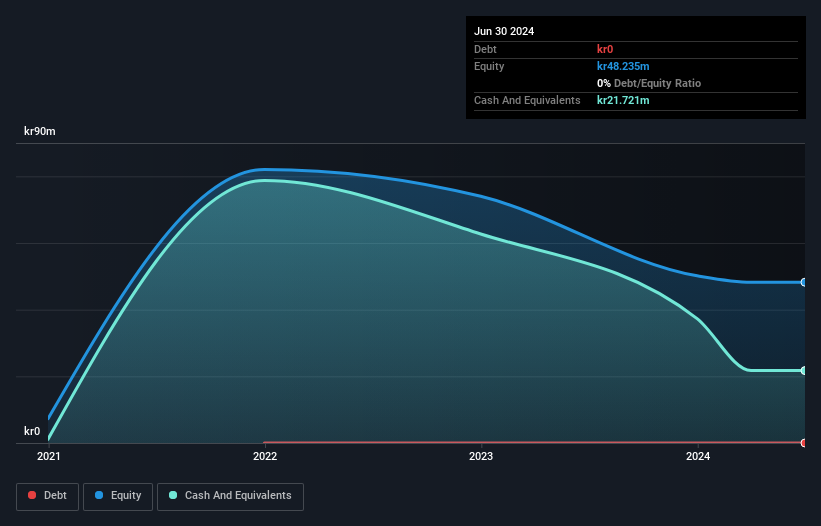

Lokotech Group, with a market cap of NOK180.40 million, is pre-revenue, generating only NOK0.01 million in the latest half-year report and incurring a net loss of NOK12.87 million. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges due to its unprofitability and high volatility compared to most Norwegian stocks. Recent developments include a framework agreement with AsicXchange for hashblades procurement, indicating potential growth opportunities through increased partnerships. Lokotech's cash runway is sufficient for over two years if current cash flow trends persist without significant dilution in shareholder value recently.

- Take a closer look at Lokotech Group's potential here in our financial health report.

- Gain insights into Lokotech Group's historical outcomes by reviewing our past performance report.

Sa Sa International Holdings (SEHK:178)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sa Sa International Holdings Limited is an investment holding company involved in the retail and wholesale of cosmetic products across Hong Kong, Macau, Mainland China, Southeast Asia, and internationally, with a market cap of HK$2.11 billion.

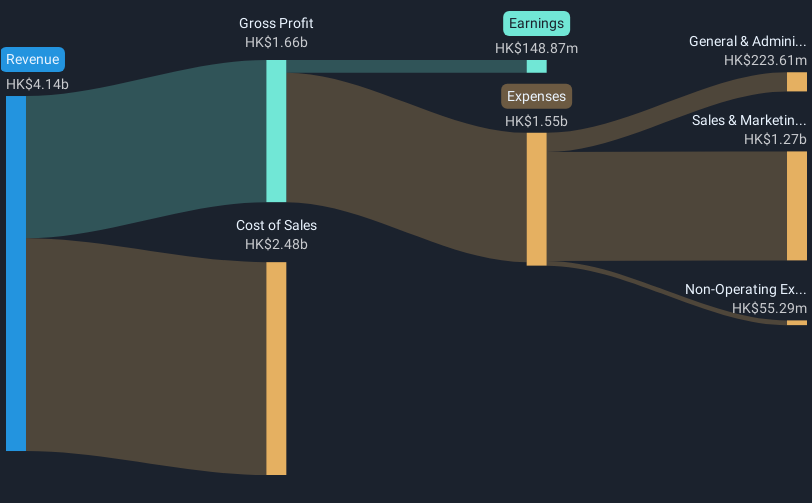

Operations: The company's revenue is primarily derived from Hong Kong & Macau at HK$3.41 billion, followed by Mainland China with HK$581.58 million and Southeast Asia generating HK$365.75 million.

Market Cap: HK$2.11B

Sa Sa International Holdings, with a market cap of HK$2.11 billion, recently reported half-year sales of HK$1.92 billion, down from the previous year, alongside a net income drop to HK$32.41 million. Despite this decline and an unstable dividend track record, the company remains debt-free with strong short-term asset coverage over liabilities (HK$1.4 billion vs. HK$815.3 million). The management team is seasoned with over 10 years average tenure and high-quality earnings are noted despite low return on equity at 17.5%. Earnings grew significantly by 275.8% last year but face challenges in maintaining momentum amidst declining turnover in core markets like Hong Kong and Macau due to shifting consumer behaviors and currency impacts.

- Jump into the full analysis health report here for a deeper understanding of Sa Sa International Holdings.

- Explore Sa Sa International Holdings' analyst forecasts in our growth report.

Terminal X Online (TASE:TRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Terminal X Online Ltd. operates an online platform offering clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenagers under various brands with a market cap of ₪492.14 million.

Operations: The company generates revenue of ₪454.04 million from its online retail segment.

Market Cap: ₪492.14M

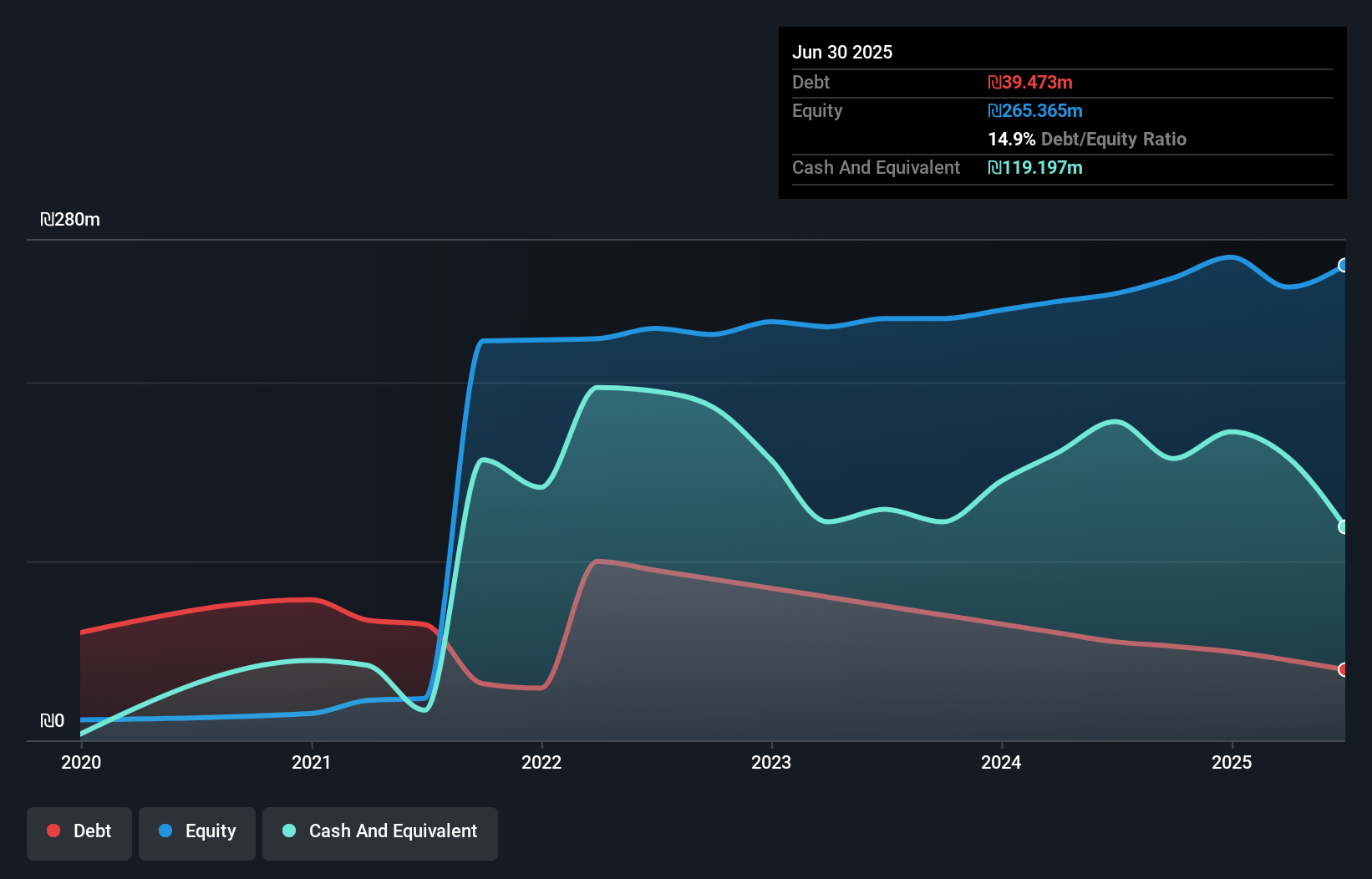

Terminal X Online Ltd., with a market cap of ₪492.14 million, has demonstrated financial stability by covering both short-term and long-term liabilities with its assets. The company reported significant revenue growth, achieving sales of ₪116.62 million in Q2 2024, up from the previous year, and transitioning to profitability with a net income of ₪7.31 million for the quarter. While its return on equity remains low at 5%, Terminal X benefits from strong cash flow coverage of debt and stable earnings quality. The experienced management team supports this positive trajectory without recent shareholder dilution concerns.

- Get an in-depth perspective on Terminal X Online's performance by reading our balance sheet health report here.

- Examine Terminal X Online's past performance report to understand how it has performed in prior years.

Summing It All Up

- Gain an insight into the universe of 5,780 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terminal X Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TRX

Terminal X Online

Offers clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenager under various brands through online.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives