- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1759

Sino Gas Holdings Group (HKG:1759) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Sino Gas Holdings Group Limited (HKG:1759) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Sino Gas Holdings Group

What Is Sino Gas Holdings Group's Debt?

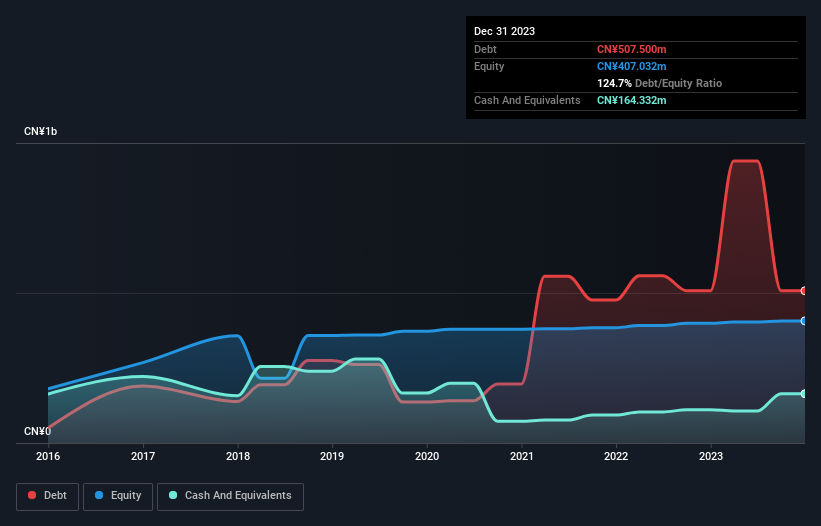

The chart below, which you can click on for greater detail, shows that Sino Gas Holdings Group had CN¥507.5m in debt in December 2023; about the same as the year before. However, it does have CN¥164.3m in cash offsetting this, leading to net debt of about CN¥343.2m.

How Healthy Is Sino Gas Holdings Group's Balance Sheet?

The latest balance sheet data shows that Sino Gas Holdings Group had liabilities of CN¥544.7m due within a year, and liabilities of CN¥4.13m falling due after that. Offsetting this, it had CN¥164.3m in cash and CN¥182.9m in receivables that were due within 12 months. So its liabilities total CN¥201.6m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's CN¥158.1m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Strangely Sino Gas Holdings Group has a sky high EBITDA ratio of 17.4, implying high debt, but a strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! Notably, Sino Gas Holdings Group's EBIT launched higher than Elon Musk, gaining a whopping 188% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sino Gas Holdings Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Sino Gas Holdings Group actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Sino Gas Holdings Group's net debt to EBITDA was a real negative on this analysis, as was its level of total liabilities. But like a ballerina ending on a perfect pirouette, it has not trouble covering its interest expense with its EBIT. When we consider all the factors mentioned above, we do feel a bit cautious about Sino Gas Holdings Group's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 5 warning signs for Sino Gas Holdings Group you should be aware of, and 2 of them are potentially serious.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1759

Sino Gas Holdings Group

Engages in the retail and wholesale of liquefied petroleum gas (LPG), compressed natural gas (CNG), and liquefied natural gas (LNG) in the People’s Republic of China.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026