- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1759

Sino Gas Holdings Group (HKG:1759) Seems To Be Using A Lot Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Sino Gas Holdings Group Limited (HKG:1759) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Sino Gas Holdings Group

What Is Sino Gas Holdings Group's Debt?

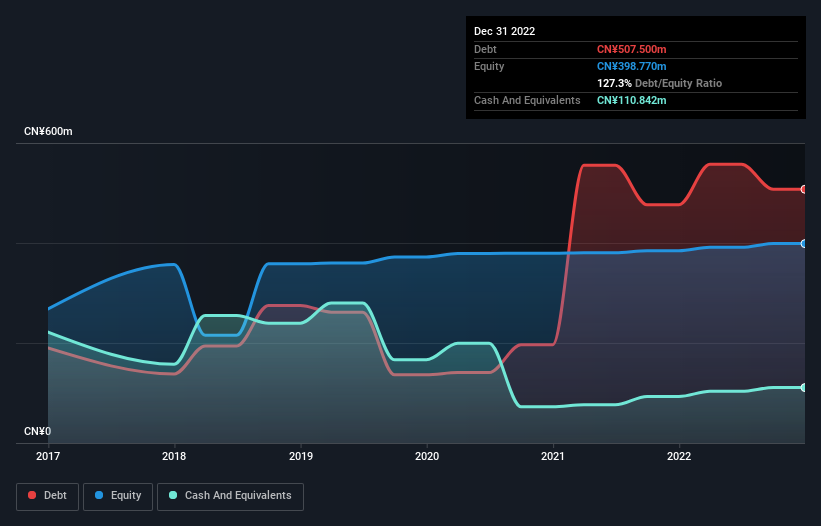

You can click the graphic below for the historical numbers, but it shows that as of December 2022 Sino Gas Holdings Group had CN¥507.5m of debt, an increase on CN¥476.5m, over one year. However, it also had CN¥110.8m in cash, and so its net debt is CN¥396.7m.

How Strong Is Sino Gas Holdings Group's Balance Sheet?

According to the last reported balance sheet, Sino Gas Holdings Group had liabilities of CN¥544.4m due within 12 months, and liabilities of CN¥4.72m due beyond 12 months. Offsetting these obligations, it had cash of CN¥110.8m as well as receivables valued at CN¥160.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥277.9m.

The deficiency here weighs heavily on the CN¥129.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Sino Gas Holdings Group would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Sino Gas Holdings Group shareholders face the double whammy of a high net debt to EBITDA ratio (21.6), and fairly weak interest coverage, since EBIT is just 1.5 times the interest expense. The debt burden here is substantial. However, the silver lining was that Sino Gas Holdings Group achieved a positive EBIT of CN¥3.4m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sino Gas Holdings Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Considering the last year, Sino Gas Holdings Group actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both Sino Gas Holdings Group's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its EBIT growth rate is not so bad. Taking into account all the aforementioned factors, it looks like Sino Gas Holdings Group has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for Sino Gas Holdings Group (2 are a bit unpleasant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Sino Gas Holdings Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1759

Sino Gas Holdings Group

Engages in the retail and wholesale of liquefied petroleum gas (LPG), compressed natural gas (CNG), and liquefied natural gas (LNG) in the People’s Republic of China.

Moderate with mediocre balance sheet.