Century Ginwa Retail Holdings'(HKG:162) Share Price Is Down 80% Over The Past Five Years.

While not a mind-blowing move, it is good to see that the Century Ginwa Retail Holdings Limited (HKG:162) share price has gained 15% in the last three months. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 80%. So we don't gain too much confidence from the recent recovery. The fundamental business performance will ultimately determine if the turnaround can be sustained.

See our latest analysis for Century Ginwa Retail Holdings

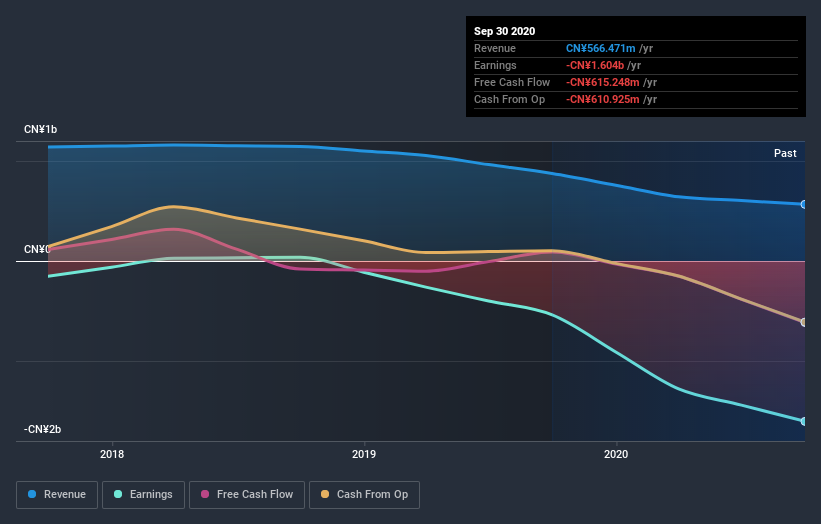

Given that Century Ginwa Retail Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Century Ginwa Retail Holdings' earnings, revenue and cash flow.

A Different Perspective

Century Ginwa Retail Holdings provided a TSR of 17% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 12% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Century Ginwa Retail Holdings better, we need to consider many other factors. Even so, be aware that Century Ginwa Retail Holdings is showing 3 warning signs in our investment analysis , and 2 of those are significant...

Of course Century Ginwa Retail Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Century Ginwa Retail Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:162

Century Ginwa Retail Holdings

An investment holding company, engages in the operation of department stores, a shopping mall, and supermarkets in the People’s Republic of China.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives