- Hong Kong

- /

- Specialty Stores

- /

- SEHK:128

Even after rising 13% this past week, ENM Holdings (HKG:128) shareholders are still down 19% over the past three years

This week we saw the ENM Holdings Limited (HKG:128) share price climb by 13%. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 19% in the last three years, falling well short of the market return.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for ENM Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, ENM Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

Arguably the revenue decline of 14% per year has people thinking ENM Holdings is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

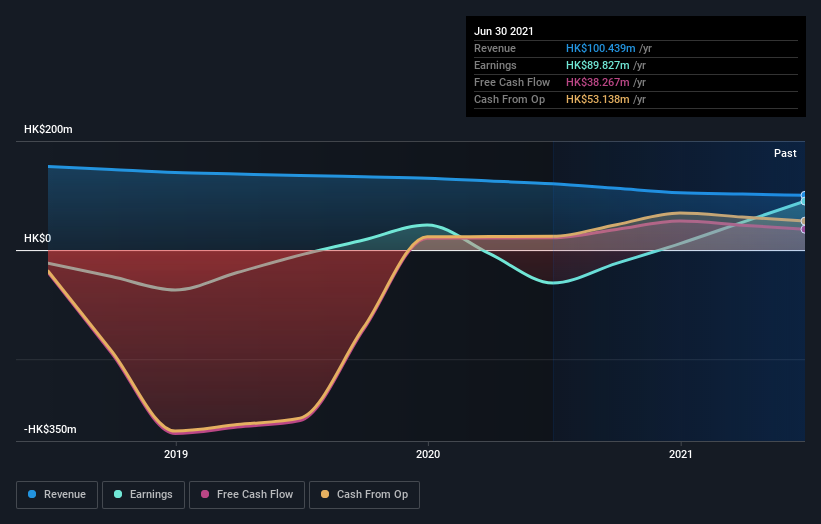

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on ENM Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

ENM Holdings shareholders are down 9.1% over twelve months, which isn't far from the market return of -9.7%. So last year was actually even worse than the last five years, which cost shareholders 0.6% per year. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - ENM Holdings has 1 warning sign we think you should be aware of.

We will like ENM Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if ENM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:128

ENM Holdings

An investment holding company, engages in the retail of fashion wear and accessories in Hong Kong, the Americas, Europe, and Other Asia Pacific regions.

Flawless balance sheet and fair value.

Market Insights

Community Narratives