- Hong Kong

- /

- Retail Distributors

- /

- SEHK:1123

We Think Shareholders May Want To Consider A Review Of China-Hongkong Photo Products Holdings Limited's (HKG:1123) CEO Compensation Package

The results at China-Hongkong Photo Products Holdings Limited (HKG:1123) have been quite disappointing recently and CEO Stanley Sun bears some responsibility for this. At the upcoming AGM on 13 August 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for China-Hongkong Photo Products Holdings

Comparing China-Hongkong Photo Products Holdings Limited's CEO Compensation With the industry

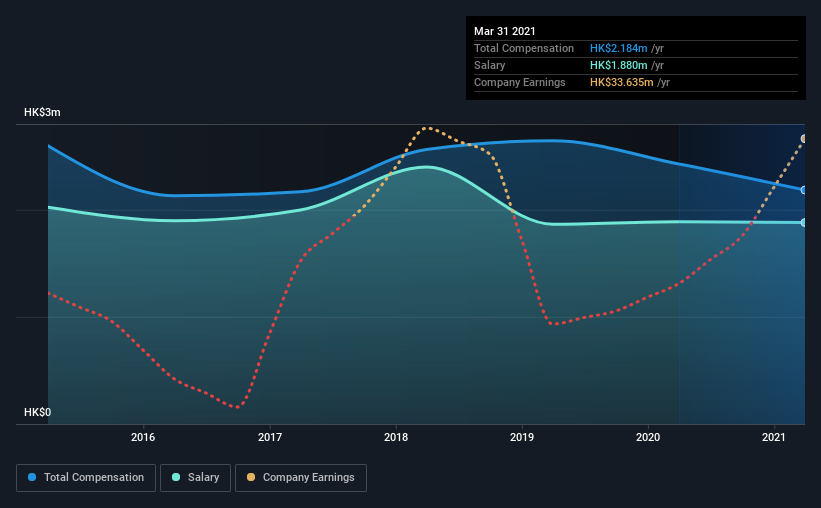

Our data indicates that China-Hongkong Photo Products Holdings Limited has a market capitalization of HK$211m, and total annual CEO compensation was reported as HK$2.2m for the year to March 2021. Notably, that's a decrease of 10.0% over the year before. We note that the salary portion, which stands at HK$1.88m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.9m. From this we gather that Stanley Sun is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$1.9m | HK$1.9m | 86% |

| Other | HK$304k | HK$538k | 14% |

| Total Compensation | HK$2.2m | HK$2.4m | 100% |

Speaking on an industry level, nearly 94% of total compensation represents salary, while the remainder of 6% is other remuneration. China-Hongkong Photo Products Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at China-Hongkong Photo Products Holdings Limited's Growth Numbers

China-Hongkong Photo Products Holdings Limited has reduced its earnings per share by 4.2% a year over the last three years. It achieved revenue growth of 4.1% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has China-Hongkong Photo Products Holdings Limited Been A Good Investment?

The return of -56% over three years would not have pleased China-Hongkong Photo Products Holdings Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for China-Hongkong Photo Products Holdings that investors should be aware of in a dynamic business environment.

Important note: China-Hongkong Photo Products Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1123

China-Hongkong Photo Products Holdings

Engages in the marketing and distribution of photographic developing, processing, and printing products in Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026