- Hong Kong

- /

- Real Estate

- /

- SEHK:9983

These Analysts Just Made A Noticeable Downgrade To Their Central China New Life Limited (HKG:9983) EPS Forecasts

The analysts covering Central China New Life Limited (HKG:9983) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business. Shares are up 8.1% to HK$3.47 in the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

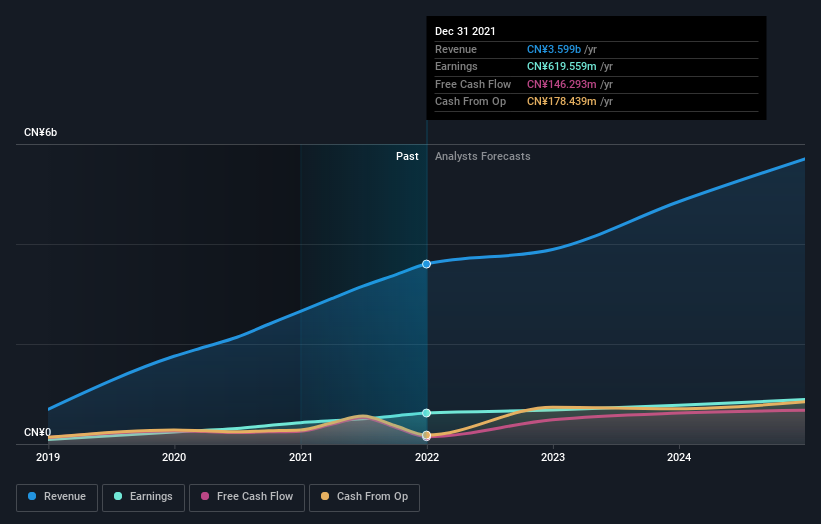

Following the downgrade, the current consensus from Central China New Life's six analysts is for revenues of CN¥3.9b in 2022 which - if met - would reflect a decent 8.1% increase on its sales over the past 12 months. Statutory earnings per share are presumed to accumulate 9.3% to CN¥0.53. Prior to this update, the analysts had been forecasting revenues of CN¥4.6b and earnings per share (EPS) of CN¥0.64 in 2022. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a considerable drop in earnings per share numbers as well.

Check out our latest analysis for Central China New Life

It'll come as no surprise then, to learn that the analysts have cut their price target 19% to CN¥4.93. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Central China New Life analyst has a price target of CN¥10.10 per share, while the most pessimistic values it at CN¥2.92. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Central China New Life's revenue growth will slow down substantially, with revenues to the end of 2022 expected to display 8.1% growth on an annualised basis. This is compared to a historical growth rate of 39% over the past three years. Compare this to the 275 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 8.7% per year. Factoring in the forecast slowdown in growth, it looks like Central China New Life is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

There might be good reason for analyst bearishness towards Central China New Life, like concerns around earnings quality. Learn more, and discover the 1 other warning sign we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9983

Central China New Life

An investment holding company, provides property management and value-added services in the People’s Republic of China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026