- Hong Kong

- /

- Real Estate

- /

- SEHK:9909

Should You Be Adding Powerlong Commercial Management Holdings (HKG:9909) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Powerlong Commercial Management Holdings (HKG:9909). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Powerlong Commercial Management Holdings

Powerlong Commercial Management Holdings's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, Powerlong Commercial Management Holdings's EPS soared from CN¥0.38 to CN¥0.48, in just one year. That's a impressive gain of 25%.

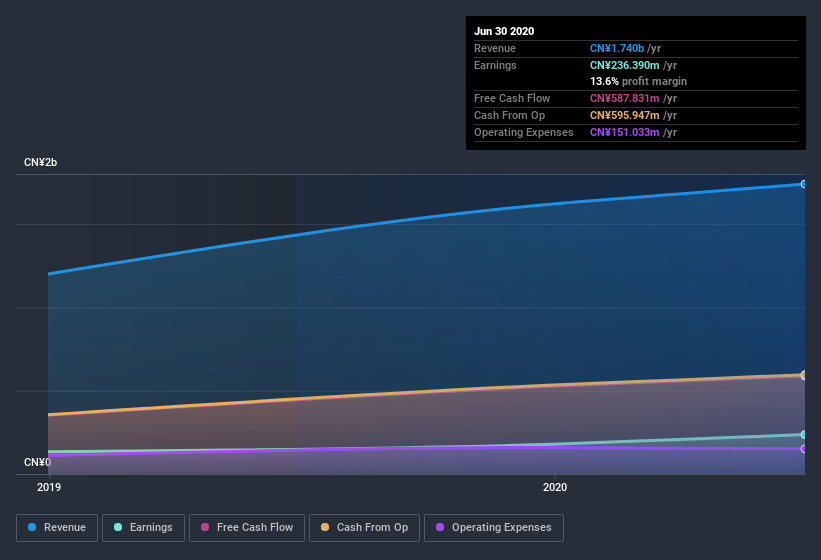

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Powerlong Commercial Management Holdings's EBIT margins were flat over the last year, revenue grew by a solid 23% to CN¥1.7b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Powerlong Commercial Management Holdings's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Powerlong Commercial Management Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Powerlong Commercial Management Holdings is the serious outlay one insider has made to buy shares, in the last year. Indeed, CEO & Director De Li Chen has accumulated shares over the last year, paying a total of CN¥273m at an average price of about CN¥24.30. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for Powerlong Commercial Management Holdings is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥1.8b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Powerlong Commercial Management Holdings Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Powerlong Commercial Management Holdings's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 2 warning signs for Powerlong Commercial Management Holdings you should be aware of.

As a growth investor I do like to see insider buying. But Powerlong Commercial Management Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Powerlong Commercial Management Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:9909

Powerlong Commercial Management Holdings

Provides commercial operational and residential property management services in the People’s Republic of China.

Flawless balance sheet and undervalued.