- Hong Kong

- /

- Retail REITs

- /

- SEHK:823

Assessing Link REIT (SEHK:823) Valuation Following Latest Earnings and Interim Distribution Update

Reviewed by Simply Wall St

Link Real Estate Investment Trust (SEHK:823) just released earnings for the half year through September 2025, showing a narrower loss compared to last year but also revealing a slight dip in sales. Alongside the results, an interim distribution was announced with important payout dates for unitholders.

See our latest analysis for Link Real Estate Investment Trust.

After a tough week that saw Link Real Estate Investment Trust’s share price slide more than 12%, recent earnings and a new interim distribution caught some attention. Despite this drop, its year-to-date share price return remains in positive territory at 12.13%. The one-year total shareholder return stands at 12.81%. However, the longer-term trend still points lower, with a decline of 14% over three years and 27% over five. This signals that momentum is still finding its footing even as management looks for ways to steady the course.

If today’s market moves have you thinking bigger, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the latest results now out and the share price still below analyst targets, is Link Real Estate Investment Trust presenting a value opportunity, or has the market already accounted for all possible future gains?

Price-to-Sales of 6.7x: Is it justified?

Link Real Estate Investment Trust trades at a price-to-sales ratio of 6.7, slightly below both its peer group and the broader Asian Retail REITs industry. This signals a discount relative to its counterparts, despite its recent earnings challenges.

The price-to-sales ratio compares the current share price with the company’s revenue per share. For REITs, where earnings can be volatile or negative, this multiple is often preferred as it gives investors a sense of how much they are paying for each dollar of sales. A lower ratio can indicate better value if revenue streams are stable.

With its price-to-sales of 6.7, Link Real Estate Investment Trust is not only cheaper than the typical industry average of 6.9, but it is also below its statistically estimated fair price-to-sales ratio of 8.8. This means that the market could potentially re-rate the shares higher if sentiment or fundamentals improve in the future.

Explore the SWS fair ratio for Link Real Estate Investment Trust

Result: Price-to-Sales of 6.7 (UNDERVALUED)

However, ongoing pressure on revenue growth and a recent net loss may challenge any quick turnaround or sustained market re-rating for Link REIT.

Find out about the key risks to this Link Real Estate Investment Trust narrative.

Another View: What Does the SWS DCF Model Reveal?

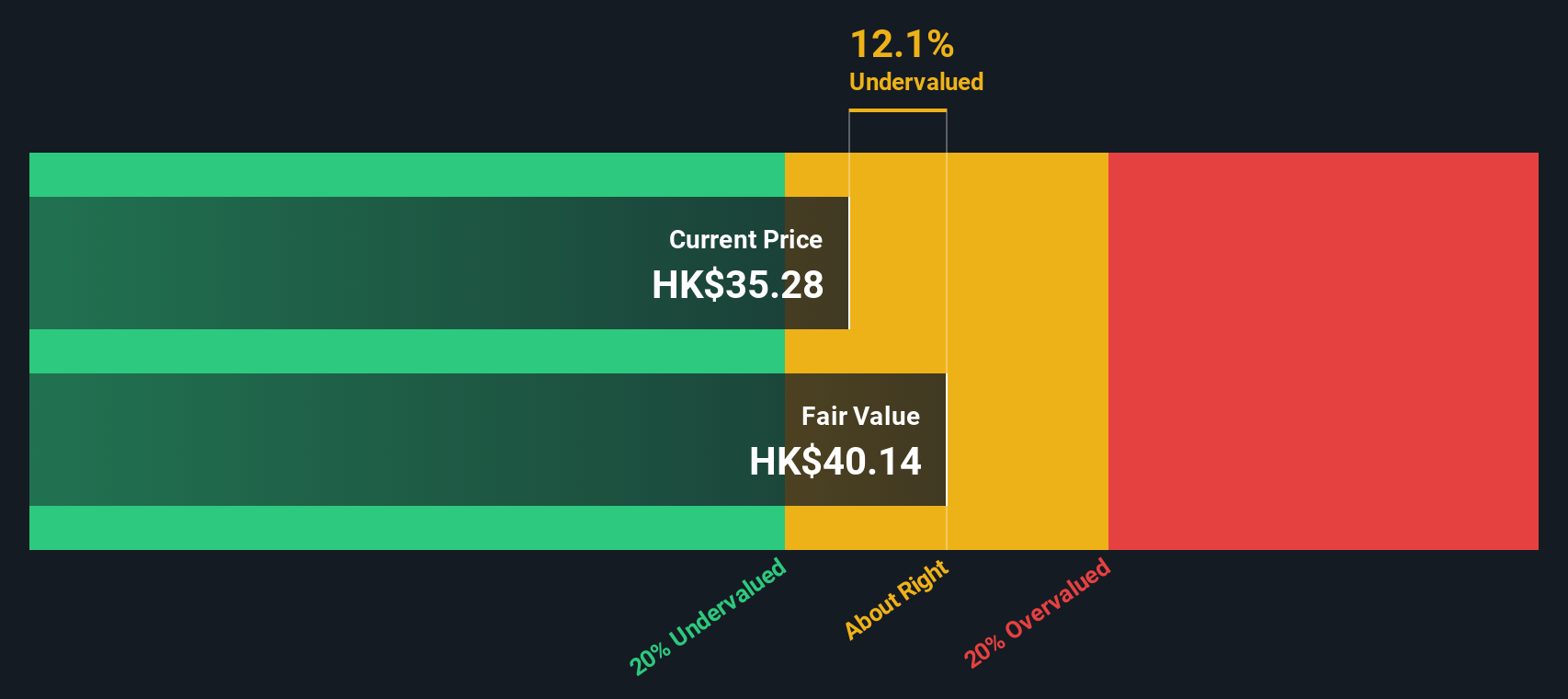

While the market currently values Link Real Estate Investment Trust below its peers based on sales, our SWS DCF model also signals undervaluation. The shares trade 9.5% below our estimate of fair value (HK$40.44), which further supports the idea that there could be upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Link Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Link Real Estate Investment Trust Narrative

If you want to dig deeper or have a different perspective, you can pull up the numbers yourself and assemble your own view in minutes, so why not Do it your way

A great starting point for your Link Real Estate Investment Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take your strategy to the next level and find stocks other investors are already talking about. Act now so you don't let great opportunities get away from you.

- Spot potential market surprises early and capitalize on these 918 undervalued stocks based on cash flows based on strong cash flow fundamentals before the crowd catches on.

- Tap into future health innovation and check out these 30 healthcare AI stocks with powerful artificial intelligence driving breakthroughs in medical technology and diagnostics.

- Earn steady passive income by following these 14 dividend stocks with yields > 3% consistently paying yields above 3% for reliable long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:823

Link Real Estate Investment Trust

Link Real Estate Investment Trust (Link REIT) is the largest REIT in Asia by many measures including asset value.

Undervalued established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.