- Hong Kong

- /

- Real Estate

- /

- SEHK:81

If You Like EPS Growth Then Check Out China Overseas Grand Oceans Group (HKG:81) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China Overseas Grand Oceans Group (HKG:81). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for China Overseas Grand Oceans Group

China Overseas Grand Oceans Group's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud China Overseas Grand Oceans Group's stratospheric annual EPS growth of 45%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

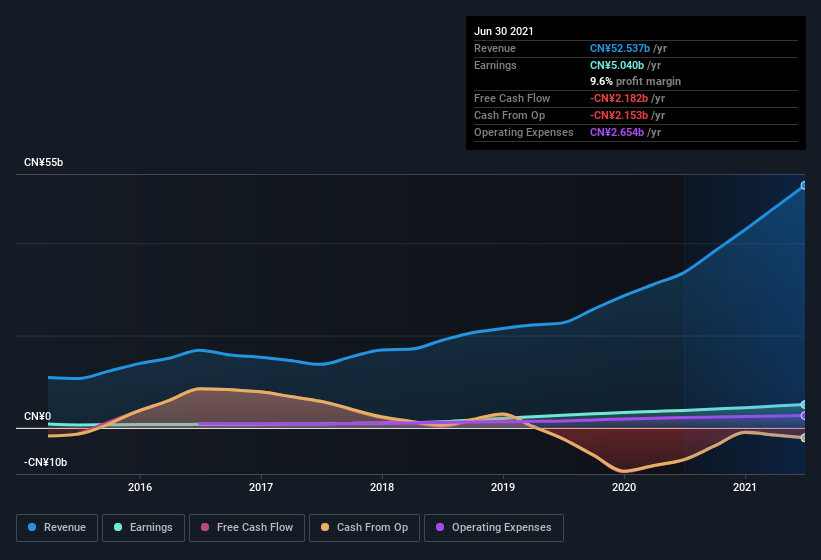

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While China Overseas Grand Oceans Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for China Overseas Grand Oceans Group.

Are China Overseas Grand Oceans Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no China Overseas Grand Oceans Group insiders reported share sales in the last twelve months. But the really good news is that Executive Chairman of the Board Yong Zhuang spent CN¥1.9m buying stock stock, at an average price of around CN¥3.83. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for China Overseas Grand Oceans Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥1.9b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is China Overseas Grand Oceans Group Worth Keeping An Eye On?

China Overseas Grand Oceans Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest China Overseas Grand Oceans Group belongs on the top of your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for China Overseas Grand Oceans Group (1 doesn't sit too well with us!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But China Overseas Grand Oceans Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:81

China Overseas Grand Oceans Group

An investment holding company, invests in, develops, and leases real estate properties in the People’s Republic of China and Hong Kong.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives