We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in Shoucheng Holdings Limited (HKG:697).

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for Shoucheng Holdings

The Last 12 Months Of Insider Transactions At Shoucheng Holdings

In the last twelve months, the biggest single sale by an insider was when the Executive Chairman of the Board, Tianyang Zhao, sold HK$5.9m worth of shares at a price of HK$2.66 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of HK$2.02. So it may not shed much light on insider confidence at current levels.

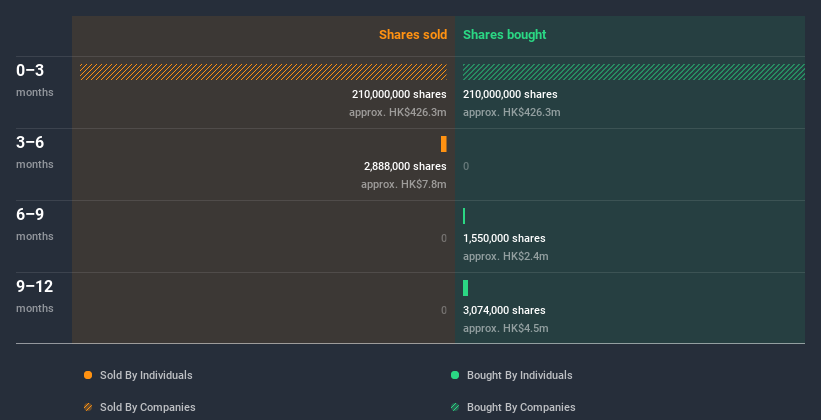

Happily, we note that in the last year insiders paid HK$6.8m for 4.62m shares. On the other hand they divested 2.89m shares, for HK$7.7m. All up, insiders sold more shares in Shoucheng Holdings than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Shoucheng Holdings better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Based on our data, Shoucheng Holdings insiders have about 0.05% of the stock, worth approximately HK$8.1m. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. I generally like to see higher levels of ownership.

So What Do The Shoucheng Holdings Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Shoucheng Holdings shares in the last quarter. Our analysis of Shoucheng Holdings insider transactions leaves us unenthusiastic. And usually insiders own more stock in the company, according to our data. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Shoucheng Holdings. In terms of investment risks, we've identified 3 warning signs with Shoucheng Holdings and understanding these should be part of your investment process.

Of course Shoucheng Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Shoucheng Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:697

Shoucheng Holdings

An investment holding company, engages in the management and operation of car parking assets.

High growth potential with excellent balance sheet.