- Hong Kong

- /

- Real Estate

- /

- SEHK:672

Shareholders Will Likely Find Zhong An Group Limited's (HKG:672) CEO Compensation Acceptable

The performance at Zhong An Group Limited (HKG:672) has been rather lacklustre of late and shareholders may be wondering what CEO Jiangang Zhang is planning to do about this. At the next AGM coming up on 10 June 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Zhong An Group

Comparing Zhong An Group Limited's CEO Compensation With the industry

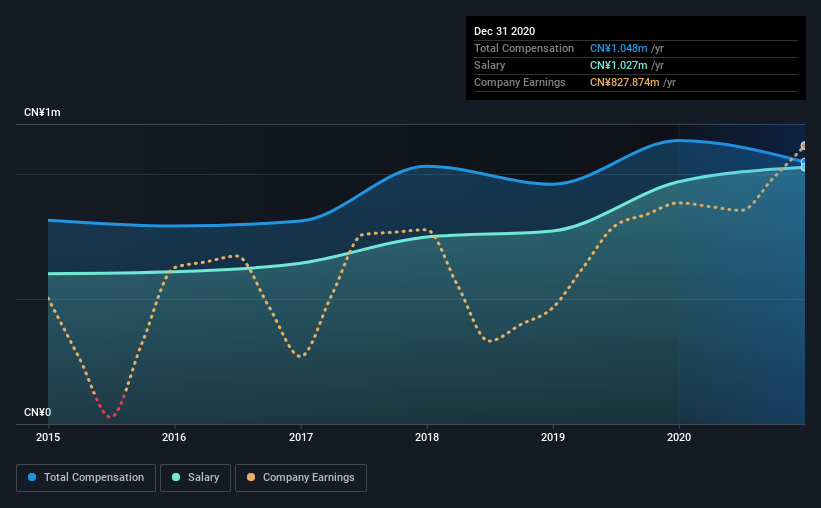

Our data indicates that Zhong An Group Limited has a market capitalization of HK$2.1b, and total annual CEO compensation was reported as CN¥1.0m for the year to December 2020. We note that's a small decrease of 7.6% on last year. In particular, the salary of CN¥1.03m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between HK$776m and HK$3.1b had a median total CEO compensation of CN¥2.2m. In other words, Zhong An Group pays its CEO lower than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥1.0m | CN¥969k | 98% |

| Other | CN¥21k | CN¥165k | 2% |

| Total Compensation | CN¥1.0m | CN¥1.1m | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. Zhong An Group has gone down a largely traditional route, paying Jiangang Zhang a high salary, giving it preference over non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Zhong An Group Limited's Growth Numbers

Over the past three years, Zhong An Group Limited has seen its earnings per share (EPS) grow by 12% per year. It achieved revenue growth of 20% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Zhong An Group Limited Been A Good Investment?

Since shareholders would have lost about 18% over three years, some Zhong An Group Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Zhong An Group pays its CEO a majority of compensation through a salary. The loss to shareholders over the past three years is certainly concerning. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key focus for the board and management will be how to align the share price with fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Zhong An Group that investors should look into moving forward.

Important note: Zhong An Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zhong An Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:672

Zhong An Group

An investment holding company, engages in property development, property leasing, and hotel operations.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026