- Hong Kong

- /

- Real Estate

- /

- SEHK:6093

Hevol Services Group (HKG:6093) Shareholders Booked A 55% Gain In The Last Year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Hevol Services Group Co. Limited (HKG:6093) share price is 55% higher than it was a year ago, much better than the market return of around 2.5% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Hevol Services Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

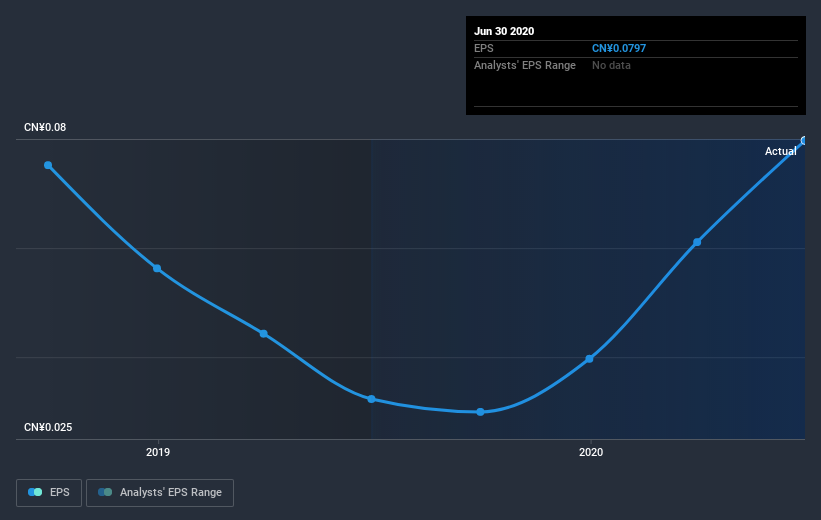

During the last year Hevol Services Group grew its earnings per share (EPS) by 147%. It's fair to say that the share price gain of 55% did not keep pace with the EPS growth. So it seems like the market has cooled on Hevol Services Group, despite the growth. Interesting.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Hevol Services Group's key metrics by checking this interactive graph of Hevol Services Group's earnings, revenue and cash flow.

A Different Perspective

Hevol Services Group boasts a total shareholder return of 55% for the last year. Unfortunately the share price is down 6.5% over the last quarter. Shorter term share price moves often don't signify much about the business itself. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Hevol Services Group .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Hevol Services Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hevol Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:6093

Hevol Services Group

An investment holding company, provides property management and value-added services in the People’s Republic of China.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives