- Hong Kong

- /

- Real Estate

- /

- SEHK:3319

I Ran A Stock Scan For Earnings Growth And A-Living Smart City Services (HKG:3319) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like A-Living Smart City Services (HKG:3319). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for A-Living Smart City Services

How Quickly Is A-Living Smart City Services Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud A-Living Smart City Services's stratospheric annual EPS growth of 48%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While A-Living Smart City Services did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

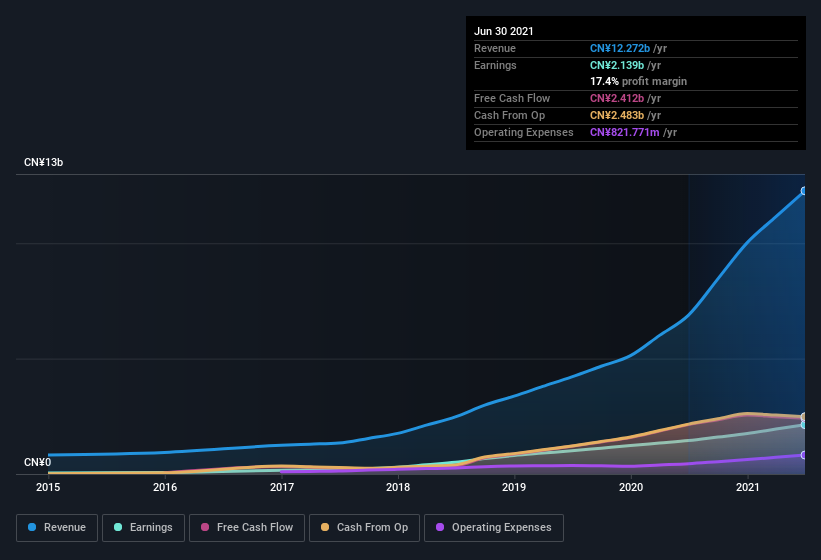

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for A-Living Smart City Services.

Are A-Living Smart City Services Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One shining light for A-Living Smart City Services is the serious outlay one insider has made to buy shares, in the last year. Indeed, President Dalong Li has accumulated shares over the last year, paying a total of CN¥6.5m at an average price of about CN¥32.36. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

It's reassuring that A-Living Smart City Services insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between CN¥26b and CN¥77b, like A-Living Smart City Services, the median CEO pay is around CN¥4.1m.

A-Living Smart City Services offered total compensation worth CN¥3.0m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does A-Living Smart City Services Deserve A Spot On Your Watchlist?

A-Living Smart City Services's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests A-Living Smart City Services may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. However, before you get too excited we've discovered 2 warning signs for A-Living Smart City Services that you should be aware of.

The good news is that A-Living Smart City Services is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3319

A-Living Smart City Services

Provides property management, sale, and inspection services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives