- Hong Kong

- /

- Real Estate

- /

- SEHK:3301

Ronshine China Holdings (HKG:3301) Will Pay A Smaller Dividend Than Last Year

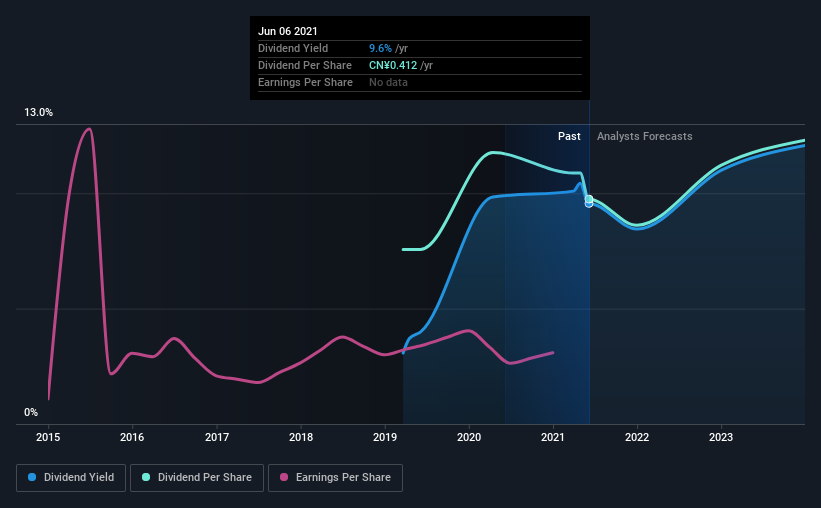

Ronshine China Holdings Limited (HKG:3301) is reducing its dividend to HK$0.50 on the 27th of August. The yield is still above the industry average at 9.6%.

View our latest analysis for Ronshine China Holdings

Ronshine China Holdings' Earnings Easily Cover the Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Ronshine China Holdings was earning enough to cover the dividend, but free cash flows weren't positive. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, earnings per share is forecast to fall by 17.8% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 43%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Ronshine China Holdings' Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The dividend has gone from CN¥0.32 in 2019 to the most recent annual payment of CN¥0.41. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. Ronshine China Holdings has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Although it's important to note that Ronshine China Holdings' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. While growth may be thin on the ground, Ronshine China Holdings could always pay out a higher proportion of earnings to increase shareholder returns.

Our Thoughts On Ronshine China Holdings' Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While Ronshine China Holdings is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for Ronshine China Holdings you should be aware of, and 1 of them is a bit unpleasant. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3301

Ronshine China Holdings

An investment holding company, engages in the property development business in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Community Narratives