- Hong Kong

- /

- Real Estate

- /

- SEHK:2772

Earnings growth of 1.5% over 1 year hasn't been enough to translate into positive returns for Zhongliang Holdings Group (HKG:2772) shareholders

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Zhongliang Holdings Group Company Limited (HKG:2772) share price is down 33% in the last year. That contrasts poorly with the market decline of 0.03%. Zhongliang Holdings Group hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Zhongliang Holdings Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Zhongliang Holdings Group share price fell, it actually saw its earnings per share (EPS) improve by 1.5%. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

We don't see any weakness in the Zhongliang Holdings Group's dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Unless, of course, the market was expecting a revenue uptick.

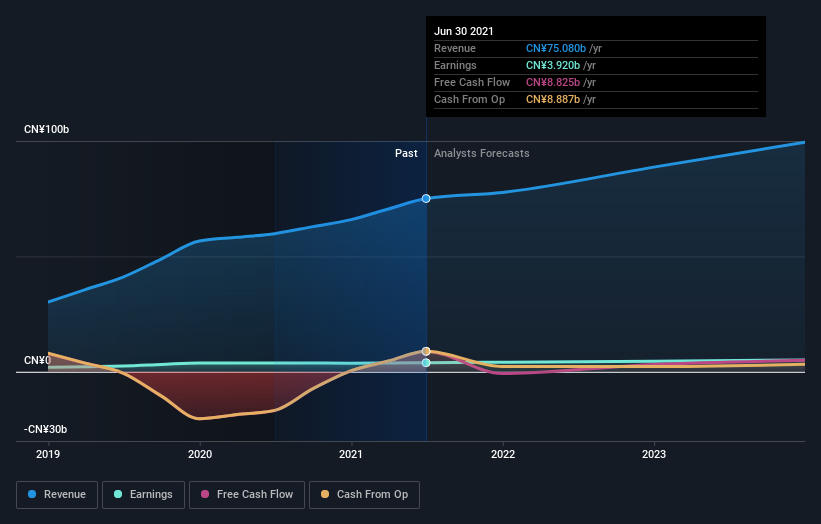

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Zhongliang Holdings Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Zhongliang Holdings Group's TSR for the last 1 year was -28%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Given that the market gained 0.03% in the last year, Zhongliang Holdings Group shareholders might be miffed that they lost 28% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 24% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Zhongliang Holdings Group better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Zhongliang Holdings Group (of which 1 is significant!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhongliang Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2772

Zhongliang Holdings Group

An investment holding company, engages in the property development and leasing business in Mainland China.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success