- Hong Kong

- /

- Real Estate

- /

- SEHK:2669

Shareholders of China Overseas Property Holdings (HKG:2669) Must Be Delighted With Their 563% Total Return

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. To wit, the China Overseas Property Holdings Limited (HKG:2669) share price has soared 521% over five years. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 1.6% in thirty days.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for China Overseas Property Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

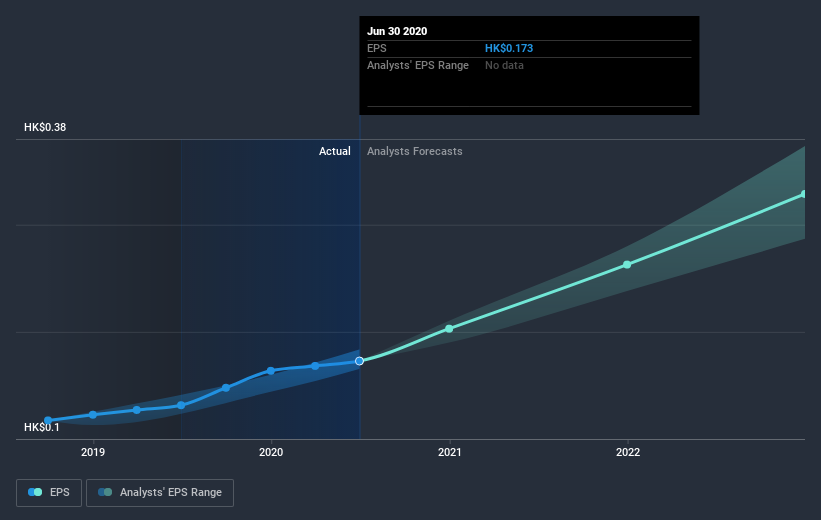

Over half a decade, China Overseas Property Holdings managed to grow its earnings per share at 37% a year. So the EPS growth rate is rather close to the annualized share price gain of 44% per year. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that China Overseas Property Holdings has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of China Overseas Property Holdings, it has a TSR of 563% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

China Overseas Property Holdings shareholders are down 1.1% for the year (even including dividends), but the market itself is up 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 46% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is China Overseas Property Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

We will like China Overseas Property Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade China Overseas Property Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2669

China Overseas Property Holdings

An investment holding company, provides property management services in Hong Kong, Macau, and Mainland China.

Very undervalued with solid track record.

Market Insights

Community Narratives