- Hong Kong

- /

- Real Estate

- /

- SEHK:1922

Qingping Huang Is The Non-Executive Director of Yincheng Life Service CO., Ltd. (HKG:1922) And They Just Picked Up 4.2% More Shares

Those following along with Yincheng Life Service CO., Ltd. (HKG:1922) will no doubt be intrigued by the recent purchase of shares by Qingping Huang, Non-Executive Director of the company, who spent a stonking HK$19m on stock at an average price of HK$4.66. There's no denying a buy of that magnitude suggests conviction in a brighter future, although we do note that proportionally it only increased their holding by 4.2%.

Check out our latest analysis for Yincheng Life Service

Yincheng Life Service Insider Transactions Over The Last Year

In fact, the recent purchase by Non-Executive Director Qingping Huang was not their only trade of Yincheng Life Service shares this year. Earlier in the year, they sold shares at a price ofHK$6.30 per share in a -HK$59m transaction. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The good news is that this large sale was at well above current price of HK$4.90. So it is hard to draw any strong conclusion from it.

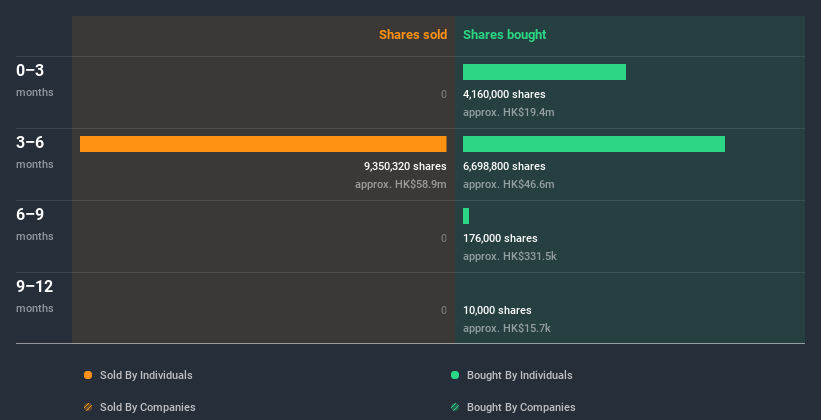

Over the last year, we can see that insiders have bought 11.04m shares worth HK$62m. But they sold 9.35m shares for HK$59m. In total, Yincheng Life Service insiders bought more than they sold over the last year. Their average price was about HK$5.61. This is nice to see since it implies that insiders might see value around current prices. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Yincheng Life Service is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Yincheng Life Service insiders own 73% of the company, currently worth about HK$936m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Yincheng Life Service Insiders?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. When combined with notable insider ownership, these factors suggest Yincheng Life Service insiders are well aligned, and quite possibly think the share price is too low. Nice! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Yincheng Life Service. You'd be interested to know, that we found 2 warning signs for Yincheng Life Service and we suggest you have a look.

But note: Yincheng Life Service may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Yincheng Life Service or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1922

Ruisen Life Service Co

An investment holding company, provides property management services in the Mainland China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026