- Hong Kong

- /

- Real Estate

- /

- SEHK:1922

Do Yincheng Life Service's (HKG:1922) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Yincheng Life Service (HKG:1922). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Yincheng Life Service

How Fast Is Yincheng Life Service Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a wedge-tailed eagle on the wind, Yincheng Life Service's EPS soared from CN¥0.13 to CN¥0.21, in just one year. That's a commendable gain of 65%.

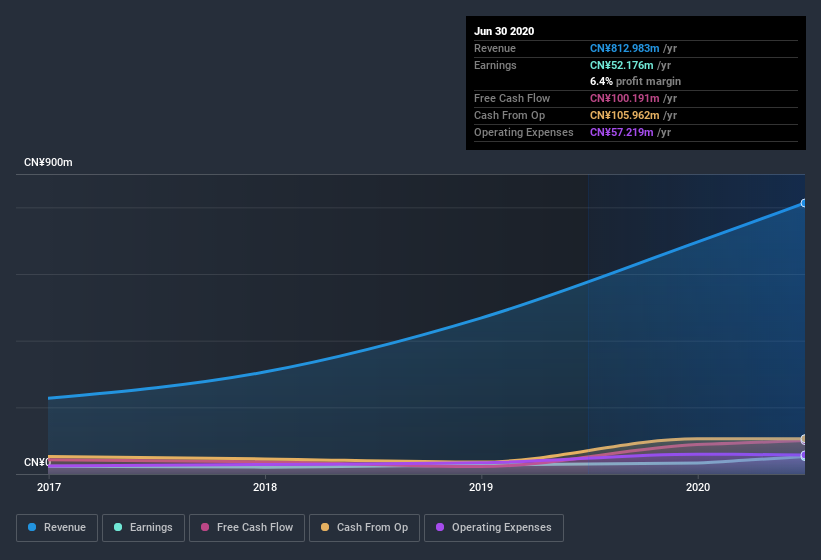

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Yincheng Life Service shareholders can take confidence from the fact that EBIT margins are up from 7.4% to 10%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Yincheng Life Service is no giant, with a market capitalization of HK$1.2b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Yincheng Life Service Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While Yincheng Life Service insiders did net -CN¥59m selling stock over the last year, they invested CN¥62m, a much higher figure. You could argue that level of buying implies genuine confidence in the business. We also note that it was the President & Executive Director, Chunling Li, who made the biggest single acquisition, paying HK$34m for shares at about HK$6.30 each.

On top of the insider buying, we can also see that Yincheng Life Service insiders own a large chunk of the company. Indeed, with a collective holding of 75%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about CN¥912m riding on the stock, at current prices. That's nothing to sneeze at!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Chunling Li, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Yincheng Life Service with market caps between CN¥654m and CN¥2.6b is about CN¥2.0m.

Yincheng Life Service offered total compensation worth CN¥1.3m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Yincheng Life Service Deserve A Spot On Your Watchlist?

For growth investors like me, Yincheng Life Service's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Yincheng Life Service that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Yincheng Life Service, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Yincheng Life Service, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1922

Ruisen Life Service Co

An investment holding company, provides property management services in the Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success