- Hong Kong

- /

- Real Estate

- /

- SEHK:1622

What Type Of Shareholders Own The Most Number of Redco Properties Group Limited (HKG:1622) Shares?

If you want to know who really controls Redco Properties Group Limited (HKG:1622), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Redco Properties Group has a market capitalization of HK$10b, so we would expect some institutional investors to have noticed the stock. In the chart below, we can see that institutions are not really that prevalent on the share registry. We can zoom in on the different ownership groups, to learn more about Redco Properties Group.

See our latest analysis for Redco Properties Group

What Does The Institutional Ownership Tell Us About Redco Properties Group?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

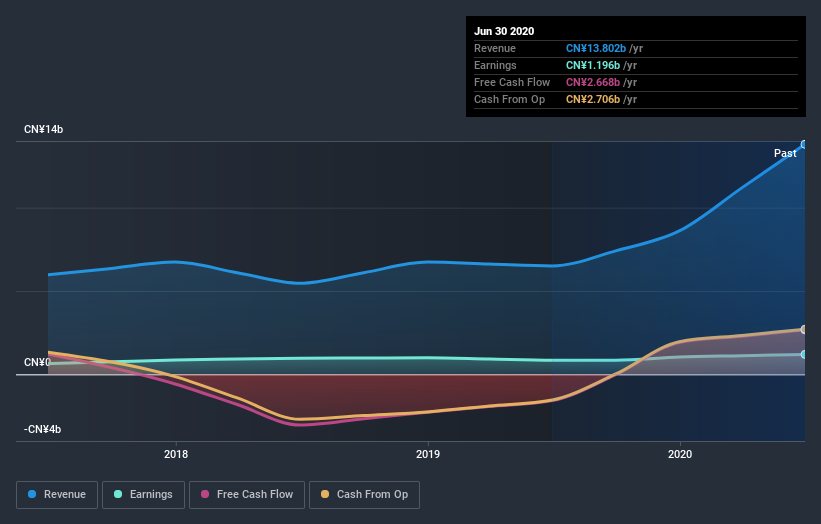

Institutions have a very small stake in Redco Properties Group. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

Hedge funds don't have many shares in Redco Properties Group. Our data suggests that Yeuk Hung Wong, who is also the company's Top Key Executive, holds the most number of shares at 39%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company. With 27% and 8.8% of the shares outstanding respectively, Ruoqing Huang and Leung Ho Ng are the second and third largest shareholders. Interestingly, the second-largest shareholder, Ruoqing Huang is also Chief Executive Officer, again, pointing towards strong insider ownership amongst the company's top shareholders.

To make our study more interesting, we found that the top 2 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Redco Properties Group

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own the majority of Redco Properties Group Limited. This means they can collectively make decisions for the company. Insiders own HK$7.5b worth of shares in the HK$10b company. That's extraordinary! It is good to see this level of investment. You can check here to see if those insiders have been selling any of their shares.

General Public Ownership

The general public holds a 23% stake in Redco Properties Group. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Redco Properties Group you should be aware of, and 1 of them shouldn't be ignored.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Redco Properties Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1622

Redco Properties Group

An investment holding company, engages in the property development and investment activities in the People’s Republic of China and Hong Kong.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026