- Hong Kong

- /

- Real Estate

- /

- SEHK:1238

Do Powerlong Real Estate Holdings's (HKG:1238) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Powerlong Real Estate Holdings (HKG:1238). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Powerlong Real Estate Holdings

Powerlong Real Estate Holdings's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Powerlong Real Estate Holdings has grown EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

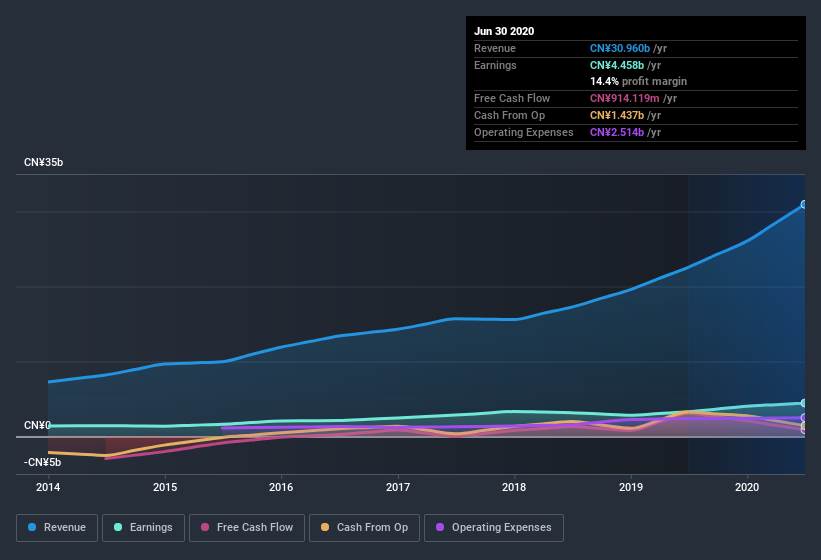

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Powerlong Real Estate Holdings maintained stable EBIT margins over the last year, all while growing revenue 37% to CN¥31b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Powerlong Real Estate Holdings's future profits.

Are Powerlong Real Estate Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Powerlong Real Estate Holdings shareholders can gain quiet confidence from the fact that insiders shelled out CN¥4.5m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. It is also worth noting that it was Non-Executive Director Wa Fan Hoi who made the biggest single purchase, worth HK$2.7m, paying HK$5.19 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Powerlong Real Estate Holdings insiders own more than a third of the company. In fact, they own 65% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling CN¥15b. Now that's what I call some serious skin in the game!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Wa Fong Hoi is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between CN¥13b and CN¥42b, like Powerlong Real Estate Holdings, the median CEO pay is around CN¥4.7m.

The Powerlong Real Estate Holdings CEO received total compensation of just CN¥1.2m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Powerlong Real Estate Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of Powerlong Real Estate Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Powerlong Real Estate Holdings (1 is concerning) you should be aware of.

The good news is that Powerlong Real Estate Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Powerlong Real Estate Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1238

Powerlong Real Estate Holdings

An investment holding company, invests in, develops, operates, and manages commercial real estate projects in the People’s Republic of China.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives