- Hong Kong

- /

- Real Estate

- /

- SEHK:1233

Times China Holdings Limited (HKG:1233) Just Recorded An Earnings Miss And Analysts Are Updating Their Numbers

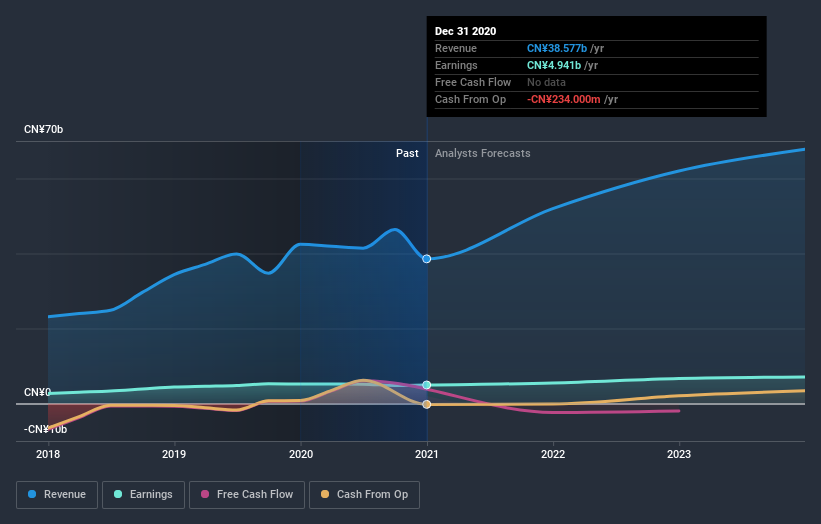

It's shaping up to be a tough period for Times China Holdings Limited (HKG:1233), which a week ago released some disappointing annual results that could have a notable impact on how the market views the stock. Times China Holdings missed earnings this time around, with CN¥39b revenue coming in 9.6% below what the analysts had modelled. Statutory earnings per share (EPS) of CN¥2.54 also fell short of expectations by 11%. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for Times China Holdings

Taking into account the latest results, the consensus forecast from Times China Holdings' eleven analysts is for revenues of CN¥52.0b in 2021, which would reflect a sizeable 35% improvement in sales compared to the last 12 months. Per-share earnings are expected to step up 14% to CN¥2.91. In the lead-up to this report, the analysts had been modelling revenues of CN¥57.2b and earnings per share (EPS) of CN¥3.30 in 2021. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a real cut to earnings per share estimates.

It'll come as no surprise then, to learn that the analysts have cut their price target 8.0% to CN¥11.73. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Times China Holdings at CN¥17.98 per share, while the most bearish prices it at CN¥10.40. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Times China Holdings' growth to accelerate, with the forecast 35% annualised growth to the end of 2021 ranking favourably alongside historical growth of 25% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 15% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Times China Holdings to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Times China Holdings. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Times China Holdings going out to 2023, and you can see them free on our platform here..

Plus, you should also learn about the 2 warning signs we've spotted with Times China Holdings (including 1 which is potentially serious) .

When trading Times China Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Times China Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Times China Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1233

Times China Holdings

An investment holding company, operates as a property developer in the People’s Republic of China.

Good value slight.