- Hong Kong

- /

- Real Estate

- /

- SEHK:106

These 4 Measures Indicate That Landsea Green Properties (HKG:106) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Landsea Green Properties Co., Ltd. (HKG:106) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Landsea Green Properties

What Is Landsea Green Properties's Net Debt?

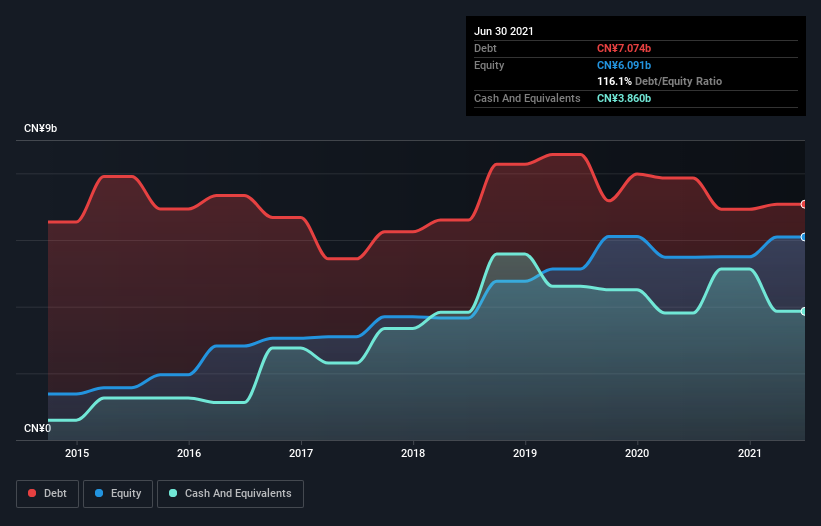

You can click the graphic below for the historical numbers, but it shows that Landsea Green Properties had CN¥7.07b of debt in June 2021, down from CN¥7.86b, one year before. However, it also had CN¥3.86b in cash, and so its net debt is CN¥3.21b.

How Healthy Is Landsea Green Properties' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Landsea Green Properties had liabilities of CN¥12.0b due within 12 months and liabilities of CN¥6.25b due beyond that. On the other hand, it had cash of CN¥3.86b and CN¥4.07b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥10.3b.

This deficit casts a shadow over the CN¥1.71b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Landsea Green Properties would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Landsea Green Properties shareholders face the double whammy of a high net debt to EBITDA ratio (12.9), and fairly weak interest coverage, since EBIT is just 0.76 times the interest expense. The debt burden here is substantial. Worse, Landsea Green Properties's EBIT was down 84% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Landsea Green Properties will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Landsea Green Properties recorded free cash flow worth a fulsome 82% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

To be frank both Landsea Green Properties's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Taking into account all the aforementioned factors, it looks like Landsea Green Properties has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Landsea Green Properties has 4 warning signs (and 2 which are concerning) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:106

Landsea Green Management

An investment holding company, develops, manages, and sells properties in Mainland China and the United States.

Medium-low and slightly overvalued.

Market Insights

Community Narratives