- Hong Kong

- /

- Real Estate

- /

- SEHK:1036

Vanke Overseas Investment Holding (HKG:1036) Has Announced A Dividend Of HK$0.09

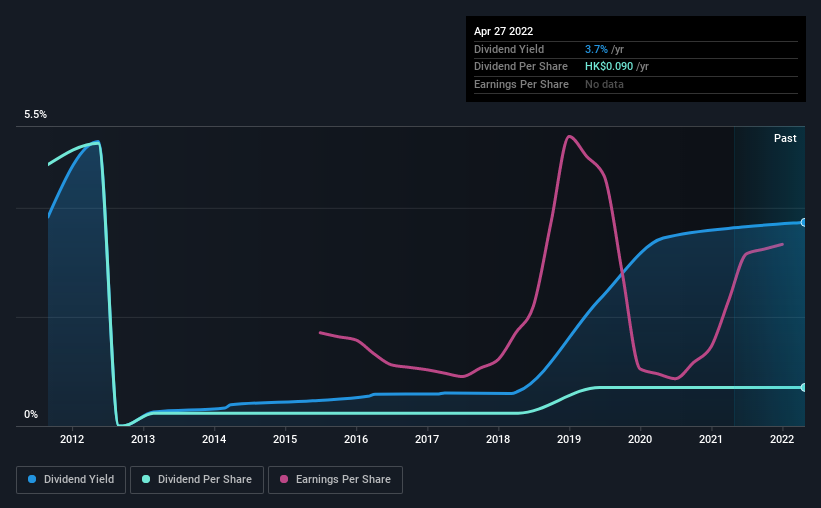

Vanke Overseas Investment Holding Company Limited (HKG:1036) has announced that it will pay a dividend of HK$0.09 per share on the 13th of July. Including this payment, the dividend yield on the stock will be 3.7%, which is a modest boost for shareholders' returns.

See our latest analysis for Vanke Overseas Investment Holding

Vanke Overseas Investment Holding's Payment Has Solid Earnings Coverage

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. However, prior to this announcement, Vanke Overseas Investment Holding's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 26.5% if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio will be 8.1%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from HK$0.61 in 2012 to the most recent annual payment of HK$0.09. The dividend has fallen 85% over that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Vanke Overseas Investment Holding has seen EPS rising for the last five years, at 26% per annum. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

We Really Like Vanke Overseas Investment Holding's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 2 warning signs for Vanke Overseas Investment Holding that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1036

Vanke Overseas Investment Holding

An investment holding company, engages in the asset management, and property development and investment in Hong Kong, the United Kingdom, and the United States.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026