- Hong Kong

- /

- Real Estate

- /

- SEHK:10

Shareholders May Be Wary Of Increasing Hang Lung Group Limited's (HKG:10) CEO Compensation Package

Shareholders will probably not be too impressed with the underwhelming results at Hang Lung Group Limited (HKG:10) recently. At the upcoming AGM on 30 April 2021, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Hang Lung Group

How Does Total Compensation For Weber Lo Compare With Other Companies In The Industry?

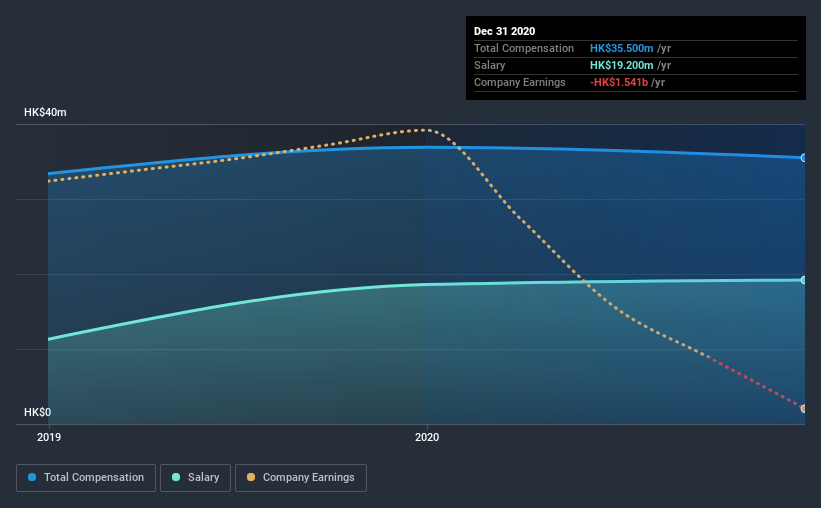

Our data indicates that Hang Lung Group Limited has a market capitalization of HK$28b, and total annual CEO compensation was reported as HK$36m for the year to December 2020. That's a slight decrease of 3.8% on the prior year. Notably, the salary which is HK$19.2m, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between HK$16b and HK$50b, we discovered that the median CEO total compensation of that group was HK$6.9m. Accordingly, our analysis reveals that Hang Lung Group Limited pays Weber Lo north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$19m | HK$19m | 54% |

| Other | HK$16m | HK$18m | 46% |

| Total Compensation | HK$36m | HK$37m | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. Hang Lung Group pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Hang Lung Group Limited's Growth

Over the last three years, Hang Lung Group Limited has shrunk its earnings per share by 42% per year. In the last year, its revenue is down 4.0%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Hang Lung Group Limited Been A Good Investment?

With a three year total loss of 4.0% for the shareholders, Hang Lung Group Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Hang Lung Group you should be aware of, and 1 of them shouldn't be ignored.

Switching gears from Hang Lung Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Hang Lung Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:10

Hang Lung Group

An investment holding company, operates as a property developer in Hong Kong and Mainland China.

Established dividend payer with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026