- Hong Kong

- /

- Real Estate

- /

- SEHK:9983

Why Investors Shouldn't Be Surprised By Central China New Life Limited's (HKG:9983) 27% Share Price Surge

Those holding Central China New Life Limited (HKG:9983) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 57% share price decline over the last year.

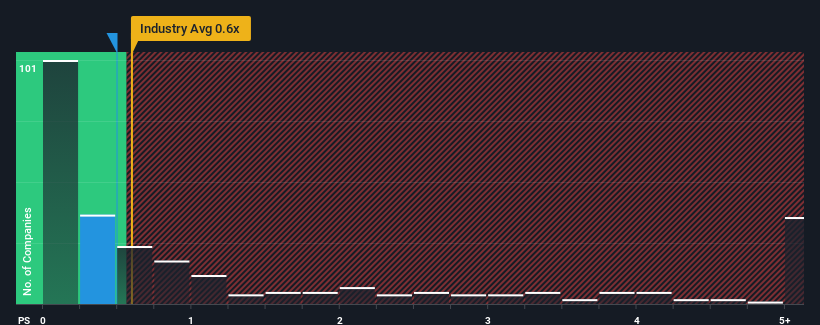

In spite of the firm bounce in price, there still wouldn't be many who think Central China New Life's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Hong Kong's Real Estate industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Central China New Life

What Does Central China New Life's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Central China New Life's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Central China New Life.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Central China New Life would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.2% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 5.7% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.4% per year, which is not materially different.

In light of this, it's understandable that Central China New Life's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Central China New Life's P/S Mean For Investors?

Its shares have lifted substantially and now Central China New Life's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Central China New Life's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You should always think about risks. Case in point, we've spotted 2 warning signs for Central China New Life you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9983

Central China New Life

An investment holding company, provides property management services and value-added services in the People’s Republic of China.

Adequate balance sheet low.

Market Insights

Community Narratives