- Hong Kong

- /

- Real Estate

- /

- SEHK:9982

Central China Management Company Limited (HKG:9982) Shares Fly 26% But Investors Aren't Buying For Growth

Central China Management Company Limited (HKG:9982) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

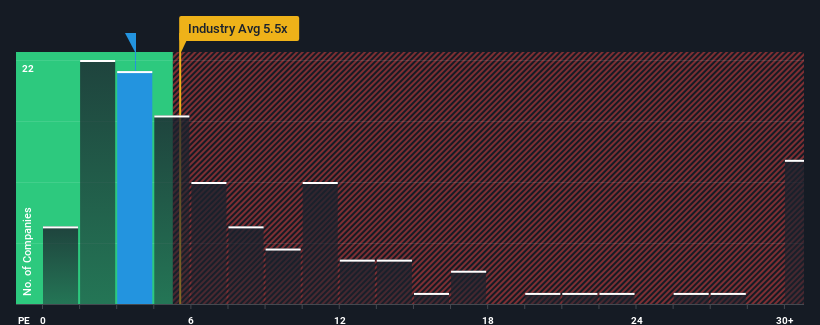

Although its price has surged higher, Central China Management may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 3.7x, since almost half of all companies in Hong Kong have P/E ratios greater than 9x and even P/E's higher than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Central China Management has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Central China Management

Is There Any Growth For Central China Management?

In order to justify its P/E ratio, Central China Management would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 53%. As a result, earnings from three years ago have also fallen 68% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 3.0% each year as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

With this information, we can see why Central China Management is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Central China Management's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Central China Management maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Central China Management that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9982

Central China Management

An investment holding company, provides project management services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives