- Hong Kong

- /

- Real Estate

- /

- SEHK:95

Investors in LVGEM (China) Real Estate Investment (HKG:95) from five years ago are still down 84%, even after 15% gain this past week

LVGEM (China) Real Estate Investment Company Limited (HKG:95) shareholders should be happy to see the share price up 24% in the last month. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 84% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The important question is if the business itself justifies a higher share price in the long term. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

The recent uptick of 15% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for LVGEM (China) Real Estate Investment

LVGEM (China) Real Estate Investment wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade LVGEM (China) Real Estate Investment reduced its trailing twelve month revenue by 9.3% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 13% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

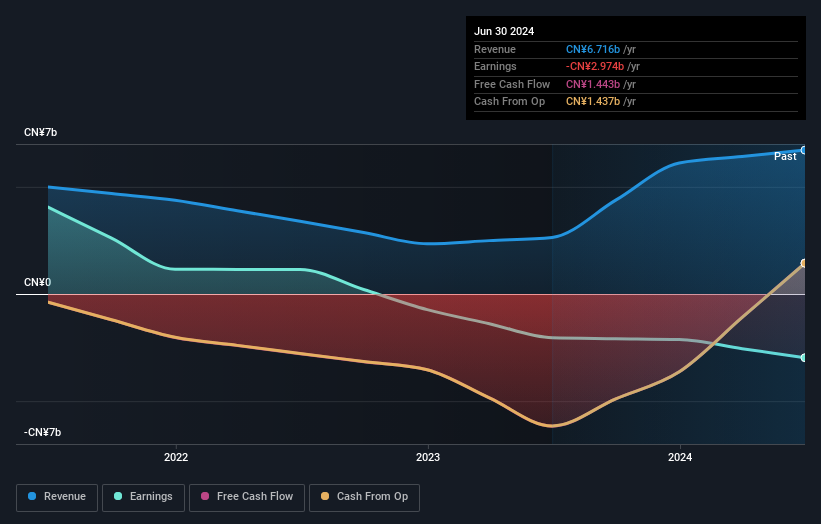

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on LVGEM (China) Real Estate Investment's earnings, revenue and cash flow.

A Different Perspective

LVGEM (China) Real Estate Investment shareholders are down 35% for the year, but the market itself is up 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for LVGEM (China) Real Estate Investment you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:95

LVGEM (China) Real Estate Investment

An investment holding company, engages in property development and investment businesses in the People’s Republic of China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives