- Hong Kong

- /

- Real Estate

- /

- SEHK:884

Health Check: How Prudently Does CIFI Holdings (Group) (HKG:884) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CIFI Holdings (Group) Co. Ltd. (HKG:884) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for CIFI Holdings (Group)

How Much Debt Does CIFI Holdings (Group) Carry?

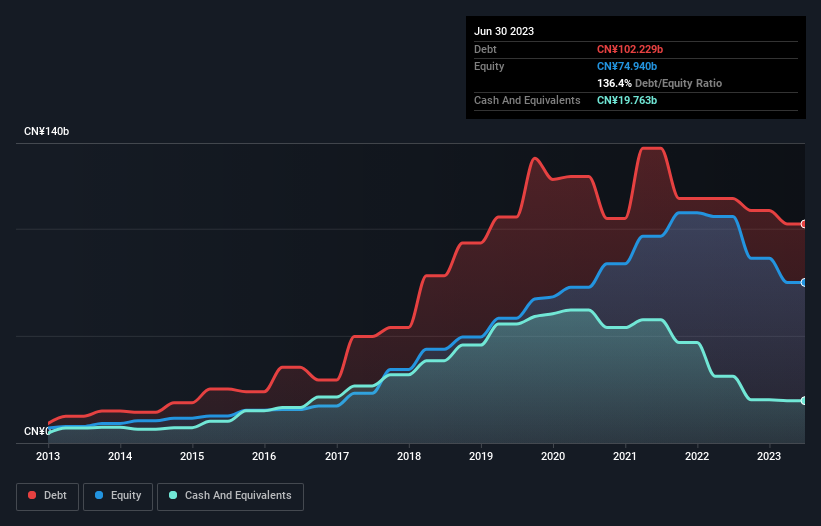

You can click the graphic below for the historical numbers, but it shows that CIFI Holdings (Group) had CN¥102.2b of debt in June 2023, down from CN¥114.1b, one year before. However, it does have CN¥19.8b in cash offsetting this, leading to net debt of about CN¥82.5b.

How Strong Is CIFI Holdings (Group)'s Balance Sheet?

According to the last reported balance sheet, CIFI Holdings (Group) had liabilities of CN¥253.0b due within 12 months, and liabilities of CN¥34.9b due beyond 12 months. Offsetting this, it had CN¥19.8b in cash and CN¥97.2b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥170.9b.

This deficit casts a shadow over the CN¥2.19b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, CIFI Holdings (Group) would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if CIFI Holdings (Group) can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year CIFI Holdings (Group) had a loss before interest and tax, and actually shrunk its revenue by 52%, to CN¥49b. To be frank that doesn't bode well.

Caveat Emptor

While CIFI Holdings (Group)'s falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping CN¥14b. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Sure, the company might have a nice story about how they are going on to a brighter future. But the reality is that it is low on liquid assets relative to liabilities, and it lost CN¥23b in the last year. So we're not very excited about owning this stock. Its too risky for us. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for CIFI Holdings (Group) you should be aware of, and 1 of them shouldn't be ignored.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:884

CIFI Holdings (Group)

Engages in the property development and investment business in the People’s Republic of China.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026