- Hong Kong

- /

- Real Estate

- /

- SEHK:817

With China Jinmao Holdings Group Limited (HKG:817) It Looks Like You'll Get What You Pay For

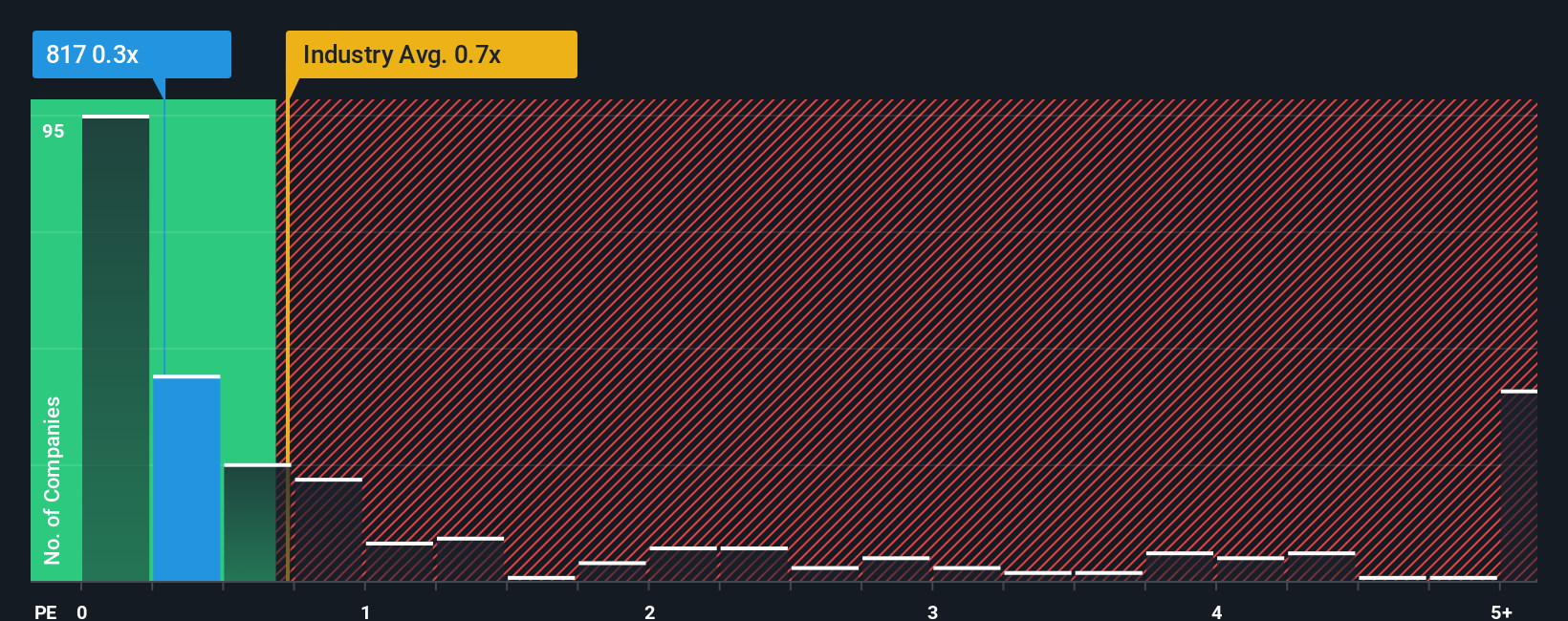

There wouldn't be many who think China Jinmao Holdings Group Limited's (HKG:817) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Real Estate industry in Hong Kong is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for China Jinmao Holdings Group

What Does China Jinmao Holdings Group's P/S Mean For Shareholders?

China Jinmao Holdings Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on China Jinmao Holdings Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For China Jinmao Holdings Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Jinmao Holdings Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.9% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 31% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.5% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.7% each year, which is not materially different.

In light of this, it's understandable that China Jinmao Holdings Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A China Jinmao Holdings Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Real Estate industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Jinmao Holdings Group that you should be aware of.

If you're unsure about the strength of China Jinmao Holdings Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:817

China Jinmao Holdings Group

Engages in the property development business in Mainland China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives