Exploring 3 Top Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures and the U.S. economic indicators show mixed signals, small-cap stocks have been navigating a complex landscape. The S&P 600 index for small-cap stocks has seen varied performance, reflecting broader market sentiments influenced by consumer confidence and housing sector data. In this environment, identifying undervalued small caps with notable insider activity can offer unique investment opportunities. These stocks often exhibit strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 3.8x | 3.8x | 20.52% | ★★★★★☆ |

| Tourism Holdings | 9.8x | 0.4x | 38.29% | ★★★★★☆ |

| East West Banking | 3.5x | 0.7x | 38.82% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 25.58% | ★★★★★☆ |

| Sagicor Financial | 1.2x | 0.3x | -30.46% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 41.55% | ★★★★☆☆ |

| German American Bancorp | 13.8x | 4.6x | 47.10% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -218.68% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -244.72% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer and distributor of building materials and interior decoration products, with a market cap of approximately CN¥ 22.79 billion.

Operations: The company derives its revenue primarily from the Plastics & Rubber segment, with a gross profit margin of 26.04%. Operating expenses and non-operating expenses significantly impact net income, which is CN¥1.92 billion for the latest period.

PE: 5.8x

China Lesso Group Holdings, a small-cap stock, recently reported a decline in sales and net income for the half year ended June 30, 2024. Sales dropped to CNY 13.56 billion from CNY 15.30 billion a year ago, while net income fell to CNY 1.04 billion from CNY 1.49 billion. Despite this, insider confidence is evident as Luen Hei Wong purchased four million shares worth approximately US$10 million in August 2024. The company faces high debt levels but forecasts earnings growth of over 10% annually.

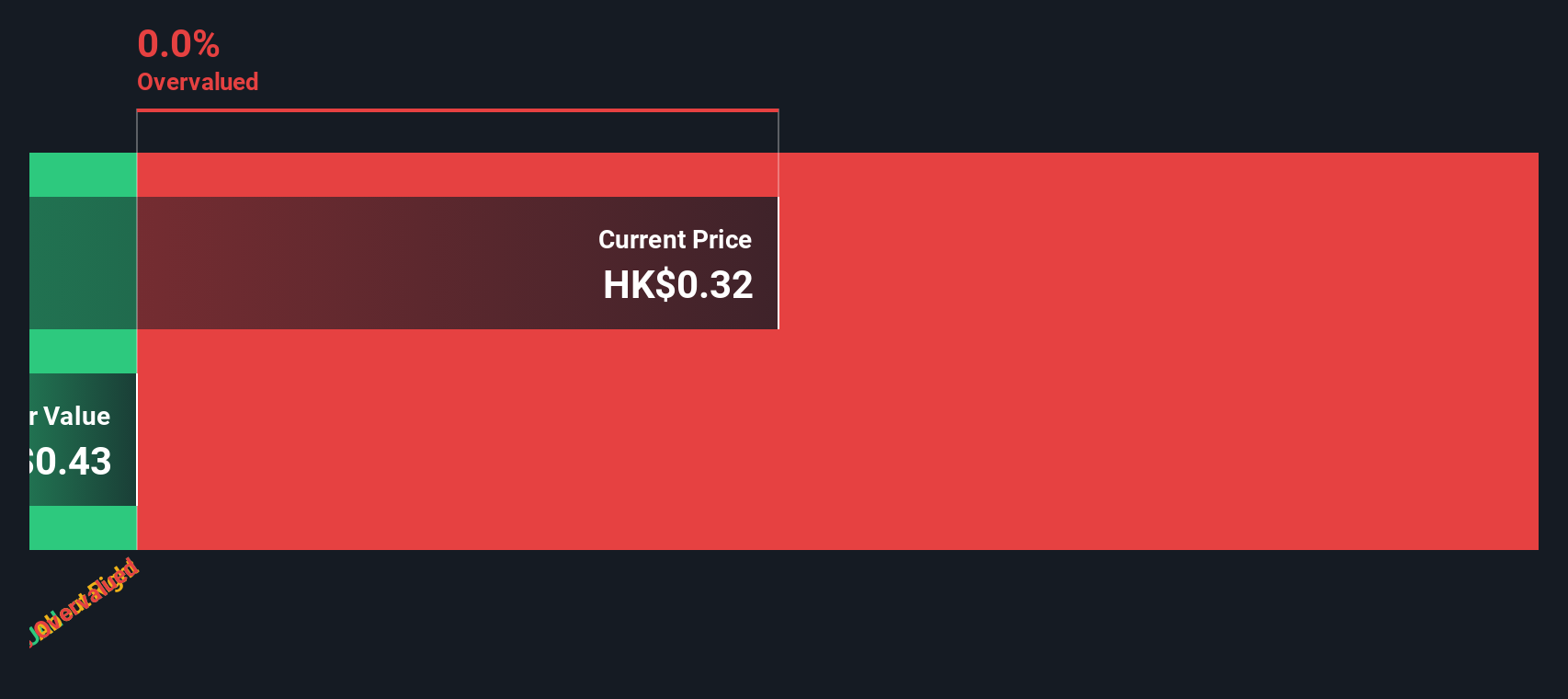

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment focuses on property development, investment, and management with a market cap of CN¥5.02 billion.

Operations: Revenue primarily comes from Property Development (CN¥17.26 billion) and Property Investment and Management (CN¥1.23 billion). The cost of goods sold significantly impacts gross profit margins, which have fluctuated, reaching as low as -0.04% and as high as 41.63%. Operating expenses have generally remained under CN¥700 million over the periods analyzed.

PE: -2.1x

Gemdale Properties and Investment, a smaller company in the real estate sector, has seen significant insider confidence recently. Lian Huat Loh purchased 10 million shares worth approximately RMB 2.6 million between August and September 2024, increasing their stake by nearly 486%. Despite earnings declining by an average of 29.5% annually over the past five years and a recent net loss of RMB 2.18 billion for the first half of 2024, contracted sales have been strong with RMB 12.43 billion achieved from January to August this year. This mixed performance suggests potential for future growth amidst current undervaluation concerns.

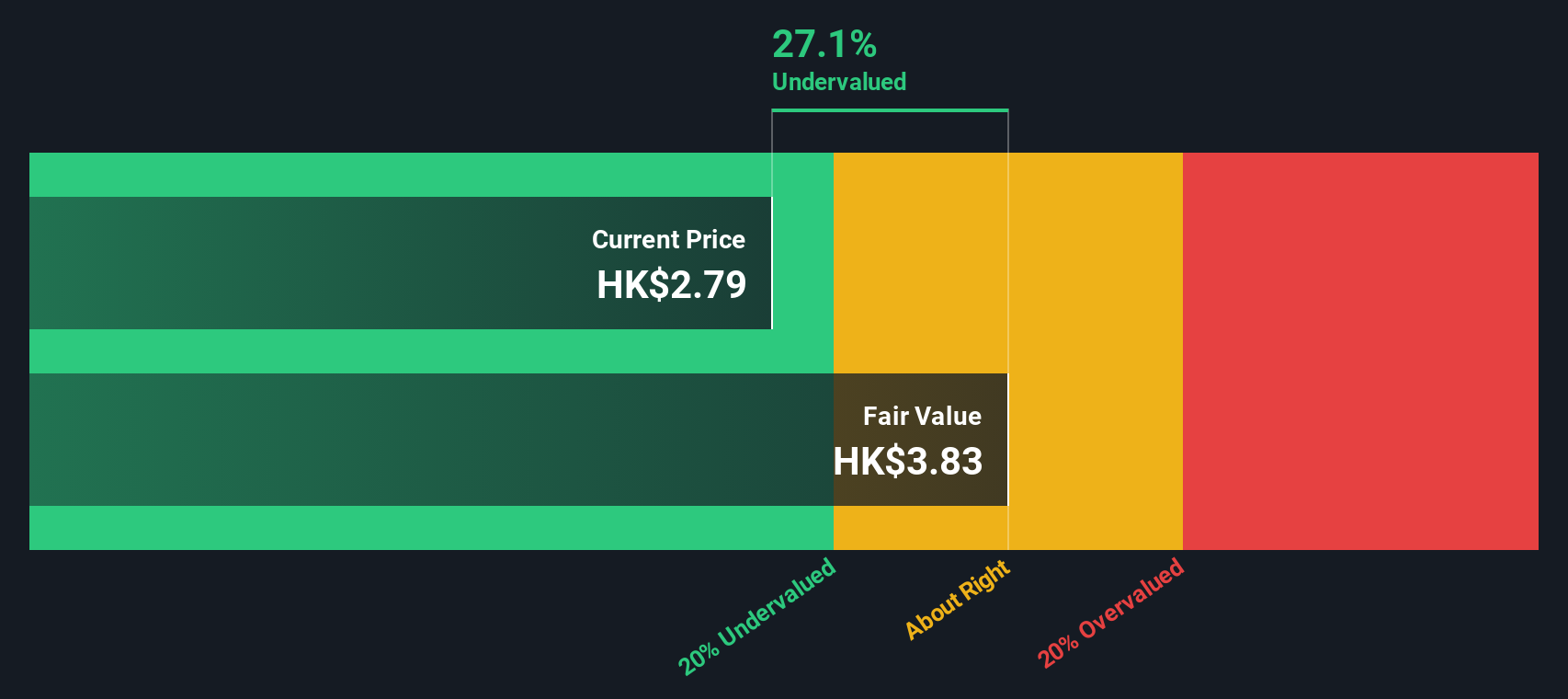

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ming Yuan Cloud Group Holdings specializes in providing cloud services and on-premise software solutions, with a market cap of approximately CN¥10.92 billion.

Operations: The company generates revenue primarily from Cloud Services (CN¥1315.70 million) and On-premise Software and Services (CN¥281.71 million). As of the latest reporting period, the gross profit margin stands at 79.64%.

PE: -13.7x

Ming Yuan Cloud Group Holdings, a smaller company in the tech sector, has recently seen significant insider confidence. VP & Executive Director Xiaohui Chen bought 1 million shares for approximately CNY 2.53 million on September 25, demonstrating their belief in the company's potential. Despite reporting a net loss of CNY 115 million for H1 2024, down from CNY 323 million the previous year, earnings are forecasted to grow by over 74% annually. The company also initiated a share repurchase program in July to enhance earnings per share, reflecting strategic moves to improve shareholder value amidst recent board changes and address updates.

Key Takeaways

- Investigate our full lineup of 180 Undervalued Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:909

Ming Yuan Cloud Group Holdings

An investment holding company, provides software solutions for property developers in China.

Excellent balance sheet with reasonable growth potential.