- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

Alibaba Health Information Technology And 2 Other Stocks That Might Be Undervalued

Reviewed by Simply Wall St

Global markets have recently experienced significant movements, with U.S. stocks reaching record highs driven by optimism around China's stimulus measures and advancements in artificial intelligence. As these developments unfold, the search for undervalued stocks becomes increasingly pertinent. In this context, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on market inefficiencies. Here are three such stocks that might be undervalued: Alibaba Health Information Technology and two others worth considering.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3420.00 | ¥6804.13 | 49.7% |

| Densan System Holdings (TSE:4072) | ¥2659.00 | ¥5311.48 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥512.00 | ¥1021.58 | 49.9% |

| Pilot (TSE:7846) | ¥4435.00 | ¥8867.73 | 50% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| ArcticZymes Technologies (OB:AZT) | NOK18.04 | NOK36.07 | 50% |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR1.08 | MYR2.14 | 49.6% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$13.00 | HK$25.94 | 49.9% |

| MedAdvisor (ASX:MDR) | A$0.425 | A$0.85 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.39 | €0.78 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

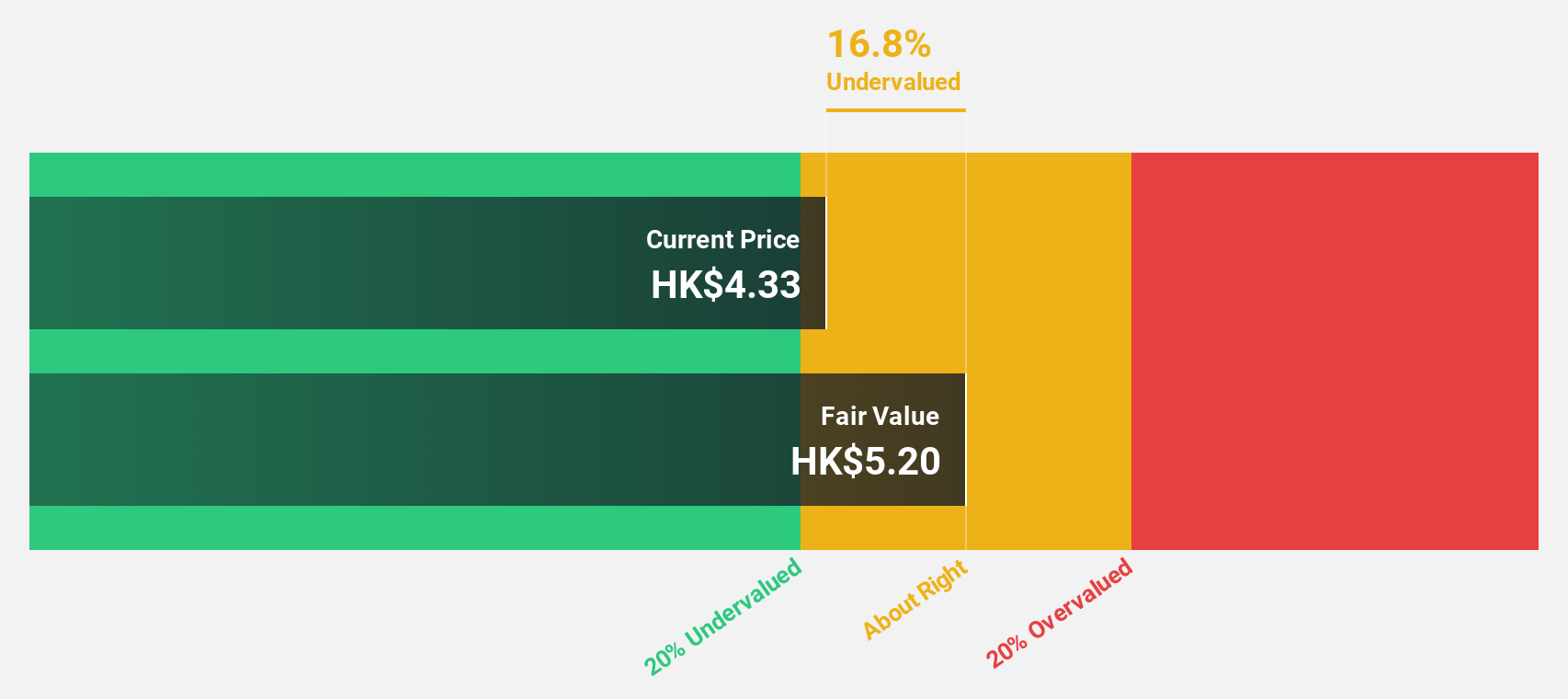

Alibaba Health Information Technology (SEHK:241)

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$66.26 billion.

Operations: The company's revenue segments include CN¥27.03 billion from the distribution and development of pharmaceutical and healthcare business.

Estimated Discount To Fair Value: 46.6%

Alibaba Health Information Technology is trading at HK$5.35, significantly below its estimated fair value of HK$10.01, indicating it may be undervalued based on cash flows. Earnings grew by 64.9% over the past year and are forecast to grow 24.17% annually, outpacing the Hong Kong market's expected growth of 12%. However, shareholders have experienced dilution recently, and return on equity is forecast to remain low at 14.1% in three years.

- Our expertly prepared growth report on Alibaba Health Information Technology implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Alibaba Health Information Technology here with our thorough financial health report.

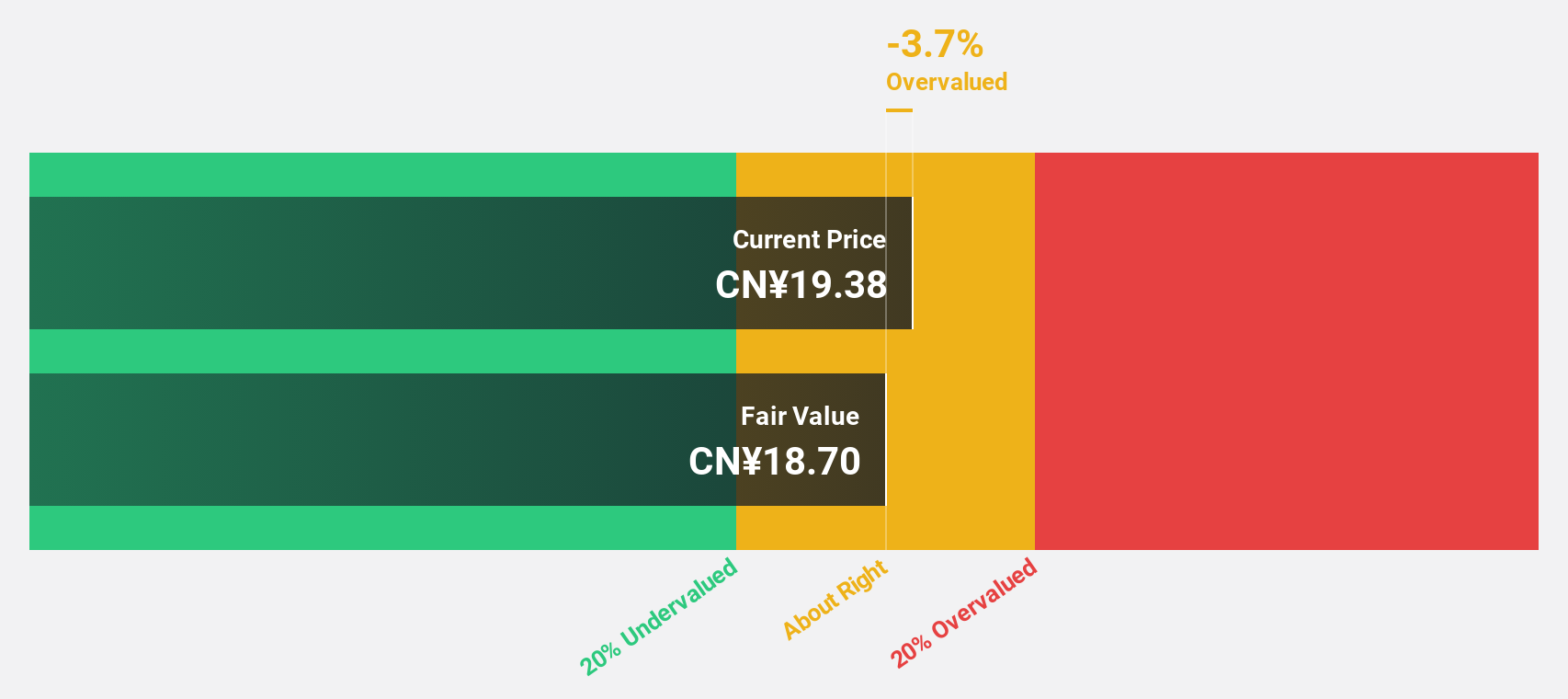

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products with a market cap of CN¥119.97 billion.

Operations: The company's revenue segments include Coking Products (CN¥14.15 billion), Olefin Products (CN¥19.16 billion), and Fine Chemical Products (CN¥4.08 billion).

Estimated Discount To Fair Value: 40%

Ningxia Baofeng Energy Group reported H1 2024 sales of CNY 16.90 billion and net income of CNY 3.30 billion, showing significant growth from the previous year. Trading at CN¥17.35, it is undervalued compared to its estimated fair value of CN¥28.93 and offers good relative value among peers. Despite high debt levels, its earnings are forecast to grow significantly at 31.86% annually, outpacing the Chinese market's growth rate of 23%.

- Our earnings growth report unveils the potential for significant increases in Ningxia Baofeng Energy Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Ningxia Baofeng Energy Group.

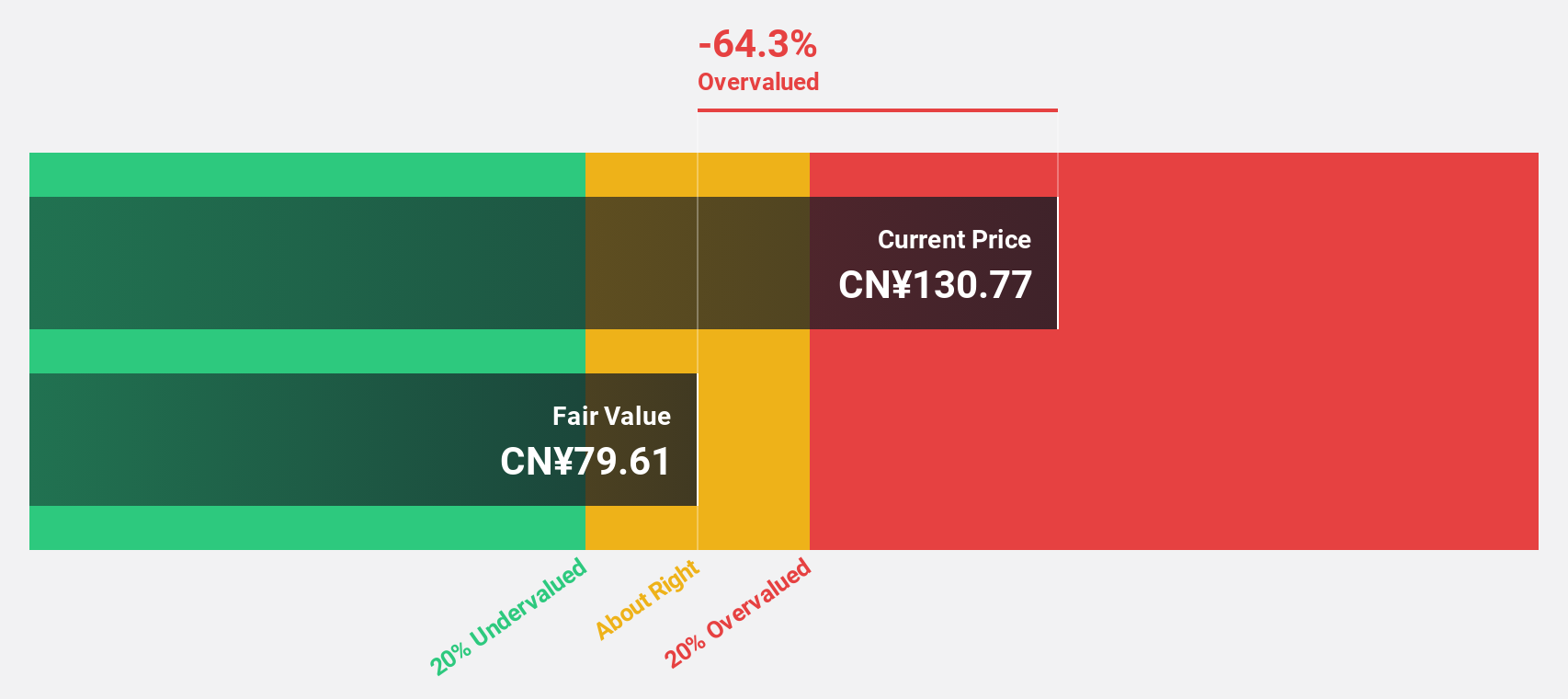

Seres GroupLtd (SHSE:601127)

Overview: Seres Group Co., Ltd. researches, develops, manufactures, sells, and supplies automobiles and auto parts in China with a market cap of CN¥123.79 billion.

Operations: Seres Group Ltd. generates revenue primarily from its automobile industry segment, amounting to CN¥89.85 billion.

Estimated Discount To Fair Value: 46.4%

Seres Group Ltd. reported H1 2024 sales of CNY 62.66 billion and net income of CNY 1.62 billion, a turnaround from a net loss the previous year. Trading at CN¥90.42, it's undervalued compared to its fair value estimate of CN¥168.75 and is expected to see significant earnings growth at 40% annually over the next three years, outpacing market averages. Recent M&A activity may further support its strategic goals in intelligent driving systems.

- Our comprehensive growth report raises the possibility that Seres GroupLtd is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Seres GroupLtd.

Summing It All Up

- Investigate our full lineup of 948 Undervalued Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with reasonable growth potential.