- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2148

Undervalued Small Caps With Insider Action Across Regions In November 2024

Reviewed by Simply Wall St

Global markets have recently experienced volatility, with U.S. stocks retracting some gains amid uncertainties surrounding the new administration's policies and their potential impact on corporate earnings. The S&P 600, a key index for small-cap stocks, reflects this broader market sentiment as investors navigate through economic indicators such as inflation data and interest rate expectations. In this context, identifying promising small-cap opportunities often involves looking at companies with strong fundamentals that can withstand economic shifts and capitalize on emerging trends.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tokmanni Group Oyj | 15.8x | 0.4x | 46.83% | ★★★★★★ |

| Paradeep Phosphates | 23.6x | 0.8x | 29.65% | ★★★★★☆ |

| Avia Avian | 16.3x | 3.7x | 10.63% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 47.23% | ★★★★☆☆ |

| NCL Industries | 14.8x | 0.5x | -81.31% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 21.1x | 0.7x | 28.54% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.7x | 1.6x | -36.16% | ★★★☆☆☆ |

| Genus | 140.9x | 1.7x | 27.84% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.3x | -881.11% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

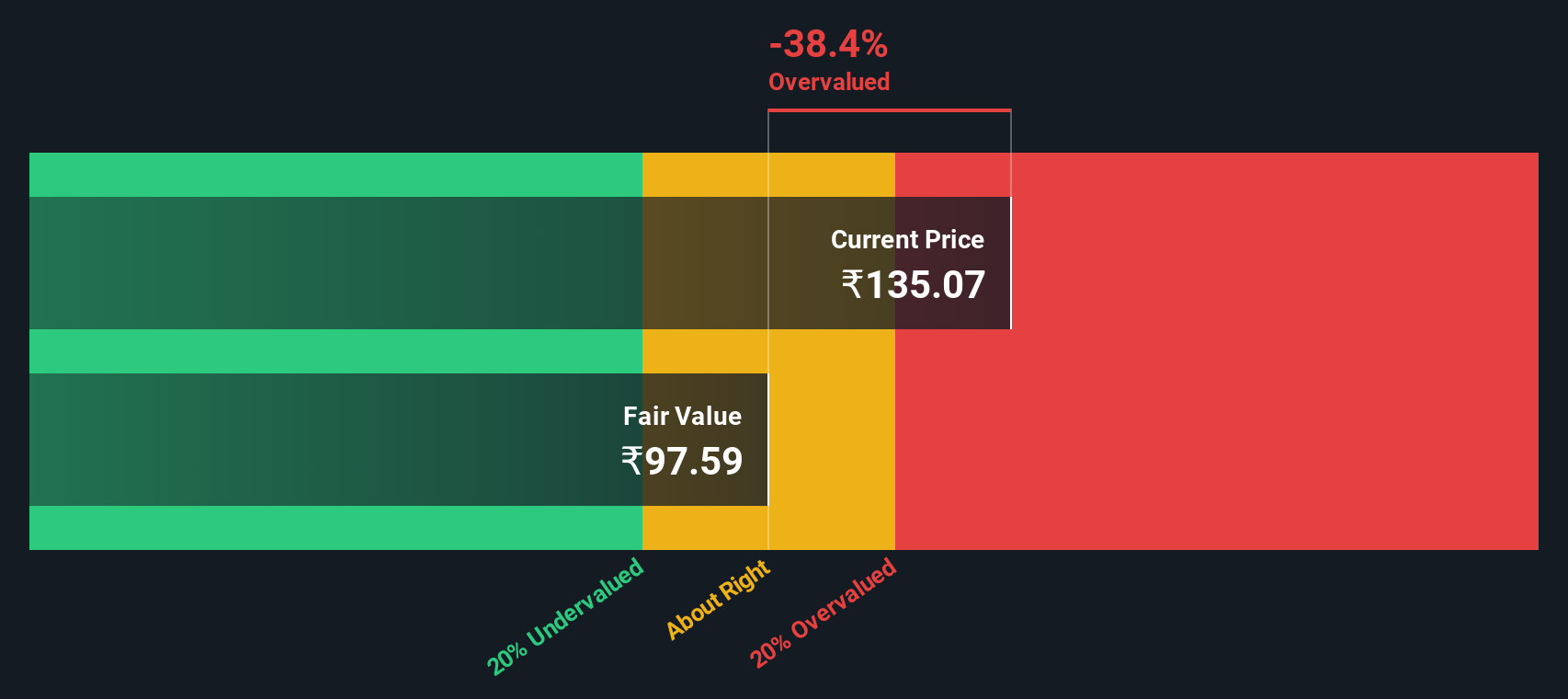

Sai Silks (Kalamandir) (NSEI:KALAMANDIR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sai Silks (Kalamandir) operates as a retailer specializing in the buying and selling of textile and textile articles, with a focus on the Indian market.

Operations: The company generates revenue primarily from the buying and selling of textiles and textile articles as a retailer, with recent revenue reaching ₹13.65 billion. The gross profit margin has shown an upward trend, notably rising to 41.39% in the latest period. Operating expenses have increased over time, impacting net income margins which stood at 6.35%.

PE: 28.3x

Sai Silks (Kalamandir) stands out in the small company category, showing potential for growth with a forecasted earnings increase of 39.15% annually. They have expanded their retail footprint, launching two new stores in Tamil Nadu recently. Insider confidence is evident as Pramod Kasat purchased 5,000 shares valued at ₹870,748. Despite facing a tax demand order of ₹36.64 million from authorities, the company maintains high-quality earnings and has announced dividends for shareholders.

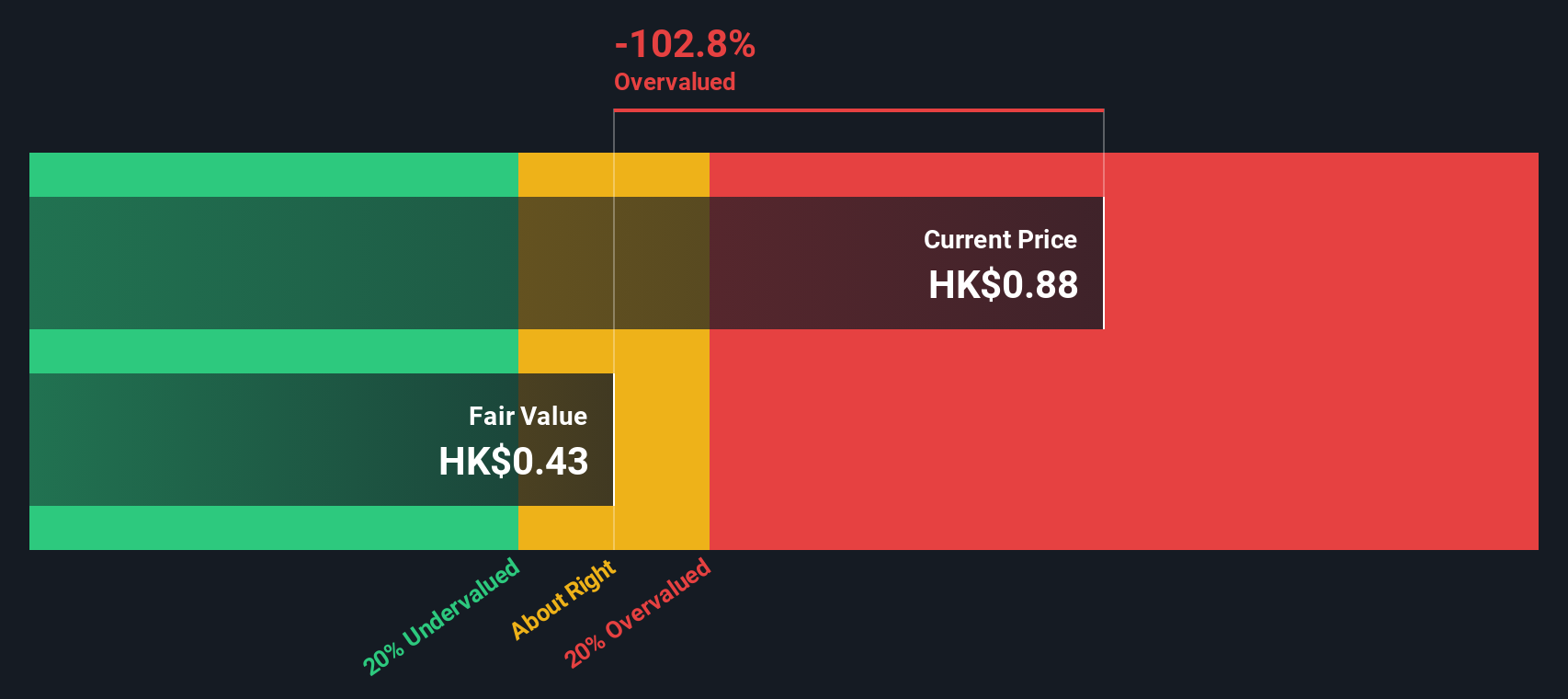

Vesync (SEHK:2148)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the development and sale of appliances and tools, with a market capitalization of approximately HK$2.47 billion.

Operations: The company's revenue reached $604.75 million by June 2024, primarily driven by its Appliance & Tool segment. Over recent periods, the gross profit margin showed a notable increase, reaching 48.46% in June 2024 from 29.02% in December 2022, indicating improved cost management or pricing strategies. Operating expenses are significant with sales and marketing being a major component at $97.52 million as of June 2024, impacting overall profitability alongside general and administrative costs.

PE: 5.9x

Vesync, a smaller company in the market, has recently shown promising growth with its sales increasing by 3% for the quarter ending September 2024. This uptick was driven by higher sales volumes of vacuum cleaners and tower fans in the U.S. and Europe. Despite relying on external borrowing for funding, Vesync's earnings are projected to grow at 6.61% annually. Insider confidence is evident as an insider purchased 200,000 shares valued at US$828,979 in recent months.

- Take a closer look at Vesync's potential here in our valuation report.

Gain insights into Vesync's historical performance by reviewing our past performance report.

CK Life Sciences Int'l. (Holdings) (SEHK:775)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CK Life Sciences Int'l. (Holdings) focuses on agriculture-related businesses and operates with a market capitalization of HK$2.14 billion.

Operations: The company's revenue is primarily generated from agriculture-related activities, amounting to HK$2.01 billion. Over recent periods, the gross profit margin has shown a slight decline, reaching 30.43% in the latest quarter of 2024. Operating expenses have consistently been a significant cost factor, with general and administrative expenses being notable components. Non-operating expenses have increased substantially in recent quarters, impacting net income margins negatively, which turned negative by mid-2024 at -0.35%.

PE: -236.9x

CK Life Sciences Int'l. (Holdings) faces challenges with earnings declining 28% annually over the past five years and interest payments not well-covered by earnings. The company relies solely on external borrowing, adding financial risk. Recent executive changes bring experienced leadership with Lance Richard Lee Yuen as CEO since September 2024. Despite being dropped from the S&P Global BMI Index in September 2024, this small-cap stock may attract attention due to its current valuation and insider confidence through share purchases earlier this year.

Taking Advantage

- Navigate through the entire inventory of 168 Undervalued Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2148

Vesync

Engages in the research and development, manufacture, and sale of smart household appliances and smart home devices in North America, Europe, and Asia.

Outstanding track record with flawless balance sheet.