As global markets react to the evolving political landscape and economic indicators, investors are navigating a complex terrain marked by policy shifts and sector-specific volatility. For those interested in exploring smaller or newer companies, penny stocks—despite their vintage name—remain an intriguing investment area. These stocks can offer unique growth opportunities at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.23 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.00 | THB1.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$70.33M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.195 | £827M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$148.62M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

Click here to see the full list of 5,791 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sino Biopharmaceutical (SEHK:1177)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Biopharmaceutical Limited is an investment holding company that operates as a research and development pharmaceutical conglomerate in the People's Republic of China, with a market cap of HK$59.53 billion.

Operations: The company generates revenue primarily from its Modernised Chinese Medicines and Chemical Medicines segment, amounting to CN¥27.45 billion.

Market Cap: HK$59.53B

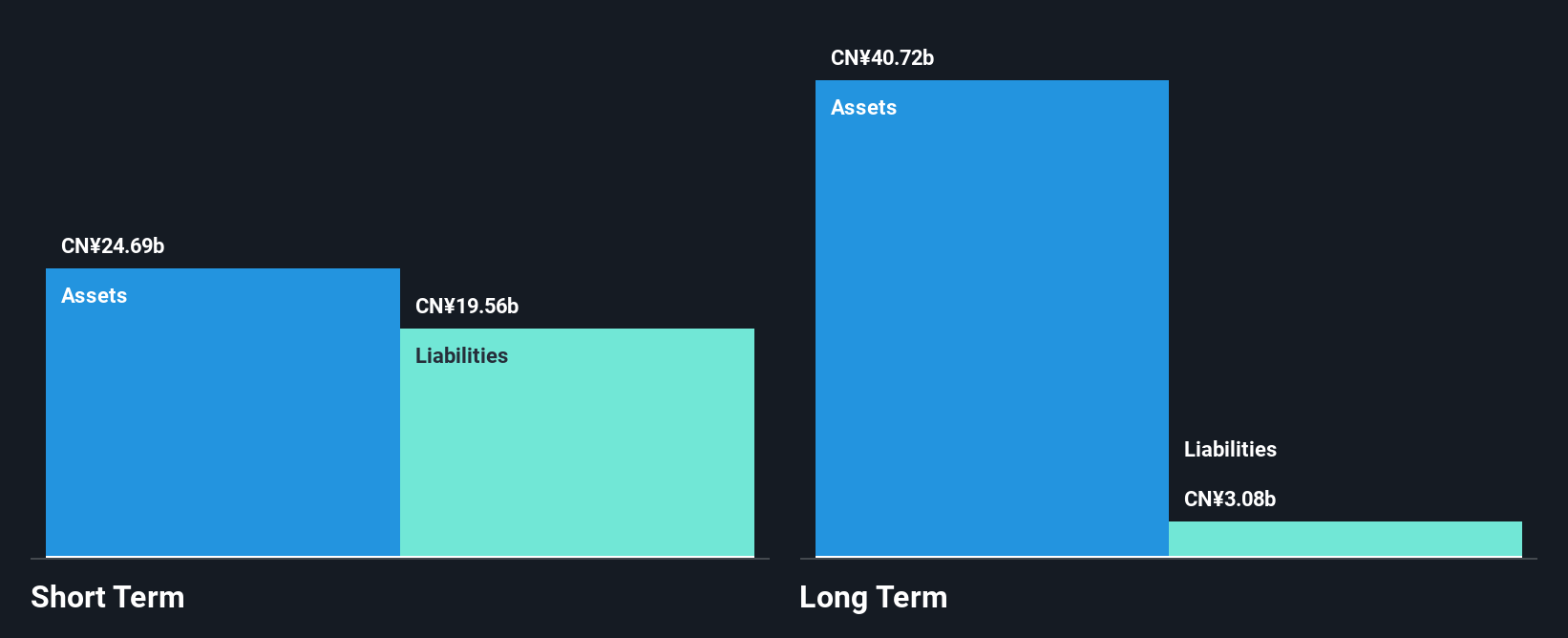

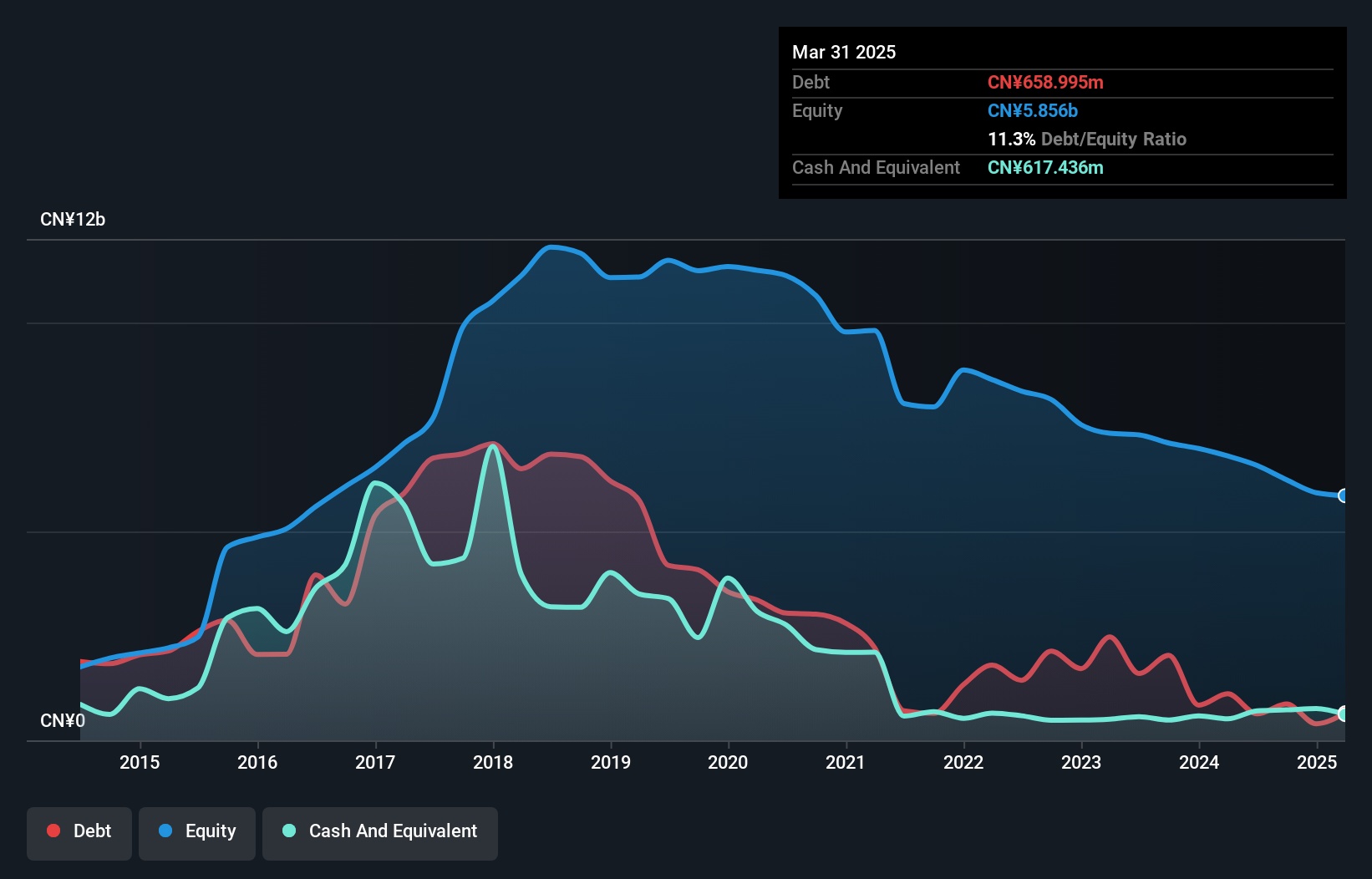

Sino Biopharmaceutical Limited, with a market cap of HK$59.53 billion, has shown significant earnings growth of 70.9% over the past year despite a five-year decline trend. The company’s strategic focus on innovative drug development is evident in recent FDA approval for its EGFR inhibitor TQB3002 and Chinese market approval for the KRAS G12C inhibitor Garsorasib, both targeting non-small cell lung cancer. While short-term assets exceed liabilities and debt is well covered by operating cash flow, insider selling raises some concerns. The management team is relatively new, but the board remains experienced.

- Get an in-depth perspective on Sino Biopharmaceutical's performance by reading our balance sheet health report here.

- Evaluate Sino Biopharmaceutical's prospects by accessing our earnings growth report.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both in China and internationally, with a market cap of CN¥30.59 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥30.59B

Zhejiang Century Huatong Group Co., Ltd, with a market cap of CN¥30.59 billion, has seen its earnings become profitable this year despite a historical decline. The company’s debt is well-managed, with operating cash flow covering 95.6% of it and more cash on hand than total debt. Short-term assets surpass both short and long-term liabilities, indicating strong liquidity. However, the board's inexperience and recent removal from major indices like FTSE All-World Index may raise concerns for investors seeking stability in penny stocks. A recent buyback reflects management's confidence but involved minimal share repurchase impact.

- Navigate through the intricacies of Zhejiang Century Huatong GroupLtd with our comprehensive balance sheet health report here.

- Explore Zhejiang Century Huatong GroupLtd's analyst forecasts in our growth report.

Beijing Haixin Energy TechnologyLtd (SZSE:300072)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Haixin Energy Technology Co., Ltd. operates in the energy technology sector and has a market capitalization of CN¥9.26 billion.

Operations: Beijing Haixin Energy Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥9.26B

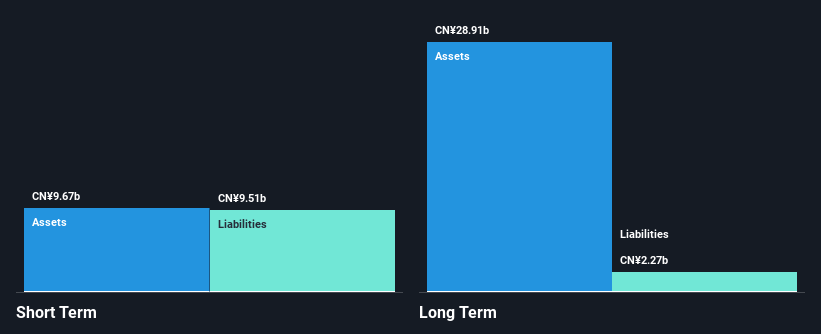

Beijing Haixin Energy Technology Co., Ltd. has a market cap of CN¥9.26 billion and is currently unprofitable, with a negative return on equity of -8.89%. Despite this, the company has reduced its debt to equity ratio significantly over five years and maintains satisfactory net debt levels at 2.2%. Short-term assets exceed both short- and long-term liabilities, reflecting good liquidity management. However, the company faces challenges with increasing volatility and declining revenues, reporting sales of CN¥1.84 billion for nine months ending September 2024 compared to CN¥5.34 billion a year prior amidst ongoing restructuring efforts including private placements for additional funding.

- Click here to discover the nuances of Beijing Haixin Energy TechnologyLtd with our detailed analytical financial health report.

- Evaluate Beijing Haixin Energy TechnologyLtd's historical performance by accessing our past performance report.

Key Takeaways

- Gain an insight into the universe of 5,791 Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Excellent balance sheet with proven track record.