- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

High Growth Tech Stocks In Hong Kong To Watch This September 2024

Reviewed by Simply Wall St

With global markets reacting positively to China's robust stimulus measures, Hong Kong's Hang Seng Index has seen a significant uptick, reflecting renewed investor confidence. In this favorable economic climate, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on market momentum and technological advancements.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| Akeso | 32.58% | 54.53% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

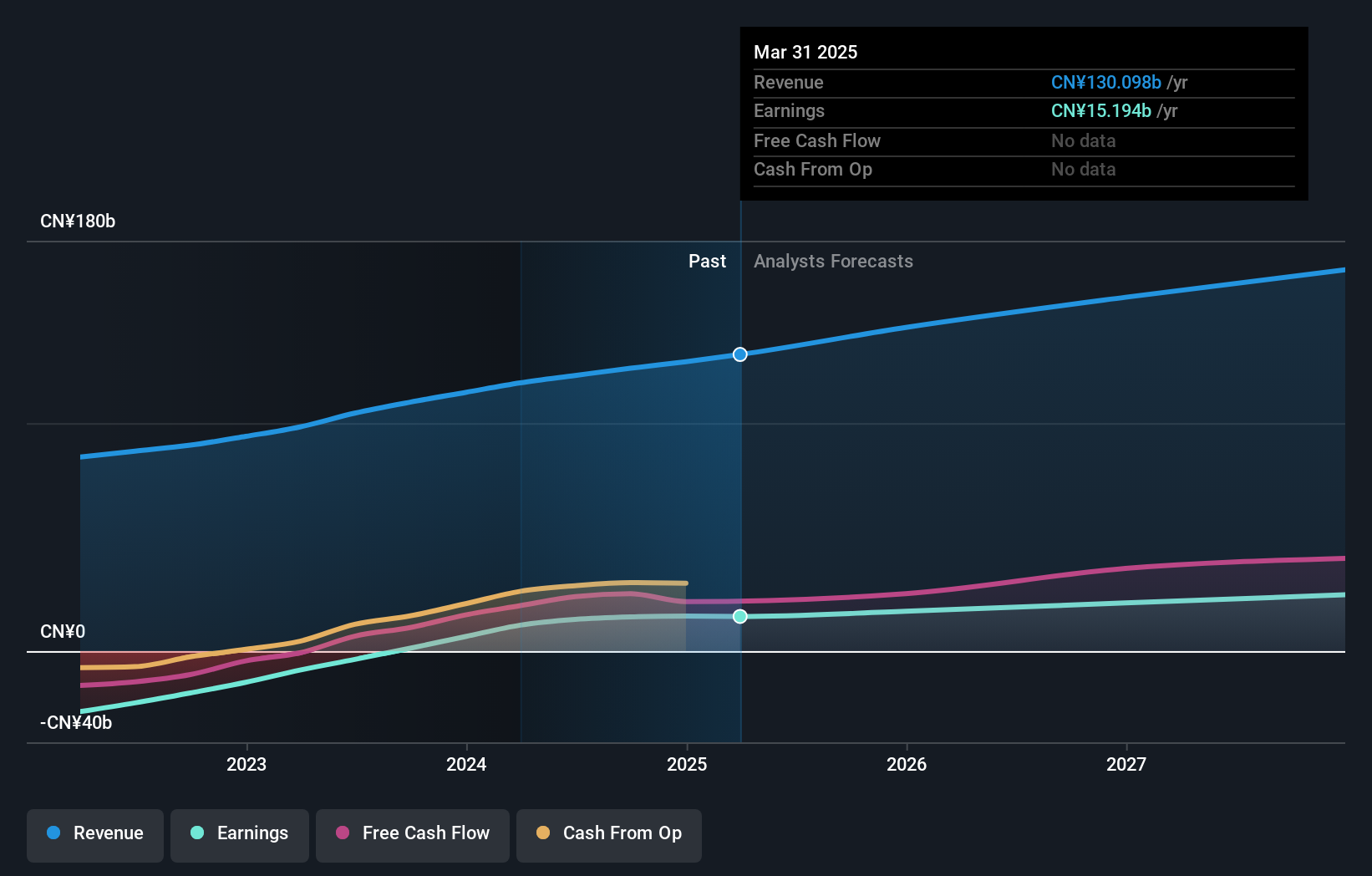

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People’s Republic of China, with a market cap of HK$219.02 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic sources (CN¥117.32 billion) and to a lesser extent from overseas markets (CN¥3.57 billion). The company's business operations include live streaming and online marketing services in the People’s Republic of China.

Kuaishou Technology has demonstrated robust growth, with its recent quarterly earnings showing a surge in sales to CNY 30.98 billion, up from CNY 27.74 billion year-over-year, and net income soaring to CNY 3.98 billion from CNY 1.48 billion. This performance is underscored by an aggressive R&D strategy that aligns with its revenue increase; the company invests significantly in innovations like the Kling AI video generation model, which now features enhanced motion performance and aesthetic improvements due to continuous upgrades. These advancements not only solidify Kuaishou's position in tech but also cater effectively to a growing base of content creators globally, promising sustained growth amidst competitive pressures.

CStone Pharmaceuticals (SEHK:2616)

Simply Wall St Growth Rating: ★★★★★☆

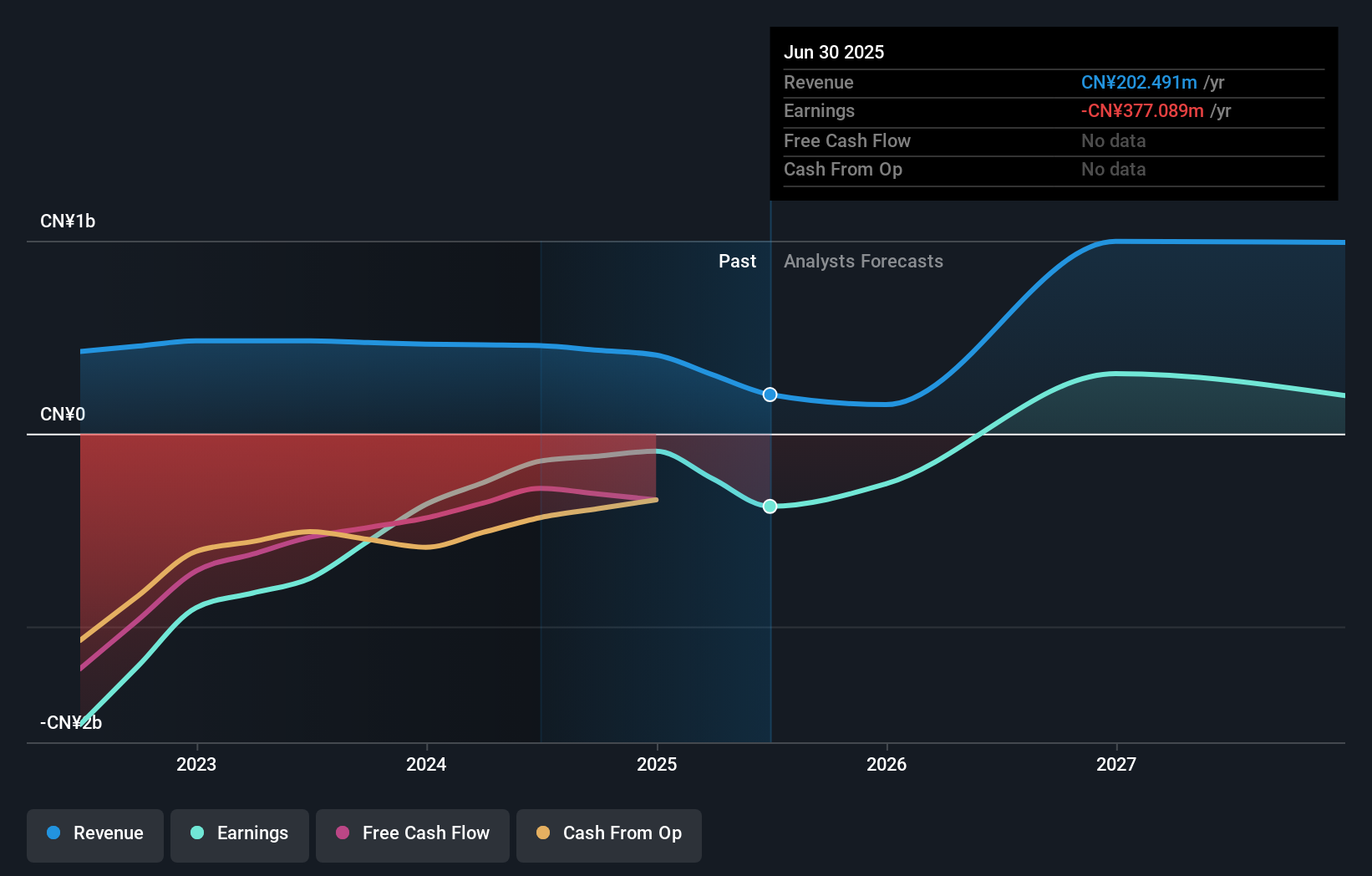

Overview: CStone Pharmaceuticals, with a market cap of HK$2.22 billion, is a biopharmaceutical company that researches, develops, and commercializes immuno-oncology and precision medicines to address the unmet medical needs of cancer patients in China and internationally.

Operations: CStone Pharmaceuticals generates revenue primarily from the sale of pharmaceuticals, amounting to CN¥463.84 million. The company focuses on immuno-oncology and precision medicines for cancer treatment in China and international markets.

CStone Pharmaceuticals has pivoted impressively from a net loss to reporting a net income of CNY 15.7 million in the first half of 2024, contrasting starkly with the previous year's loss of CNY 209.23 million. This turnaround is bolstered by their strategic R&D investments, which are integral to their long-term growth in the biopharmaceutical sector, particularly highlighted by their recent European approval for sugemalimab. This drug's innovative dual mechanism not only enhances patient outcomes but also positions CStone favorably in the competitive oncology market, evidenced by its significant prolongation of patient survival rates and progression-free survival in clinical trials. Their commitment to expanding internationally suggests robust future prospects, especially as they navigate partnerships and regulatory landscapes effectively.

- Get an in-depth perspective on CStone Pharmaceuticals' performance by reading our health report here.

Understand CStone Pharmaceuticals' track record by examining our Past report.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, operates in value-added services (VAS), online advertising, fintech, and business services both in China and internationally with a market cap of HK$4024.02 billion.

Operations: The company generates revenue primarily from Value-Added Services (VAS) at CN¥302.28 billion, followed by Fintech and Business Services at CN¥209.17 billion, and Online Advertising at CN¥111.89 billion.

Tencent Holdings has demonstrated robust financial performance, with a notable increase in revenue to CNY 320.62 billion and net income rising to CNY 89.52 billion in the first half of 2024, reflecting year-on-year growths of 8.1% and an impressive 72%, respectively. This surge is underpinned by strategic expansions in digital content and cloud services, sectors receiving heightened R&D focus which saw expenditures rise by 12.8%. Their recent presentation at the CITIC CLSA Investor's Forum further solidifies their commitment to leveraging emerging technologies to sustain growth, positioning them well amidst competitive pressures and market dynamics in Hong Kong's tech landscape.

- Click to explore a detailed breakdown of our findings in Tencent Holdings' health report.

Assess Tencent Holdings' past performance with our detailed historical performance reports.

Seize The Opportunity

- Click here to access our complete index of 45 SEHK High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives