Wharf (Holdings) Limited's (HKG:4) investors are due to receive a payment of HK$0.20 per share on 14th of September. This means the annual payment will be 2.4% of the current stock price, which is lower than the industry average.

See our latest analysis for Wharf (Holdings)

Wharf (Holdings)'s Earnings Easily Cover The Distributions

If it is predictable over a long period, even low dividend yields can be attractive. Wharf (Holdings) is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Analysts expect a massive rise in earnings per share in the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 39%, which makes us pretty comfortable with the sustainability of the dividend.

Dividend Volatility

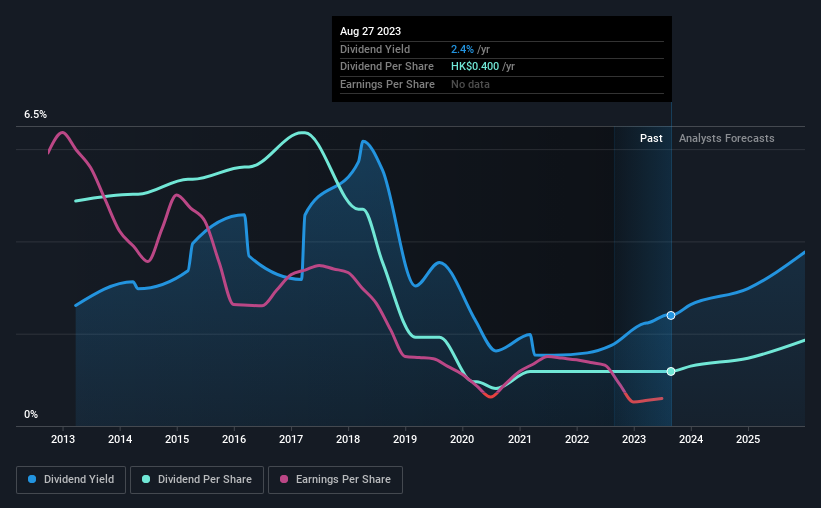

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the dividend has gone from HK$1.65 total annually to HK$0.40. Dividend payments have fallen sharply, down 76% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Wharf (Holdings)'s EPS has fallen by approximately 37% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Wharf (Holdings)'s Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. See if the 9 analysts are forecasting a turnaround in our free collection of analyst estimates here. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Wharf (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:4

Wharf (Holdings)

Founded in 1886 as the 17th company registered in Hong Kong, The Wharf (Holdings) Limited (Stock Code: 0004) is a premier company with strong connection to the history of Hong Kong.

Excellent balance sheet with reasonable growth potential.