- Hong Kong

- /

- Real Estate

- /

- SEHK:3662

Starjoy Wellness and Travel Company Limited's (HKG:3662) Shares Bounce 27% But Its Business Still Trails The Market

The Starjoy Wellness and Travel Company Limited (HKG:3662) share price has done very well over the last month, posting an excellent gain of 27%. The last 30 days bring the annual gain to a very sharp 31%.

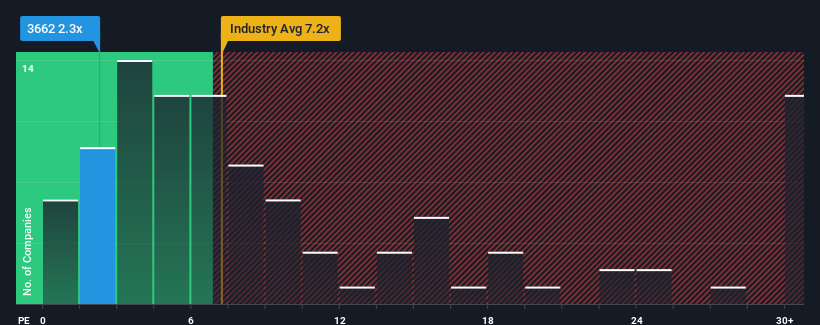

In spite of the firm bounce in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Starjoy Wellness and Travel as a highly attractive investment with its 2.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Starjoy Wellness and Travel's earnings have been unimpressive. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Starjoy Wellness and Travel

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Starjoy Wellness and Travel would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 45% drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Starjoy Wellness and Travel is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Starjoy Wellness and Travel's P/E

Shares in Starjoy Wellness and Travel are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Starjoy Wellness and Travel revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Starjoy Wellness and Travel (1 is concerning) you should be aware of.

You might be able to find a better investment than Starjoy Wellness and Travel. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3662

Starjoy Wellness and Travel

Through its subsidiaries, provides property management and commercial operational services in the People's Republic of China.

Excellent balance sheet and good value.