- Hong Kong

- /

- Real Estate

- /

- SEHK:3658

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record-high U.S. indexes, geopolitical tensions, and evolving monetary policies, investors are keenly observing opportunities for stable returns. In this climate of broad-based gains and economic optimism tempered by uncertainties, dividend stocks present an appealing option for those seeking consistent income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.77% | ★★★★★☆ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

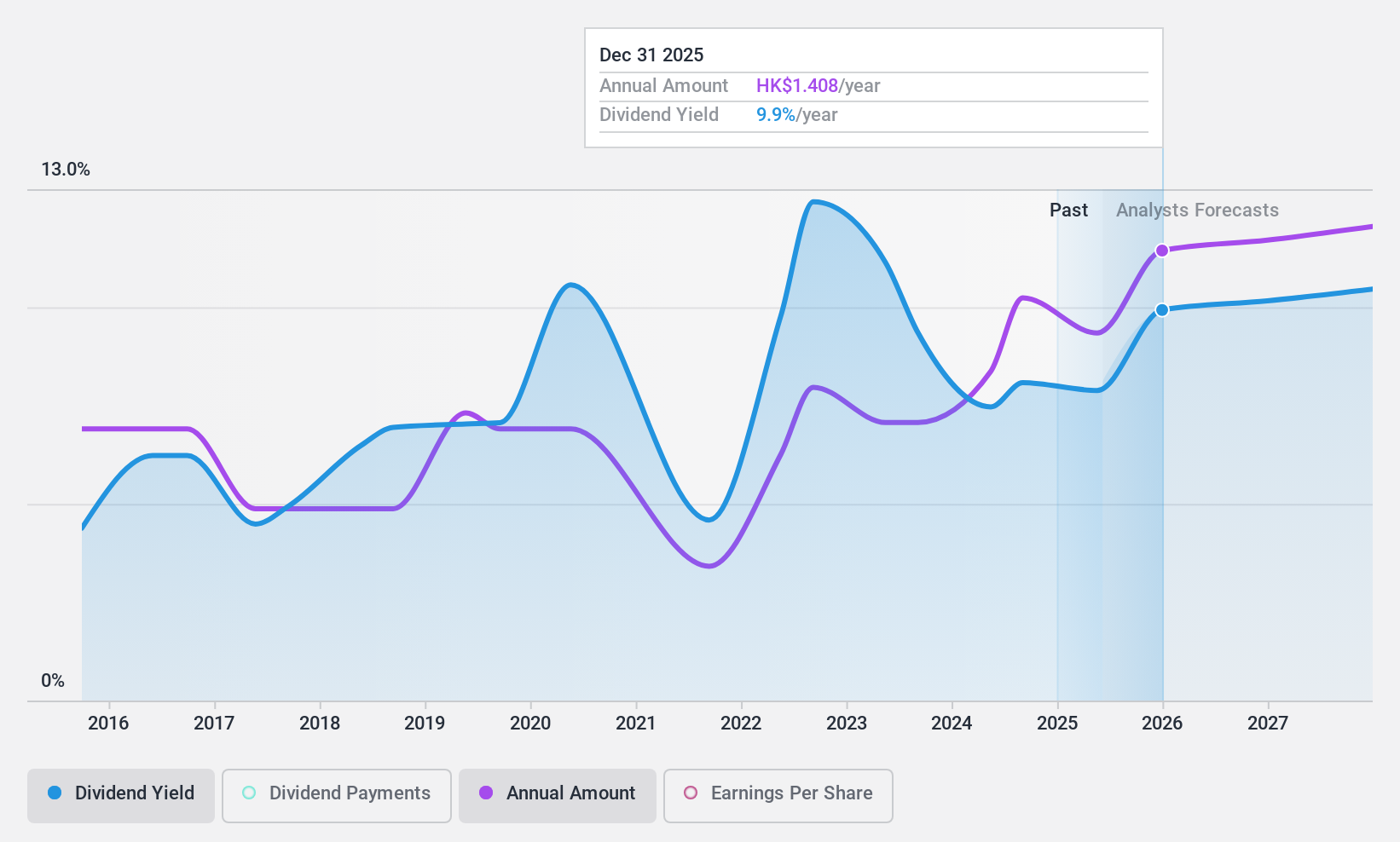

Stella International Holdings (SEHK:1836)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Stella International Holdings Limited is an investment holding company involved in the development, manufacture, and sale of footwear products and leather goods across North America, China, Europe, Asia, and other international markets with a market cap of approximately HK$11.18 billion.

Operations: Stella International Holdings Limited generates its revenue primarily from the manufacturing segment, which accounts for $1.55 billion, and also engages in retailing and wholesaling activities contributing $2.84 million.

Dividend Yield: 8.9%

Stella International Holdings offers an attractive dividend yield in the top 25% of Hong Kong payers, supported by a reasonable payout ratio of 72.6% and cash flow coverage at 54.3%. However, its dividend history is volatile with inconsistent growth over the past decade. Despite recent earnings growth and stable revenue increases—up to US$1.16 billion for nine months in 2024—the dividend's reliability remains a concern for investors seeking stability.

- Take a closer look at Stella International Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Stella International Holdings is trading beyond its estimated value.

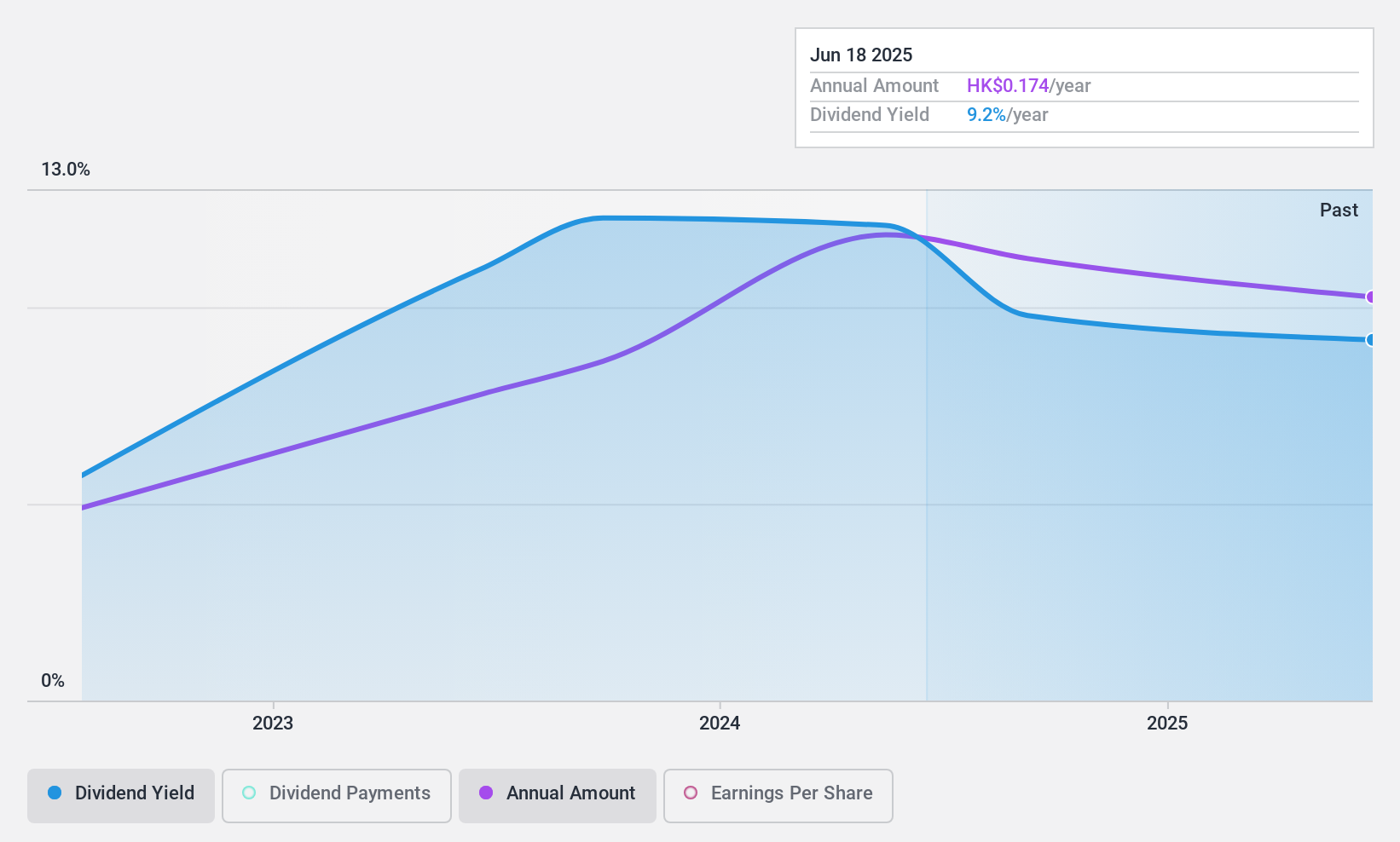

New Hope Service Holdings (SEHK:3658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Service Holdings Limited offers property management, value-added services, commercial operations, and lifestyle services with a market cap of HK$1.53 billion.

Operations: New Hope Service Holdings Limited generates revenue from four main segments: Property Management Services (CN¥734.92 million), Lifestyle Services (CN¥325.85 million), Value-Added Services to Non-Property Owners (CN¥162.85 million), and Commercial Operational Services (CN¥146.34 million).

Dividend Yield: 9.3%

New Hope Service Holdings' dividend yield ranks in the top 25% of Hong Kong payers, supported by a payout ratio of 63.4% and cash flow coverage at 63.3%. The company has increased dividends but only has a three-year history of payments. Recent earnings growth is modest, with sales reaching CNY 709.02 million for the first half of 2024, up from CNY 599.79 million last year, indicating potential for future dividend stability despite its short track record.

- Dive into the specifics of New Hope Service Holdings here with our thorough dividend report.

- Our valuation report here indicates New Hope Service Holdings may be undervalued.

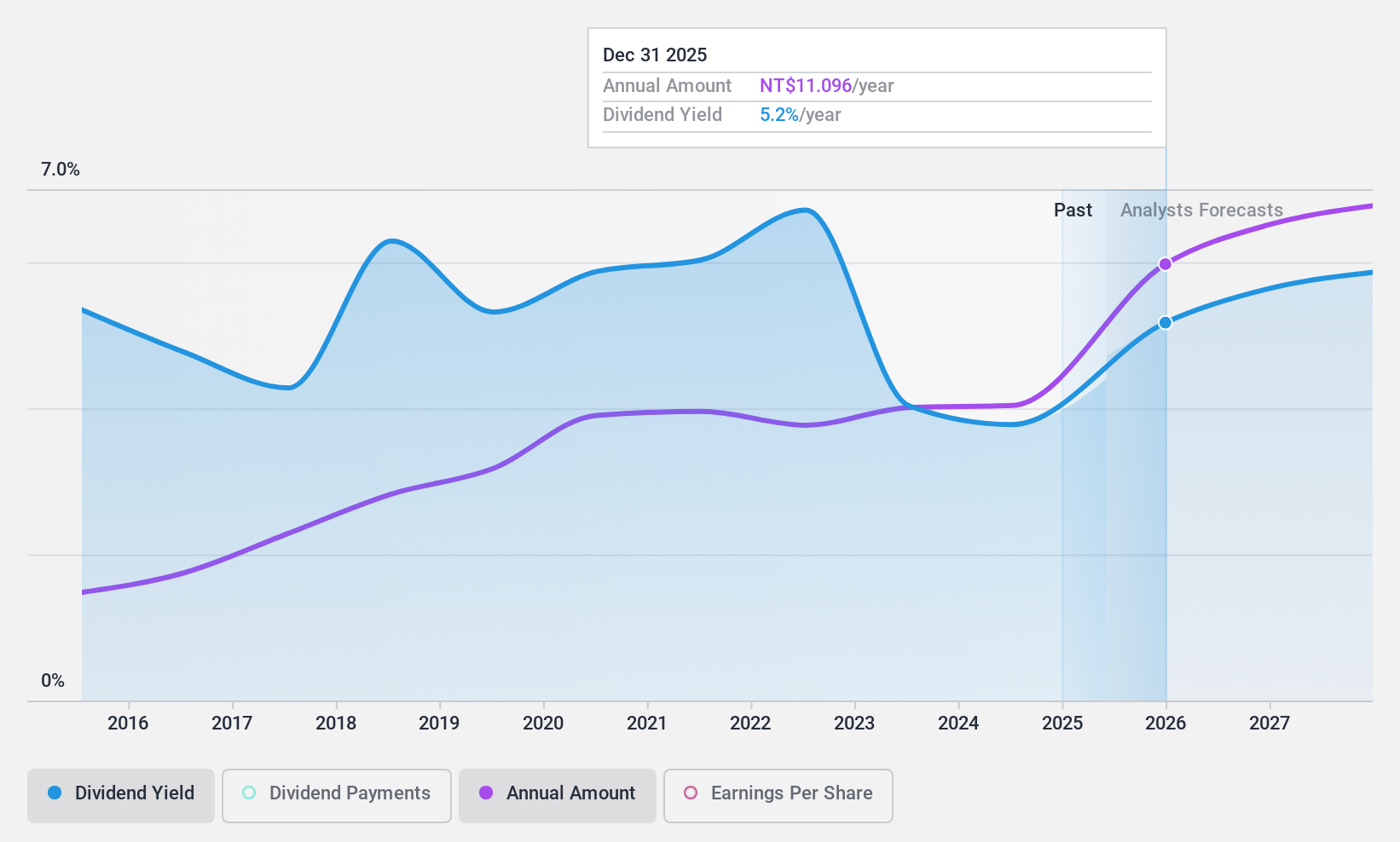

Tripod Technology (TWSE:3044)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tripod Technology Corporation is engaged in the processing, manufacturing, and sale of printed circuit boards and related components across Taiwan, China, Vietnam, Thailand, South Korea, Malaysia, and internationally with a market cap of NT$98.03 billion.

Operations: Tripod Technology Corporation generates revenue primarily from its Printed Circuit Board segment, which accounts for NT$63.31 billion.

Dividend Yield: 3.9%

Tripod Technology's dividends are well-supported by a payout ratio of 49.4% and cash flow coverage at 40.6%, indicating sustainability. The company has maintained stable and growing dividend payments over the past decade, although its yield of 3.89% is below the top quartile in Taiwan. Recent earnings growth, with net income rising to TWD 2,325.6 million in Q3 2024 from TWD 2,139.02 million last year, further strengthens its dividend reliability amidst favorable valuation metrics.

- Get an in-depth perspective on Tripod Technology's performance by reading our dividend report here.

- According our valuation report, there's an indication that Tripod Technology's share price might be on the cheaper side.

Next Steps

- Take a closer look at our Top Dividend Stocks list of 1960 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Hope Service Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3658

New Hope Service Holdings

Provides property management, value-added, commercial operational, and lifestyle services.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives