- Hong Kong

- /

- Real Estate

- /

- SEHK:2869

Greentown Service Group (SEHK:2869): Valuation Check After Board Reshuffle and New Governance Committees

Reviewed by Simply Wall St

Greentown Service Group (SEHK:2869) just reshaped its board, adding new audit, remuneration, and nomination committees, while a non executive director steps down as part of a broader succession plan.

See our latest analysis for Greentown Service Group.

These governance moves come after a solid run, with the latest HK$4.45 share price supported by a double digit year to date share price return, but set against a weak five year total shareholder return. This suggests momentum is rebuilding from a low base.

If these board changes have you rethinking governance and growth, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With analysts valuing the stock higher and earnings still growing, yet a mixed multi year return profile lingering, should investors treat Greentown Service Group as a discounted governance turnaround, or assume the market is already pricing in the next leg of growth?

Price-to-Earnings of 16.2x: Is it justified?

Greentown Service Group trades on a price to earnings ratio of 16.2x, which screens as expensive even after a recent rebound in the share price.

The price to earnings multiple compares the current share price with the company’s per share earnings. It is a straightforward way to gauge how much investors are paying for each unit of profit in a service driven, cash generative business like property management.

In this case, the market is assigning Greentown Service Group a richer multiple than both its statistically derived fair price to earnings ratio of 13.2x and the Hong Kong real estate peer average of 13.8x. This implies investors are already paying up for its improving earnings trend, while our DCF work suggests value could still exist if those profits keep compounding.

Relative to the wider industry, the stock’s 16.2x price to earnings ratio stands noticeably above both the 13.6x sector average and our 13.2x fair multiple estimate. This gap could narrow if sentiment cools or fundamentals continue to strengthen.

Explore the SWS fair ratio for Greentown Service Group

Result: Price-to-Earnings of 16.2x (OVERVALUED)

However, lingering weak multi year returns, along with any slowdown in China’s property services demand, could quickly challenge the market’s newly optimistic expectations.

Find out about the key risks to this Greentown Service Group narrative.

Another View on Value

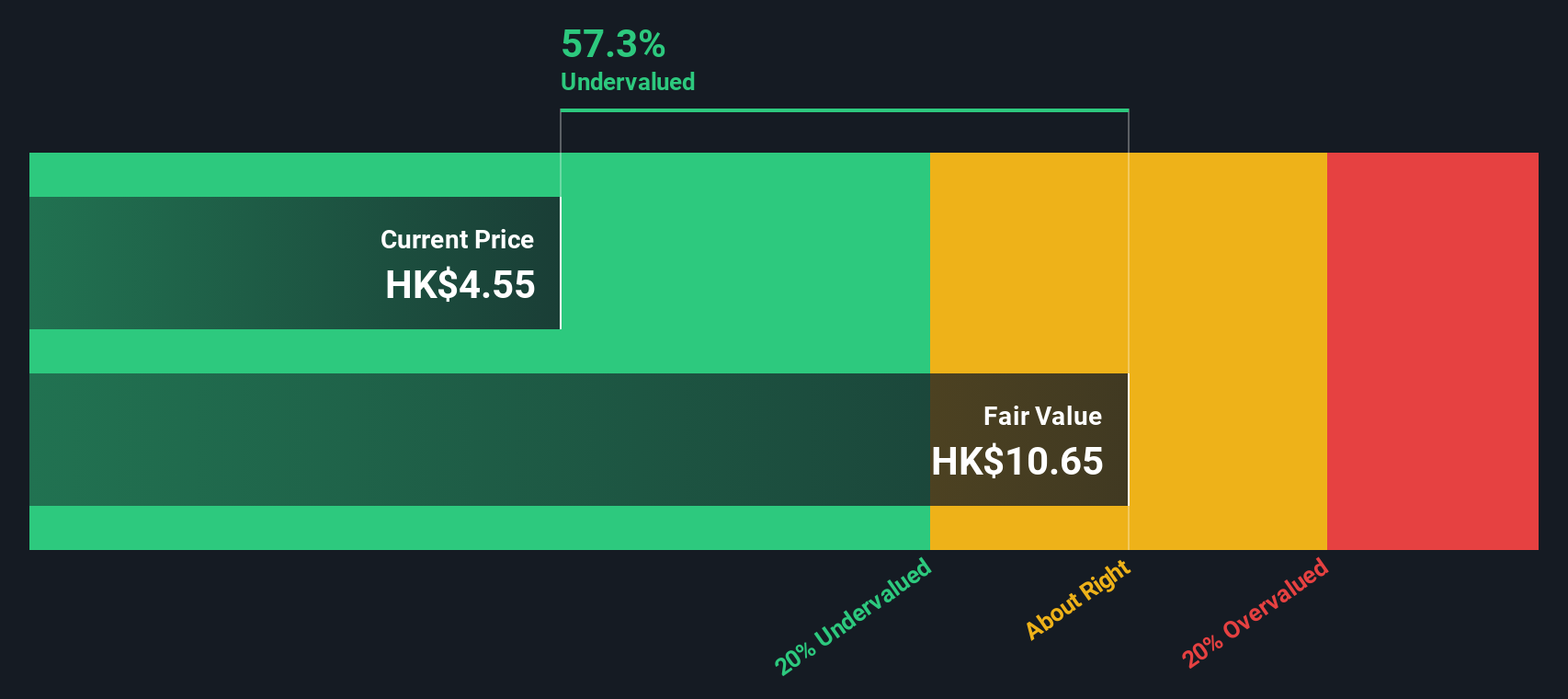

Our DCF model paints a very different picture, suggesting Greentown Service Group is trading at a steep 58% discount to its estimated fair value of HK$10.63. If cash flows are even roughly right, is the current share price a value trap or a mispriced opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greentown Service Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greentown Service Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalised view in just minutes, Do it your way.

A great starting point for your Greentown Service Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Greentown Service Group has caught your attention, do not stop there. Use the Simply Wall St screener to uncover fresh, data backed opportunities today.

- Capture high potential growth by scanning these 26 AI penny stocks that are reshaping entire industries with intelligent automation and scalable software models.

- Strengthen your income strategy by targeting these 12 dividend stocks with yields > 3% that can help support reliable cash flows in volatile markets.

- Position yourself early in transformative financial trends by reviewing these 81 cryptocurrency and blockchain stocks harnessing blockchain infrastructure and digital asset innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2869

Greentown Service Group

Provides residential property management services in the People's Republic of China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026