Discover 3 Asian Penny Stocks With At Least US$400M Market Cap

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, with notable developments in trade and economic indicators, investors are increasingly exploring diverse opportunities across regions. Penny stocks, though often seen as relics of past trading days, remain a relevant investment area for those seeking growth potential in smaller or newer companies. By focusing on penny stocks with strong financial health and clear growth trajectories, investors can uncover promising opportunities within the Asian market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.33 | HK$839.16M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.24 | HK$1.87B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.93 | THB1.37B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.33 | SGD913.59M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 984 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Greentown Service Group (SEHK:2869)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greentown Service Group Co. Ltd. offers residential property management services in the People's Republic of China and internationally, with a market cap of HK$14.30 billion.

Operations: The company's revenue is primarily derived from Property Services (CN¥12.40 billion), followed by Community Living Services excluding Technology Services (CN¥2.74 billion), Consulting Services (CN¥2.41 billion), and Technology Services (CN¥341.19 million).

Market Cap: HK$14.3B

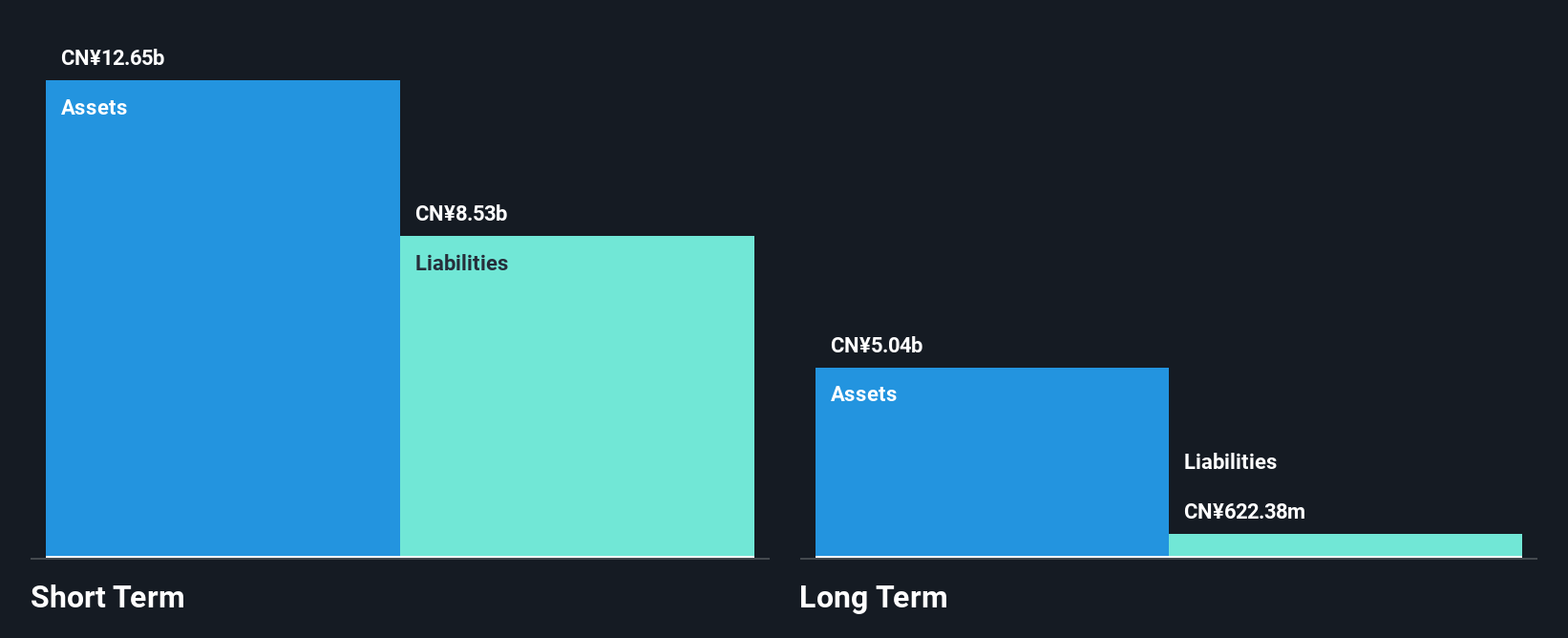

Greentown Service Group Co. Ltd., with a market cap of HK$14.30 billion, showcases strong financial health with operating cash flow significantly covering its debt and more cash than total debt. The company has shown improved net profit margins and earnings growth exceeding industry averages, although its return on equity remains low at 8.8%. Short-term assets comfortably cover both short-term and long-term liabilities, indicating robust liquidity management. Despite a stable weekly volatility of 4%, the dividend track record is unstable. Recent board changes include Ms. JIN Keli's appointment to the Nomination Committee, enhancing governance structure stability.

- Dive into the specifics of Greentown Service Group here with our thorough balance sheet health report.

- Gain insights into Greentown Service Group's outlook and expected performance with our report on the company's earnings estimates.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company offering online and offline e-commerce solutions in China, Japan, and Canada with a market cap of HK$3.32 billion.

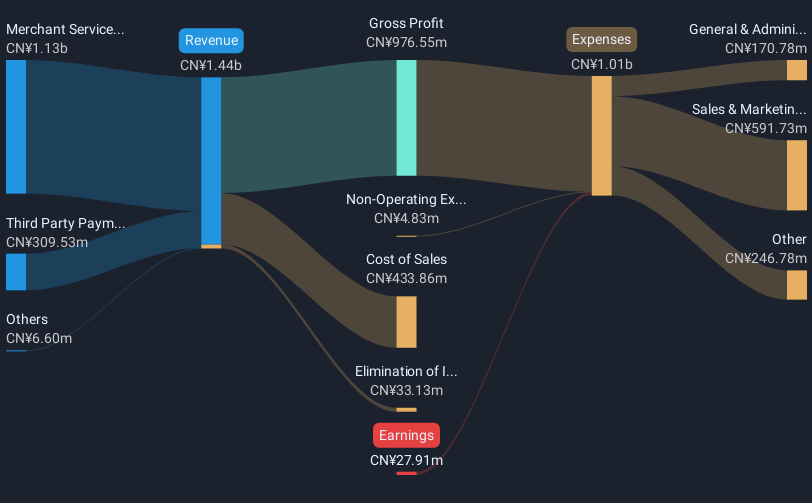

Operations: The company's revenue is primarily derived from Merchant Services at CN¥1.18 billion and Third Party Payment Services contributing CN¥313.19 million.

Market Cap: HK$3.32B

Youzan Technology Limited, with a market cap of HK$3.32 billion, is currently unprofitable but maintains a positive cash flow and has reduced losses by 19.7% annually over the past five years. The company has sufficient cash runway for more than three years and boasts short-term assets exceeding both short- and long-term liabilities, indicating strong liquidity. Recent share buyback authorization aims to enhance net asset value per share, reflecting strategic financial management despite an increased debt-to-equity ratio over five years. The seasoned management team further supports the company's operational resilience amidst ongoing challenges in profitability.

- Click here to discover the nuances of Youzan Technology with our detailed analytical financial health report.

- Gain insights into Youzan Technology's future direction by reviewing our growth report.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD576.80 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, generating CN¥4.38 billion, followed by Heating Power at CN¥196.14 million and Waste Treatment at CN¥23.39 million.

Market Cap: SGD576.8M

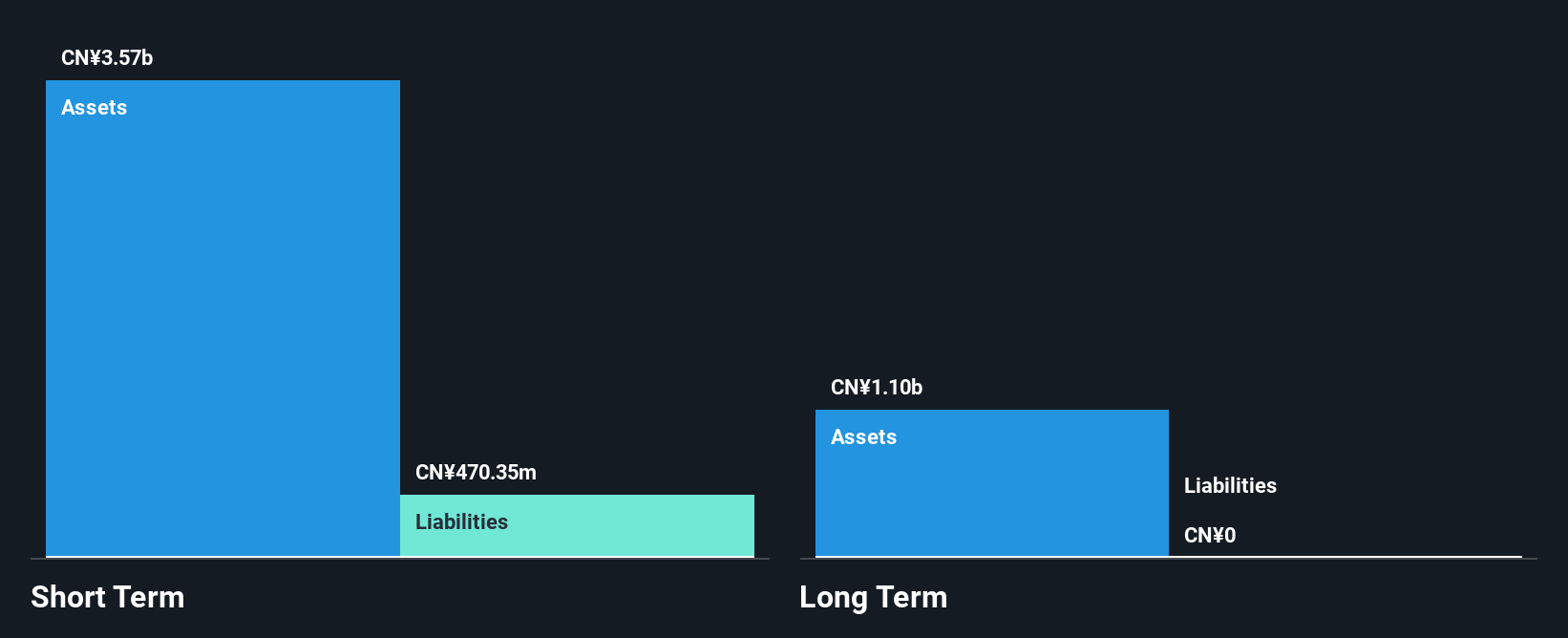

China Sunsine Chemical Holdings Ltd., with a market cap of SGD576.80 million, is actively expanding its production capacity in the specialty chemicals sector, notably through projects like the 30,000-tonne per annum IS project and the 40,000-tonne solvent MBT project. These expansions aim to reduce costs and enhance competitiveness. The company maintains a stable financial position with no debt and has shown consistent earnings growth over five years. However, its board lacks experience with an average tenure of 2.3 years. Recent dividend announcements reflect shareholder returns despite an unstable dividend track record historically.

- Unlock comprehensive insights into our analysis of China Sunsine Chemical Holdings stock in this financial health report.

- Learn about China Sunsine Chemical Holdings' future growth trajectory here.

Taking Advantage

- Discover the full array of 984 Asian Penny Stocks right here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives