- Finland

- /

- General Merchandise and Department Stores

- /

- HLSE:LINDEX

Lindex Group Oyj And 2 Other Promising Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

As global markets experience heightened volatility, with U.S. stock indexes nearing record highs and inflation data fueling expectations of prolonged interest rate policies, investors are increasingly seeking opportunities in less conventional areas. Penny stocks, though a term from earlier market days, continue to represent smaller or less-established companies that may offer significant value potential. By focusing on those with strong financial foundations and a clear growth trajectory, investors can uncover promising opportunities within this niche sector.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.84 | MYR278.83M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

Click here to see the full list of 5,690 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector both in Finland and internationally, with a market cap of €488.91 million.

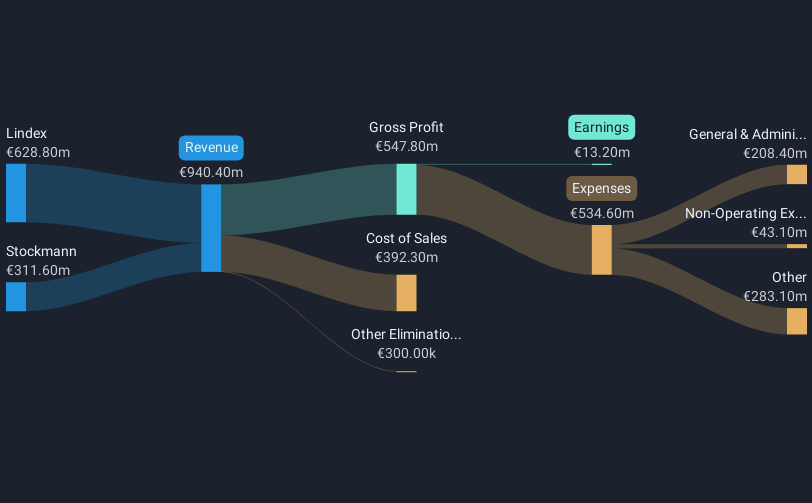

Operations: The company's revenue is derived from two main segments: Lindex, contributing €628.8 million, and Stockmann, generating €311.6 million.

Market Cap: €488.91M

Lindex Group Oyj, with a market cap of €488.91 million, operates in the retail sector and has shown mixed financial performance recently. The company reported stable fourth-quarter sales of €273.7 million but saw net income rise significantly to €19.8 million from the previous year. Despite its low Return on Equity at 3.4% and declining profit margins, Lindex's debt management is strong with cash exceeding total debt and operating cash flow covering debt well. Strategic investments like their new distribution centre aim for long-term growth, though short-term liabilities remain a concern against long-term obligations (€641.6M).

- Unlock comprehensive insights into our analysis of Lindex Group Oyj stock in this financial health report.

- Examine Lindex Group Oyj's earnings growth report to understand how analysts expect it to perform.

Wanda Hotel Development (SEHK:169)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wanda Hotel Development Company Limited is an investment holding company involved in property development, investment, leasing, and management in China and internationally, with a market cap of HK$1.88 billion.

Operations: The company's revenue is primarily derived from hotel operation and management services (HK$746.85 million), followed by hotel design and construction management services (HK$172.80 million) and investment property leasing (HK$92.29 million).

Market Cap: HK$1.88B

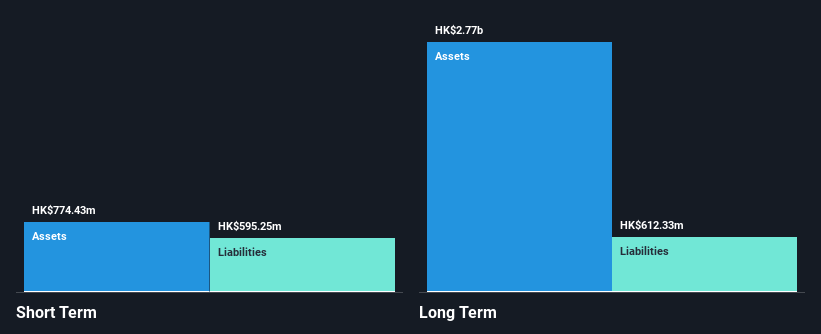

Wanda Hotel Development, with a market cap of HK$1.88 billion, is unprofitable but has significantly reduced its losses over the past five years. Despite its financial challenges, the company maintains a strong cash position with short-term assets exceeding liabilities and more cash than total debt. This provides it with a sufficient cash runway for over three years if current conditions persist. Recent board changes include the appointment of Mr. Zhang Chunyuan as a non-executive director, potentially bringing new strategic insights from his extensive experience within Dalian Wanda Group. The stock remains highly volatile and trades below estimated fair value.

- Click here to discover the nuances of Wanda Hotel Development with our detailed analytical financial health report.

- Gain insights into Wanda Hotel Development's historical outcomes by reviewing our past performance report.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market cap of HK$7.04 billion.

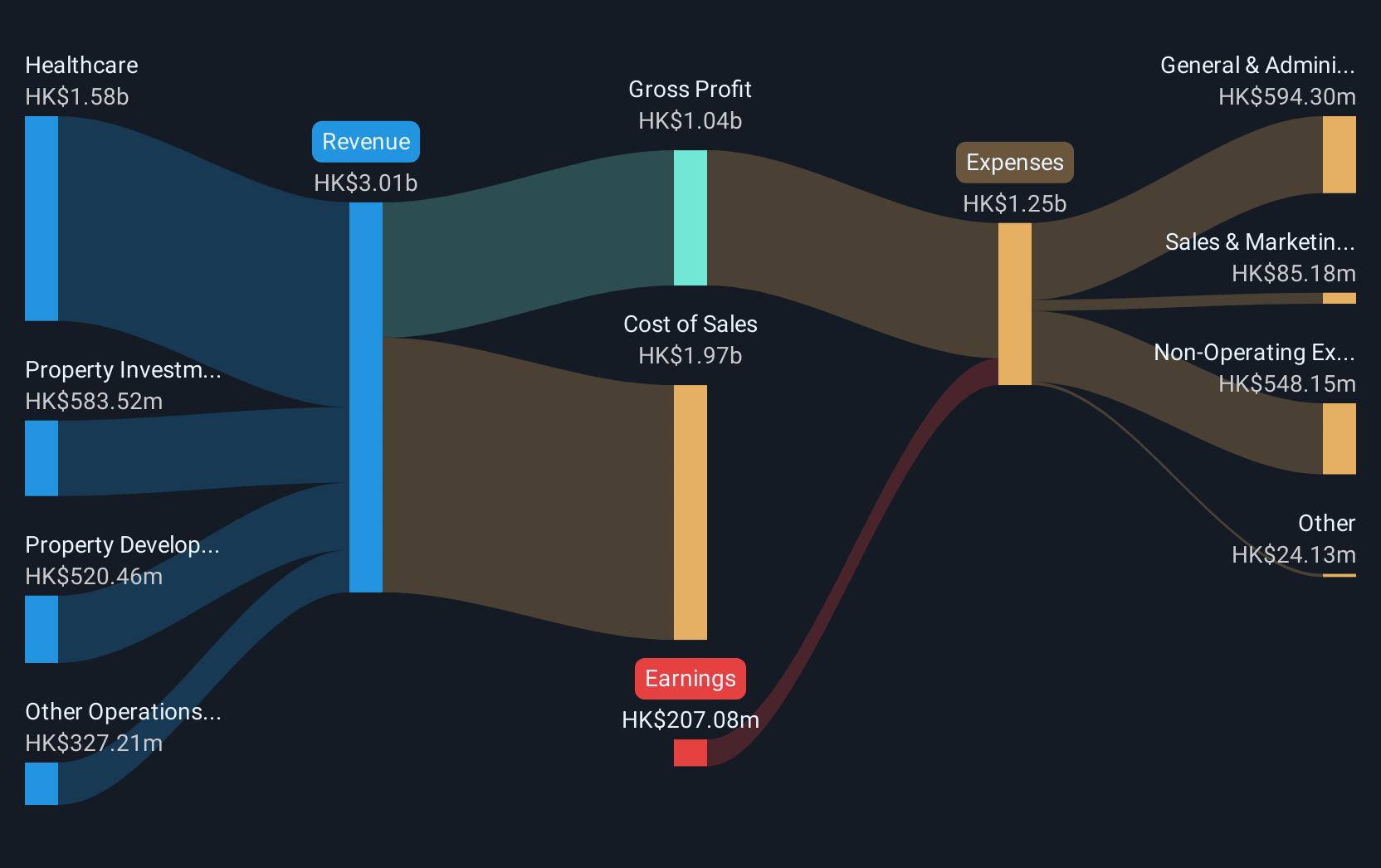

Operations: The company generates revenue primarily from property development (HK$1.10 billion) and property investment (HK$581.17 million).

Market Cap: HK$7.04B

Tian An China Investments, with a market cap of HK$7.04 billion, shows mixed financial health with short-term assets exceeding both short and long-term liabilities. However, its operating cash flow does not adequately cover debt levels, posing some risk. The company experienced negative earnings growth last year and relies on one-off gains like the HK$452.8 million impact to bolster recent results. Despite low return on equity at 3%, it maintains satisfactory net debt to equity at 6.1% and covers interest payments well with EBIT at 18.8 times coverage. Recent board changes aim to enhance corporate governance through strategic succession planning.

- Navigate through the intricacies of Tian An China Investments with our comprehensive balance sheet health report here.

- Evaluate Tian An China Investments' historical performance by accessing our past performance report.

Where To Now?

- Take a closer look at our Penny Stocks list of 5,690 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:LINDEX

Lindex Group Oyj

Engages in the retailing business in Finland and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives