- Finland

- /

- Metals and Mining

- /

- HLSE:AFAGR

3 Penny Stocks With Market Caps Over US$60M To Watch Closely

Reviewed by Simply Wall St

Global markets have experienced a tumultuous week, with U.S. stocks declining broadly amid cautious commentary from the Federal Reserve and looming political uncertainties. In this context, investors are often drawn to penny stocks, a term that may seem outdated but still signifies opportunities in smaller or less-established companies. By focusing on those with solid financials and growth potential, these stocks can offer hidden value and the possibility of significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £145.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.55 | £64.65M | ★★★★☆☆ |

Click here to see the full list of 5,852 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Afarak Group (HLSE:AFAGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Afarak Group SE is involved in the extraction, processing, marketing, and trading of specialized metals across Finland, other EU countries, the United States, China, Africa, and internationally with a market cap of €63.81 million.

Operations: The company's revenue is primarily derived from its Speciality Alloys segment, which accounts for €113.54 million, followed by the Ferro Alloys segment generating €15.80 million.

Market Cap: €63.81M

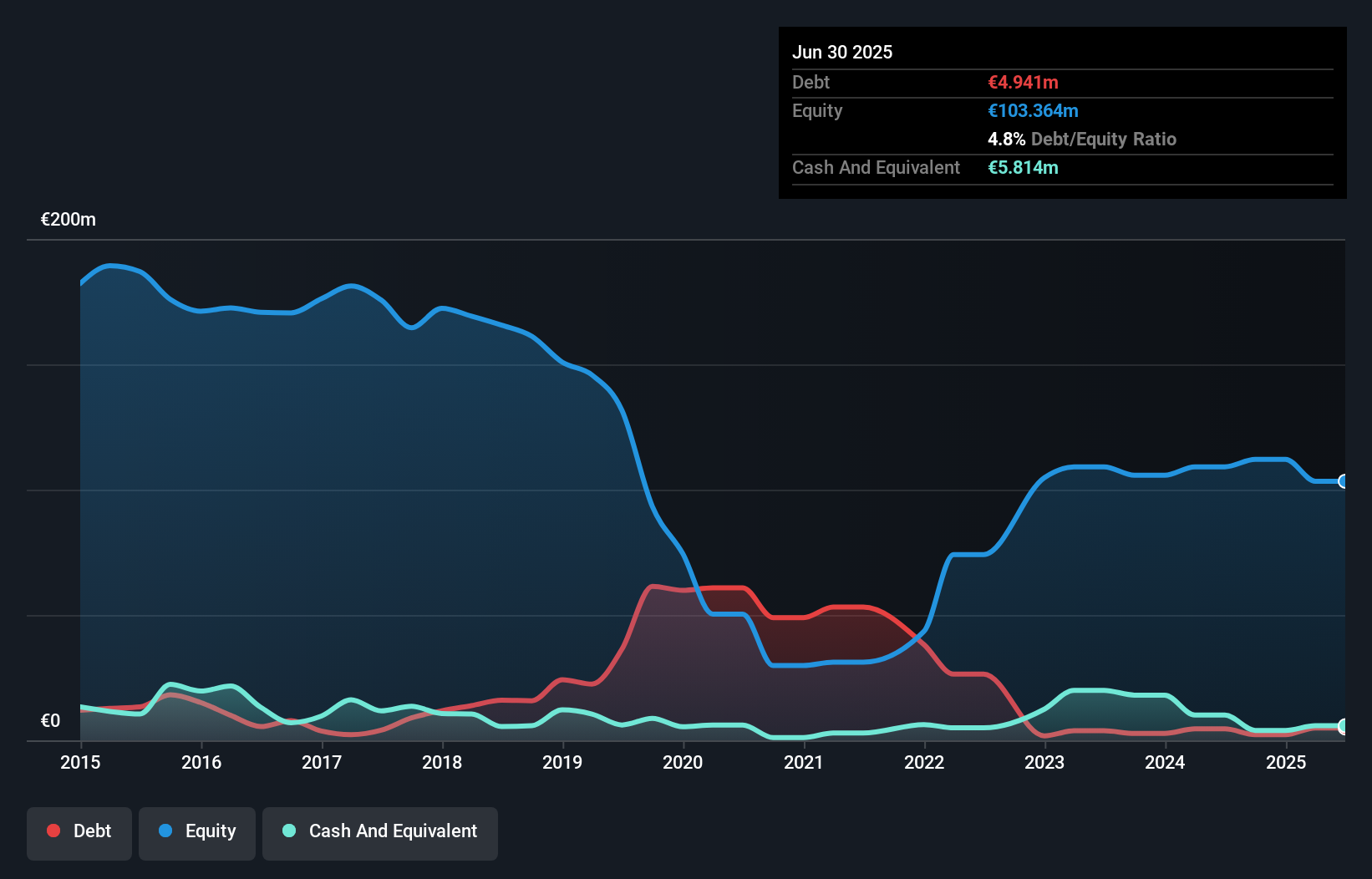

Afarak Group SE, with a market cap of €63.81 million, is currently unprofitable but has been reducing its losses at a significant rate over the past five years. Despite negative operating cash flow and return on equity, the company maintains more cash than total debt and its short-term assets exceed both short-term and long-term liabilities. The management team has limited experience with an average tenure of 1.4 years, while the board is experienced with 7.6 years average tenure. Recent production results show mixed performance in Speciality Alloys and South African mines compared to last year’s figures.

- Click here to discover the nuances of Afarak Group with our detailed analytical financial health report.

- Explore historical data to track Afarak Group's performance over time in our past results report.

PC Partner Group (SEHK:1263)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics with a market cap of HK$1.90 billion.

Operations: The company's revenue primarily comes from the design, manufacturing, and trading of electronics and PC parts and accessories, amounting to HK$9.94 billion.

Market Cap: HK$1.9B

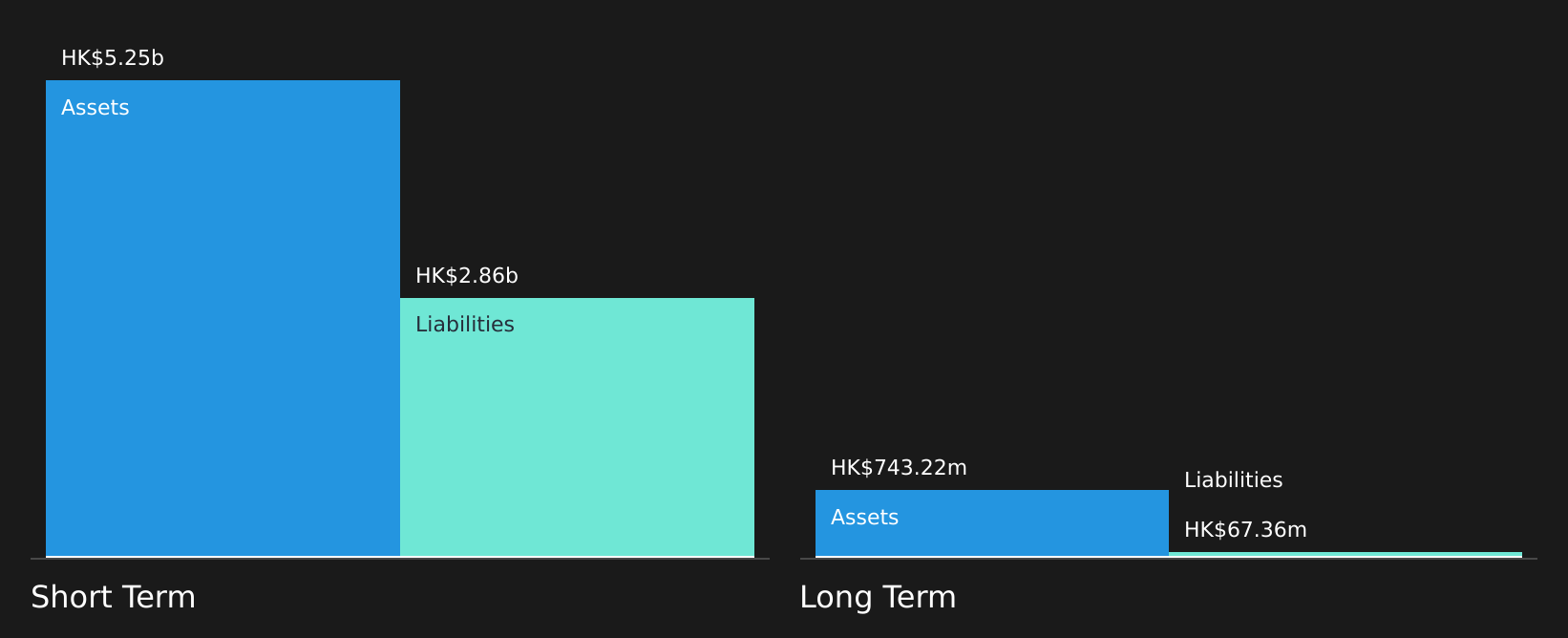

PC Partner Group, with a market cap of HK$1.90 billion, has recently turned profitable and maintains strong financial health, as evidenced by its short-term assets of HK$4.8 billion exceeding both short and long-term liabilities. The company has seen a significant reduction in its debt-to-equity ratio over the past five years and holds more cash than total debt. While the return on equity is low at 8.1%, earnings are considered high quality. Recent changes include relocating headquarters to Singapore and restructuring board committees, reflecting strategic shifts amidst stable weekly volatility in stock performance.

- Jump into the full analysis health report here for a deeper understanding of PC Partner Group.

- Evaluate PC Partner Group's historical performance by accessing our past performance report.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market cap of HK$5.70 billion.

Operations: The company's revenue is primarily derived from property development, which accounts for HK$1.10 billion, and property investment, contributing HK$581.17 million.

Market Cap: HK$5.7B

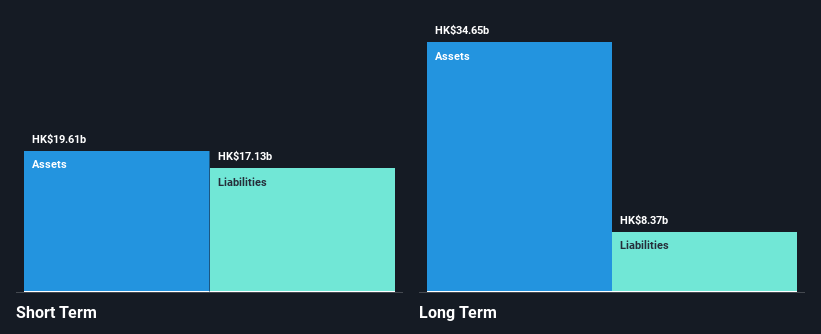

Tian An China Investments, with a market cap of HK$5.70 billion, faces challenges as its net profit margins have declined from 31.8% to 22.4% over the past year, and it has experienced negative earnings growth of -57.4%. Despite this, the company is trading at a discount to its estimated fair value and offers a reliable dividend yield of 5.14%. Its financial health remains solid with short-term assets exceeding both short-term (HK$17.1B) and long-term liabilities (HK$8.4B). However, high one-off gains impact earnings quality and operating cash flow coverage for debt is insufficient at 10.6%.

- Unlock comprehensive insights into our analysis of Tian An China Investments stock in this financial health report.

- Understand Tian An China Investments' track record by examining our performance history report.

Summing It All Up

- Investigate our full lineup of 5,852 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:AFAGR

Afarak Group

Afarak Group SE extracts, process, markets, and trades specialised metals in Finland, other EU countries, the United States, China, Africa, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives