- Hong Kong

- /

- Real Estate

- /

- SEHK:2602

Should Onewo’s New 10% Share Buyback Plan Shape Capital Allocation Views for (SEHK:2602) Investors?

Reviewed by Sasha Jovanovic

- In November 2025, Onewo Inc. (SEHK:2602) began repurchasing its own shares under a shareholder-approved mandate allowing buybacks of up to 115,649,292 H shares, or 10% of its issued share capital, using funds available under PRC and other applicable laws.

- This sizeable authorization gives management meaningful flexibility to retire shares, which can lift net asset value per share and earnings per share over time.

- We will now examine how the commencement of this sizeable share repurchase program shapes Onewo’s investment narrative and capital allocation approach.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Onewo's Investment Narrative?

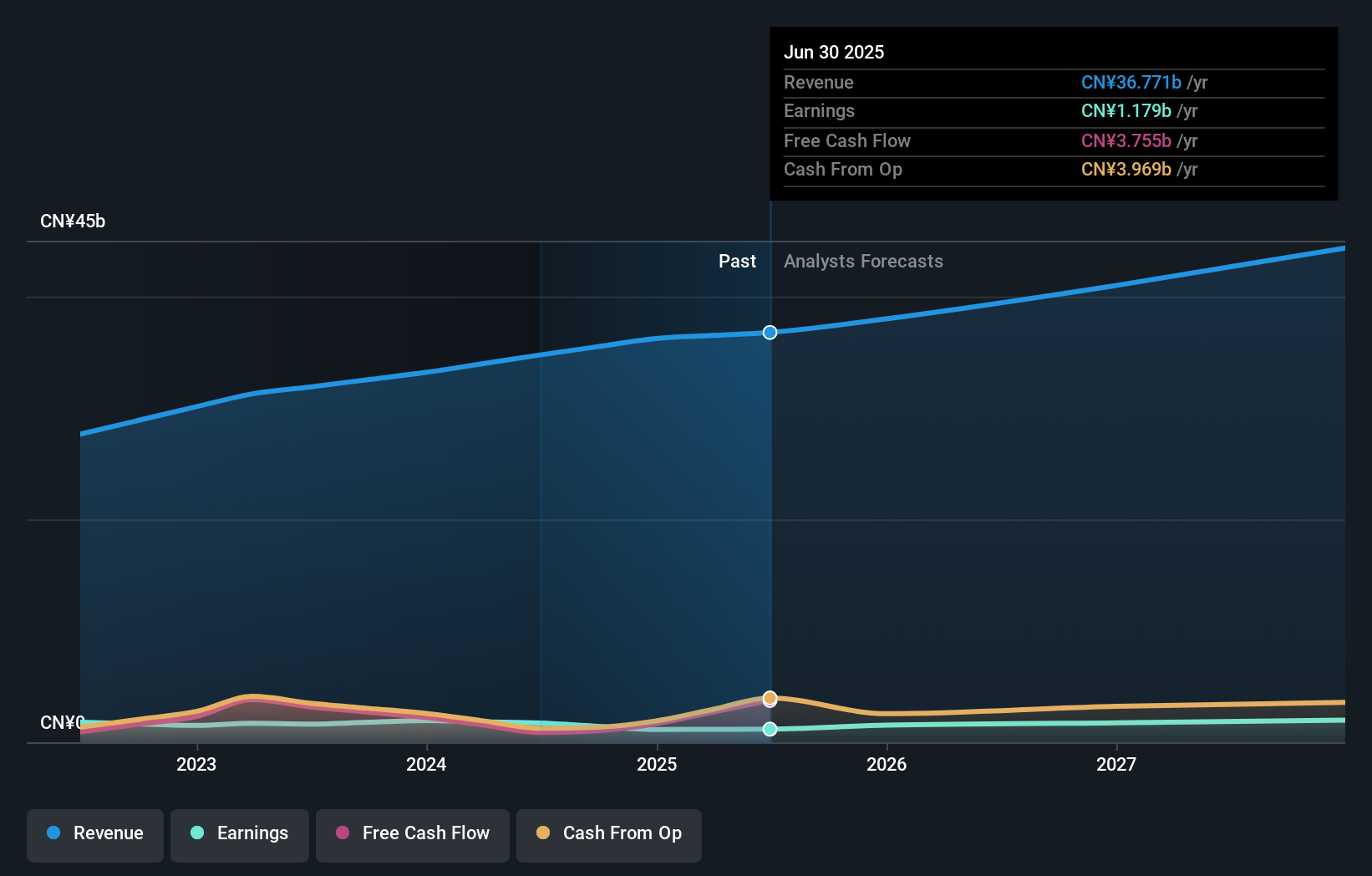

To own Onewo, you need to believe its steady, if unspectacular, revenue and earnings growth can compound alongside disciplined capital returns. The new buyback mandate, allowing repurchases of up to 10% of H shares, sits alongside a generous but thinly covered dividend and comes after the share price has lagged both the Hong Kong market and domestic real estate peers. In the near term, the commencement of this larger program could support sentiment and slightly sharpen key catalysts around improving earnings quality, capital efficiency and closing the gap to analyst fair value. That said, it does not fundamentally alter the biggest risks: low margins, relatively high valuation multiples versus peers and ongoing insider selling. The buyback helps the equity story, but it does not rewrite it.

However, the gap between the dividend payout and earnings coverage is something investors should not ignore. Despite retreating, Onewo's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Onewo - why the stock might be worth just HK$62.70!

Build Your Own Onewo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onewo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Onewo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onewo's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2602

Onewo

Provides property management services in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026